[still under construction]

[please add any relevant information in your replies! I am happy to include those.]

[written during fall 2016]

[edit January 2018: new players on the 3a market seem to rise: https://viac.ch/ which is so far briefly discussed in this thread is considered a hot candidate for the best available pillar 3a solution for long term success. MP has a feature blog articles here and a pictured tutorial here \endedit]

[edit March 2021: the 3a pillar market for low-cost robo-solutions expanded. by now there are direct competitos to viac, such as frankly and valuepension]

here the latest 3a vs non-3a calculator (with macros). current features

- Income taxl: as of yet only Qellensteuer (polynom fit 5th degree) for a single zurich residet without kids or confession

- Kapitalauszugssteuer: also only polynom fit model for that single zurich guy

- allows variable calculation durations, start and end dates

- very basic income development model

- some german terms remain

outdated the so far best known 3a vs. non 3a calculator (Excel spreadsheet). It simulates and compares a single year investment in 3a vs non-3a.

outdated is the “invest every year”-version

here extensive tables & graphs about the Kapitalbezugssteuer can be found that will apply when recieving the 3a stash. big thanks to MrRIP

This article should give some insight into pillar 3a investing. With it i hope

- to give those people who don’t yet know about it a good start, and

- to provide some in-depth information for those who already do.

So enjoy reading and don’t hesitate adding comments/ replies!

Preface

Please mind that pillar 3a is one of the most long term individual investments on can make. Things (economy, interest rates, fees, regulation, laws,…) might change within the time horizon of such investments. Therefore, the numbers and deduced conclusions presented here might lose validity at some point in the future. However the best thing one can do is to assume the laws won’t change, which i do for this article.

This article also does not free you from making up you mind yourself. Don’t make your decisions because some random internet-guy told you to do it ![]() As this is about investment and lots of money, you must be confident and be able to sleep well with whatever you decide to do!

As this is about investment and lots of money, you must be confident and be able to sleep well with whatever you decide to do!

Big Picture

For most Swiss residents, the Pillar3a is just one more annoying retirement-thingy one should take care about. Many do not. Some actually bother to take a brief look into it. Some others try to make up their minds and find something they like. But only few (among them us, mustachians) see it as part of our global portfolio! That is what this article tries to tackle, how to optimize it to the details and fit it into our other investments!

=> Usually, we aim for highest returns on the long run!

if retirement/ withdrawal is coming up on the horizon, you might adjust the quest for high returns more towards safekeeping your stash ![]() still most of the stuff here would apply, but i expect you then know what to adjust.

still most of the stuff here would apply, but i expect you then know what to adjust.

Basic 3a knowledge

The Säule 3a (=Pillar 3a) is the voluntary, private based supplement to the Säule 1 (AHV/IV or basic social welfare) and Säule 2 (Pension funds of the employers). Together with Säule 2 it is kapitalbasiert, where Säule 1 is based on the Umlageverfahren. In English this means with Säule 2 and 3a you actual pile up a stash until your retirement, where Säule 1 is more an insurance. Your contribution is directly forwarded to the current receivers.

The Säule 3a is called “gebundene Vorsorge” which translates approximately as “locked provisions for retirement”. Here is the first big difference to private investing: your stash is locked away until retirement (some exceptions apply, see below). This is good on the one hand as ist keeps people from wasting that stash for “stupid” stuff (cars…). On the other hand, we mustachians are rather disciplined savers. So to us it is more a drawback.

The Säule 3a as such is promoted by the government via tax benefits. On the other hand, a rather strict regulation limits the available options although they are meant to make the säule 3a more safe.

Why then do it? The reason is Taxation:

- You can deduct it from your taxable salary.

- When you finally receive it, it is taxed but on a very moderate level.

- Your 3a stash is not subject to your Vermögensstuer / wealth tax.

I prepared a more in-depth paragraph Taxation further down.

So what are the limits?

There is limits to the yearly contribution, in 2016 it is CHF 6’768 for most employed people and CHF 33’840 for the rest, i.e. self employed persons. Find Details in the Taxation paragraph. It does not make sense to invest more than these amounts into 3a.

So what are the options?

There are mainly 3 options where only one can actually be interesting to the mustachians. I will briefly explain them here and put the focus on the last one. The order is from lower risk&return to higher risk&return. One important aspect is that you can move your stash between these options as you like, within the contractual limits of each product.

-

3a savings account. If you don’t know what to do beyond the decision to do 3a and harvest the tax benefit, get yourself a 3a Sparkonto. You put money there and a small interest rate applies, simple. Interest rate are slightly higher than with non-3a savings accounts. These days (2016) they range from 0.0 to 1.0% (see comparis.ch) Regardless how low the fees are, this is not attractive to mustachians. Still, you can move the money to another product later.

-

Some Life insurance products. [Edit 04’2017: I strongly discurage mustachian investors to engage in Life insurance products based on personal experience! see here] I do not have good knowledge on those, so i will not give advice on them. The usual aspects of life insurances apply: You sign a contract over feeding your account a yearly amount until you retire. If your situation changes and you cannot afford it anymore, immense losses may be realized. This also applies when you want to move the money to another 3a product. Sometimes the capital or even the yearly feed is insured against unemployment, death,… This is a safety aspect, but it comes with reduced returns. Returns are typically better than in saving accounts, but in the end mostly in-transparent.

-

3a-Wertschriftenlösungen or security depots [edit 2024: since the last update, several robo-advisor-players entered the market and improved available options dramatically: VIAC, Finpension, and others] Now we start talking. There is a multitude of specialized 3a-Funds offered with all sorts of focuses. A nice but not necessarily unbiased or complete overview is given by VZ. Most of the products are some mixed portfolio of the standard stock exchange subjects: stocks, bonds, commodities, real estates.

-

WTF?? I thought it’s only 3 options? Yes, this 4th one is a minor concept but also relevant. Things like Death- and work-unability insurances can be done via 3a. This is useful if you don’t already use up the maximal tax deductable amount (2016: CHF 6768). You can then deduct your insurance premiums. Like always, there is one drawback for the 3a version: you are more limited in specifying the benefactors in the unlucky case that the inurance applies. These usually are your marial partner or closest relatives. If you have it outside of 3a, you have more freedom to decide on this.

Optimisation beyond the common knowledge

What now is the mustacian way to do 3a investment? First, we assume that we want to do 3a. At the time of writing, I am aware of a few indications that point towards standard ETF-investing being more profitable than 3a. However no clear statement can be given as of now, and since 3a is is not at all a bad thing, for now, let me commit to it. I will come bback to this at a later point in time.

with 3a we are investing long term, the guidelines boil down to those of passive [mustachian investment] (Crash course on investing):

- define your asset allocation between stocks, bonds, commodities, real estate, currencies and countries/ regions

- find suitable ETFs and invest according to your plan, keep low cost stuff

- stick to it, regardless of price development

For 2) you mostly have to browse the brochure of the individual products and se if one fits.

You will find that 3a has some limits to it. Law says for example, stocks cannot be more than 80% of the portfolio and individual stocks cannot be more than 5%. This applies for example with SLI ETFs, where the swiss big three (Roche, Novartis and Nestle) each have 9% share. That is why until recently all 3a funds had max 45% stock. But since recently, a few went up with the stock fraction to 75 (even higher? tell me!), as the example of the UBS Viainvest 75. However, the TER of 1.67% (active management) bans this product from our planning.

One potion is, as MP pointed out nicely on his blog, the Swisscanto 45 Fund. It has a medium TER of 0.35%, and can be obtained via LUKB adding only 0.25% of custody fee, totalling in 0.6% TER (+ 0.4% one-time transaction fee).

One other interesting Product is the Depot account of VZ With an all-in fee of 0.68%. Together with the ETF-TER of 0.15-0.3, the effectively offer a 3a solution with ~0.9%TER. Don’t get me wring, this is still too much. But as of now, I am not aware of cheaper solution that allow you to brick-build your own 3a ETF depot from a list. The building bricks are mainly SLI, SMI, MSCI World and Swiss and international bonds index with a couple of ETFs each. I was told a few ays ago that they plan to extend that brick list in the coming months. The aforementioned limits are given here (in German). So, according to a recent talk with VZ personnel, a 3a depot of 40% SLI, 40% MSCI world and 20% Swiss bonds is a possibility. That would be simple and transparent, and closest to the “young investor maxes out on stocks” concept.

if you know about other interesting 3a products, please specify them in your replies! ![]()

Taxation I Kapitalauszugssteuer:

When feeding you 3a account, a specified amount can be deducted from the personal taxable income for that year. The maximum amount deductable can be found here. For 2016, if you are attached to a Pensionskasse (second pillar) this is CHF 6’768. If you are not, then it is up to 20% of your income with a maximum of CHF 33’840.

You actively have to declare this with in your tax declaration to benefit from this. A calculator for the tax refund can be found at bank coop.

For example, earning ~70’000 in Zurich before Quellensteuer, deducting CHF 6’768 results in a tax refund of ~CHF 950. totally worth it!

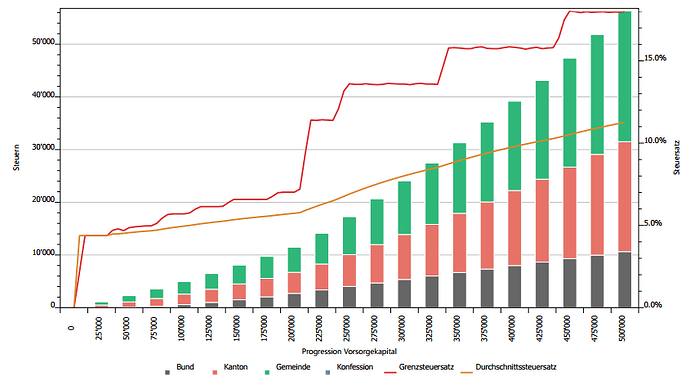

Taxes only apply later when you recieve the 3a stash in your 60s. the exact amout depends of your residence community, confession, marial status, # of children and most importantly the amount. you can calculate it with the Credit Suiss calculator. For a single male in zurich, a graphical representation looks like

You clearly see that the progressive taxation makes mustachians have multiple smaller accounts (even of the exact same product) in order to avoit the high taxation. You can not obtain fractions of your 3a accounts. you have to take everything within one account.

[author’s comment: if you know a data source of the taxation tables, please let me know!!!]

Find out mor on investment taxation in my other post on swiss taxation.

Example cases

- Lets say the single male Zurich person without church affiliation has CHF 250’000. Recieving this in 5 consecutive years instead of at once saves him CHF 5865 or 2.3% in taxes. The same with 5 times 100’000 results in savings of CHF 31’563 or 6.3%.

- A very simplistic fist assumtion: Tax bonus is 10% of your invested money. Calculation: invest CHF

6768, get CHF 1000 in tax refund and apply 5% Kapitalauszugssteuer to whatever grows from the refund. Ends up roughly at 10%

Early withdrawal

The law allows, within rather strict bounds, to cash out the 3a funds before retirement in some special cases:

- company founding

- real estate purchase for own usage

- starting self employment

- leaving switzerland

Taxation II: Vermögenssteuer

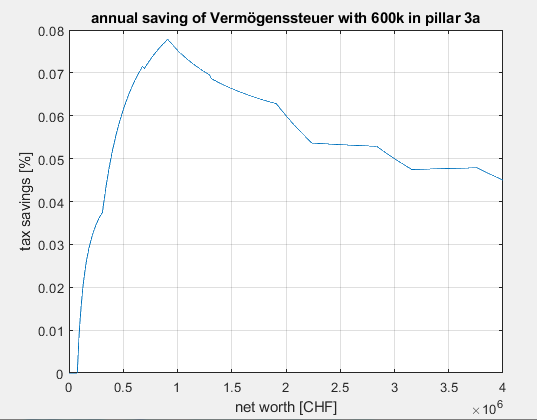

Pillar 3a has the advantage that funds in it will not be subject to Vermögenssteuer. But what difference does it make? Not a big one. In the following I assume an individual in Canton Zurich that amassed some 600kCHF in pillar 3a. this is a generous guess for 30-40 years of maximum contribution with good market returns. The annual tax saving is largest with just below 0.08% if our individual has a total net worth of about 1MCHF.

We see, savings in Vermögenssteuer are but a fraction of what typical fees for 3a producs are. I consider this negligible.

mustachian 3a vs mustachian non-3a

is it any good to do 3a? not better go with the vanguard all world ETF at SIX exchange?

Some people argue, the tax-bonus will be eaten away by the higher yearly costs on the ong term.

I pointed out above that current solutions for 3a come along with a TER of ~0.6% (Swisscanto45+LUKB) or even 0.9% (VZ), which is not exactly low cost. Non-3a products can be significantly cheaper. The Taxation is the big argument for 3a products which has to be weighted against its drawbacks. To assess this, one has to model and compare the course of 3a vs. non-3a products over time. This is tricky and connected to assumptions with large uncertainties.

One proponent against 3a is Obermatt, they provide a sophisticated excel sheet.

I looked at it and i think it’s primary target is to make you think “3a is bad! let’s invest in Obermatt stuff!”. So I provide my own spread sheet here. Try it out, it is easy to use. and please post comments about it ![]() I discuss it a little further down.

I discuss it a little further down.

I think Obermatt’s spread sheet does not do a proper control fund calculation and neglects a few minor things. My outcome is around head-to head if the same ETFs are purchased. Let me know the results of your parameters!

comparing 3a-solutions with buying ETFs with a low cost broker, Imortant aspects are

- Taxation:

- 3a investments can be deducted from income tax: big boost for the following year. They are subject to a 5-8% tax when withdrawn, if optimized properly (that is, multiple chunks of ~CHF50’000 instead of on big sum)

- independent investments are taxed with income tax before you invest your money. my spread sheed struggles with this aspect. please help

Then, dividends are basically taxed 35% unless you declare them, then they are taxed with your income tax rate. that’s all!

Then, dividends are basically taxed 35% unless you declare them, then they are taxed with your income tax rate. that’s all! - 3a money is exempt from wealth tax. well, it won’t make a big difference.

- liquidity: 3a is locked away, where non-3a is at your disposal any time. not reflected in my sheet

- costs: 3a is not very cheap. non-3a can be extremely cheap. core feature of my sheet.

- available products / ETFs: 3a has a quite limited product spectrum in terms of stocks and more strict regulations apply. non-3a has the whole investment universe. among them higher risk&return things that are expected to have a higher return on the long term.

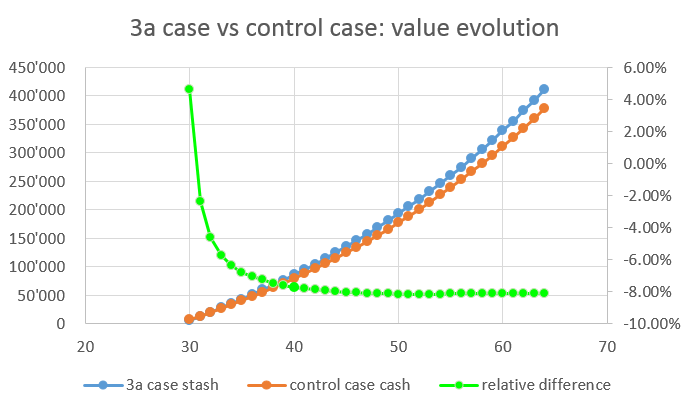

##Discussion

The Graph above shows the stash developments of my Excel model with the parameters you find in the file. They represent a young academic around 30 investing with VZ (3a case stash) or the same product with a low cost broker outside of 3a. Of course the model has quite some uncertainty, but i have not found anything more sophisticated (and transparent!) so far. I am still working to improve it.

The final 3a stash is about CHF 410k where the tax refunds of the 3a drives the it to an ~8% (CHF 33k) advantage over the control fund. Then the higher fees of the 3a depot stabilize the balance. This amounts only to about the summed yearly tax bonuses!

when the yearly returns of the 3a depot are outperformed by only 0.4% due to another allocation (you have a mandatory minumum of 20% non-stocks in your 3a account!), the advantage goes to zero. This appears ambitionus, but by far not unrealistic.

if you assume higher income and income development, the 3a advantage tends to increase. Since the used tax model is invalid above CHF 120k salaries, i won’t put numbers here.

On the bottom line, there is no “clear big advantage” of the 3a pillar with currently (2016) available options. I expect that a small advantage stays after further refinement. it primarily scales with your tax refund, and these increase for higher salaries, but decrease if you have kids, for example. You need to take into account other things than the pure numbers, like “how much is it worth to be able to turn this into cash if needed?” or “how much worth is a dramatically reduced number of available ETFs?” There it becomes a personal matter, abd you best play with the sheet on your own.

take home messages

if you decide to engage into pillar 3a, then

- do it soon / early in your life

- get yourself a low-cost 3a depot account

- fill it with ETFs of stocks and or bonds or passive funds, according to your needs

- deduct it from your taxes

- better have more smaller accounts than one big one, e.g. 5 or so