Dear all,

after derailing another thread with the topic, I’d like to open this one on EMSC stocks. As some of you know I hold on to a 100% stocks portfolio with a bias towards small, value and emerging markets stocks because i hope to get some risk premium for my 30+ years investment horizon.

Now, from the philosophy of my investment approach, it would be only consistent to add an EM SC ETF to my portfolio. Few days ago I realized, they exist! On JustETF.com i see the IE-based funds:

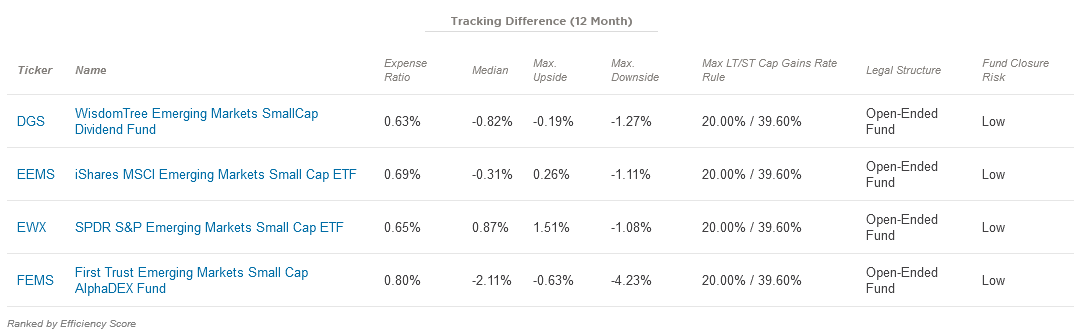

and on etf.com the US-based funds:

since most emerging markets lie outside of th United states, tax-wise the IE-domiciled funds are preferrable, so i will just discard th US funds for now.

taking a look at my (updated) Portfolio selector i find that the three funds have nice small (and value) tilt. IEMS (Ishares) has ~1850 positions, SPY (SPDR) 1114 and DGSE (WisdomTree) 750 of which lots of the small & mid cap probably are not contained in my VWO. Hence, there is some nice diversification potential!

I’d throw out the WT fund because both Index and fund are from the same company, and it has by far the fewest stocks that VWO has not already. Also it is a dividend-weighted fund. They say it adds to diversification compared to cap-weighted, but dividends are quite erratic and i prefere course gains over dividends for tax reasons.

The SPDR fund is Accumulating (less preferred) and still has significantly less stocks than IEMS, but costs 0.22% less in TER. With CHF 80M Assets under management it is really small, not so good.

IEMS does security lending, and together with the high TER of 0.72% this are the two minus points for it.

on the other side, with 0.5-0.7% TER the are quite expensive. However, accounting for witholding taxes, VWO also costs 0.5%, unless i do the DA-1 Tax claim.

so if i include one of those to my portfolio, it would be IEMS. Now, for me the pros are:

- added divesification

- nice small & value & EM tilt for my overall portfolio, risk premium etc

and the con is

- high TER

- probably (havnt checked) higher trading fees (not on US-exchanges)

Anything that i should consider on top of the already mentioned aspects?