This is a collection of information on taxation of dividends for swiss investors. It’s purpose is to compare different options (for example VT vs. VWRD) on the ETF market from the Witholding Taxation point of view.

[writing in progress]

Content:

- Dividend/ Witholding Tax

- Accumulating vs. Distributing Funds

1. Dividend Tax, a.k.a. Withholding Tax

A general nuisance to investors is withholding taxes. When dividends are distributed at some stock exchange, governments tend to keep a fraction of it for themselves ![]() . Typical values are 35% for Switzerland, 30% for US and 28% for Germany. In case of a fund holding foreign stocks, these taxations are iterated

. Typical values are 35% for Switzerland, 30% for US and 28% for Germany. In case of a fund holding foreign stocks, these taxations are iterated ![]() . for example, when ignoring all tweaks, a Swiss investor holding shares of VT will effectively receive only (1-0.3)*(1-0.35)=45.5%

. for example, when ignoring all tweaks, a Swiss investor holding shares of VT will effectively receive only (1-0.3)*(1-0.35)=45.5% ![]() of the dividends UBS distributes to VT. This is significant, as it roughly equates up to 1% cost p.a. (assuming the dividend yield is 2%)! Therefore one should consider withholding taxes.

of the dividends UBS distributes to VT. This is significant, as it roughly equates up to 1% cost p.a. (assuming the dividend yield is 2%)! Therefore one should consider withholding taxes.

Before you go on, please educate yourself on Level 1 and Level 2 Tax withholding (L1TW and L2TW) here and/or here. Simply speaking: L1TW is the taxation that applies when companies distribute their dividends to funds (or you, if you hold the shares directly), and L2TW applies when the funds forward their dividends to you.

1.1 Swiss domiciled funds

L1TW is 35% on dividends of Swiss domiciled companies and funds, i.e. SPI ETFs or UBS Stocks. (source?) For Swiss residents, this can be (or rather is intended to be) reduced to income tax level via the standard tax declaration. It does not apply to foreign based funds (i.e. IE, US, LU). Declaring these dividends is up to you.

Interesting, Swiss-specific aspect: companies can, besides to distribute dividends, pay out Kapitaleinlagereserven. For you as Swiss investor this works just like dividends, but are not taxed ![]() . the SLI companies tend to do this, typically replacing half of their former dividends with Kapitaleinlagereserven.

. the SLI companies tend to do this, typically replacing half of their former dividends with Kapitaleinlagereserven.

1.2 Ireland domiciled funds

For Swiss investors, IE based funds have the charming property of

- Not paying any withholding tax to the Irish government, i.e. L2TW is zero

- Enjoying a big set of beneficial tax treaties between Ireland and third countries. The most prominent example are the US, where IE based funds get a L1TW of only 15% (instead of the default 30%, see below).

This means, if you (a swiss domiciled investor) hold a US stock (i.e. Apple) through a IE domiciled ETF, you witholding tax loss on dividends is only 15%, i.e. half of the default value.

1.3 US domiciled funds

For dividends distributed by US domiciled companies of Funds to US domiciled investors or Funds, L1TW is zero.

however, for foreign investors (swiss domiciled…), by default, US based funds & companies pay 30% (=L2TW) of withholding Tax from distributed dividends to the US tax authorities. BUT, the swiss-american tax treaty (see below) allows to reduce this to 15% for swiss residents. But it takes some effort to get there: you need to file a W8-BEN form for this. Your broker needs to be a “qualified intermediary” for this. From IB we know they directly do it when you sign up. CT does not support this as this Guide is being written. [info on other brokers is missing]

After successfully reducing your withholding tax to 15%, you can file a DA-1 (more info) to have this remaining tax accounted for when your income tax is calculated.

hedgehog:

The other 15% are withheld in Switzerland if you’re unfortunate enough to bank with a swiss broker, that’s the “zusätzlicher Steuerrückbehalt”, see: https://www.admin.ch/opc/de/classified-compilation/19981781/index.html#a11. DA-1 should let you reclaim both. Unlike with IE, LU, and other european funds, where 15-30% of the original dividends are irrecoverably lost along the way. The 0% withholding you’re seing with IE is after those dividends were already lost.

1.4 Luxemburg based funds

For UCITS Funds domiciled in Luxemburg there is 0% L2TW. This can be found at 6.1 in this paper from the German Bundestag.

But Luxemburg has an annual subscription tax for 0.05% on the assets and it is taken directly from the fund (down to 0.01% for sustainable funds and exemptions for certain other kinds of funds).

1.5 Witholding tax: US vs. IE based funds for swiss investors

now we leave theory and go where it gets interesting ![]()

this section is based on the very interesting bogleheads article about the same topic. we will

- calculate the effective Witholding tax as swiss investors for different options

- and turn it into a total witholding ratio TWR, to compare and add it to the fund’s TER.

to calculate the total witholding tax, we use the following formula, explained in detail here. Remember:

Y = dividend Yield of the fund’s assets

Yr = dividen Yield recieved by swiss investor

L1TW = Level 1 tax rate for those dividends

TER= obvious

L2TW= Level 2 Tax rate between the fund and your broker

TWR = Tax Witholding Ratio

Yr = (1 - L2TW) * ( Y * (1 - L1TW) - TER )

basically, we assume a dividend yield (based on historic yields and multiply it with (1- L1WT) (taxes on the companies’ dividends before they arrive at the fund) to calculate what dividends arrive at the fund. after substracting the fund’s TER we multiply with (1-L2WT) to calculate what arrives at the Swiss investor. If we now take the original dividend yield and substract the TER and what arrived at our broker, we know the full witholding tax that we paid. dividing this by the original Yield Y we find the Tax Witholding Ratio:

TWR = (Y - TER - Yr ) / Y

As the bogleheads article describes quite well how to obtain all these numbers I shall not repeat it here. BUT: let’s do the examples:

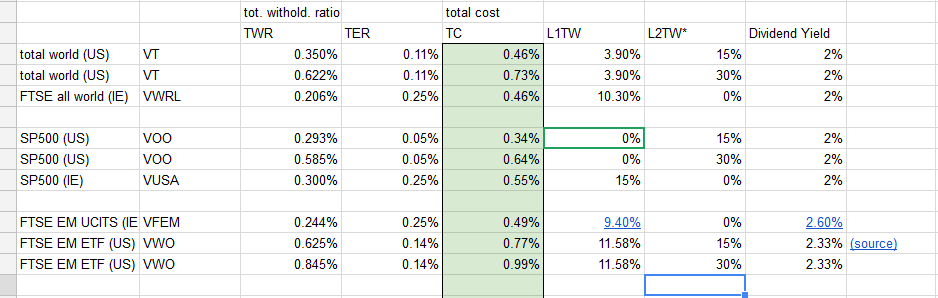

find a list of examples here. the reader is encouraged to extend the list ![]()

the two examples of “total world” ETFs and SP500 ETFs make it clear: the TWR exceeds the TER by a factor of 3-10. however, based on this point of view, US and IE domiciled funds are perfectly equal for the total world case, assuming you file the W8-BEN. For the SP500 case, the US version is slightly superior. For the EM funds, the IE version is superior: Irelands tax treaties seem to kick in. Next: check differences in composition…

2. accumulating vs. distributing

according to an article of the NZZ there is no benefit but eventual drawbacks from using accumulating ETFs. The reason is that dividends must be taxed anyways. If the swiss tax authorities cannot figure out what is dividends and what is course gains, simply everything is taxed, including the usually not taxed course gains.

check ICTax if they have your fund listed. if not, send them an email, forum users experienced a rapid positive answer.

pros for accumulating:

- less hassle with reinvesting

- cash spends less time not working for you

- no transaction fees & stamp tax applies on reinvesting (only for assets at swiss brokers, does not apply to IB holdings)

cons:

- might be tricky with tax declarations, as in some cases their dividend declaration comes only after you must hand in your tax declaraion.

- in terms of rebalancing, paid out dividends might be favourable

- after your accumulation phase, spending dividends is favourable over selling shares since because selling induces transaction costs, unlike getting paid dividends

Swiss admin resources

- Swiss Bundesverwaltung on the Steuersystem, many documents

- about the Vermögenssteuer (wealth tax)

- p10: securities as stocks bonds, real estate, and almost everything is subject to wealth tax

- p11: Pillar 2 and 3 are not subject to wealth tax

(yet) uncategorized

information of divident taxing from canton bern here (thanks to wapiti)

and DA-1 “wegleitung” (walkthrough) from Kanton Zürich here

).

).