@lv24 Yes, this is easily possible. The details you need to learn with the according bank.

I moved swisscanto shares from Bank Coop to lukb. If they offer the same fund it should be doable

I have the LUKB Swisscanto forms in front of me, and am looking at the costs: it looks like in addition to the 0.25%/year administration costs, there are 2 other costs (entry and exit): Ausgabekomission (0.40%) and Rücknahmekomission (0.40%), so just by putting your money there you can expect to lose 0.8%. Am I reading this right?

Those are one off charges. 0.25% + bank’s depot fee would be recurring

In any case I find all swisscanto funds rather disappointing. If you’re not bound to the bank for some reason, have a look at VZ’ 3a accounts: you can go 80% stocks and choose your own allocation

according to MP’s blog post the 0.4% transfer fee actually does apply.

Nugget this is all great information. I just wanted to quetion why the opportunity cost of not doing a 3a uses the same investment outside the tax shield. If you were outside the Pillar 3a, wouldn’t you do something better with the money such as a Vanguard All World or US fund? This would appear to lean more in the direction of not doing the PIllar 3a - if you had access to these funds and invested over the long term. Or am i missing something as usual?

My own situation is i am much older 49, with much higher income ~200k each of us, with 2 kids, and have not yet decided whether to do the 3a or not.

Hi @nugget, I was filling the data on your calculator Excel sheet (thanks for putting that together!) and noticed something strange in the formulas: if I change the value in cell I16, the values in the graph for control case stash also changes. That’s not expected to have an effect, is it?

UPDATE: Ah, I missed the explanation at the top of the sheet: the rest of the investment goes to the control fund. All clear now.

@SwissChalet

you are pointing out a crucial point here. I made this assumption of identical assets under the impression of Obermatt’s 7% return assumption which i think is too optimistic for the swiss investor.

however I also pointed out in the original post, that a 0.5% outperformance of a portfolio outside of 3a will completely compensate the tax benefit in the given simulation.

however, with a CHF 200k income you income tax and therefore the tax benefit might be high enough to offset this calculation in favor of 3a. Since the tax bonus is practically the 3a-provisions times your income tax rate, you can easily calculate this and put it into the simulation. I am curious what comes out of this. you might have to change (simplify?) the tax calculations then. Let me know if you need any assistance.

@pombeirp

hey pomberip,

I am glad that finally somebody looks into that excel sheet! I stopped working on it a while ago, but if you find a bug, i will fix it. I would be curious about your comments of this sheet

Thanks Nugget. I have no ‘financial’ German, am not an Excel whiz and live in Basel so adjusting the model ia a stretch for me. I’ll ask my accountant his advice but you’re probably right that i should do it. thanks

HI everyone,

forgive me as I will be asking extremely basic questions. I’m new to all of this and would really like to get more familiar. Thank you for the tutorial. Here are my questions/confusions.

- I just turned 30, is it still worth investing in pillar 3a? Or should I focus on somewhere else?

- It is mentioned that with pillar 3a, I can fill it with ETFs/stocks etc. of my choice. So I still need to pick out these things? I thought I could just set a monthly deposit in the pillar 3a and that was the end of that?

- I am currently with UBS. Any opinions on their savings/pillar 3a accounts?

- Aside from pillar 3a, I would also like to start investing my money elsewhere (other than savings account) for long term. I like to keep things simple and it seems index funds is the way to go. I am also thinking of finding a few (possibly the 3 fund portfolio I see here) and setting up a monthly deposit to these after the initial minimum. Any advice on how to start out?

hey @ATourist,

thanks for posting ![]() to give you some quick first-approximation-answers:

to give you some quick first-approximation-answers:

- just turned 30

age is the least important factor to decide for or against 3a pillar. unless you are chasing the last bit of performance, I think generally you cannot be wrong with 3a-Investing. As long as you have not fully made up your mind, I recommend you to max out a 3a with a simple savings account to benefit from the tax excemption. you can then at a later point (better sooner than later, lets say within a year) decide what to do with this money within 3a. Keep in mind you cannot easily get it out of the 3a framework, but shift it between 3a products.

- ETFs/stocks etc. of my choice. So I still need to pick out these things?

Yes and no. Yes because ther are products that allow you to pick ETFs out of a (quite small) basket. You find more about this in this thread. No because the “yes case” is rather exceptional today, so most 3a stock based solutions (that are considered by mustachians) let you buy a fund of funds with given allocation of underlying funds, so your coice is more “pick a risk level between 1 and 5” rather than on individual assets. In both cases monthly paiments are usually applicable.

- UBS

Since UBS in general is expensive, the mustachian consensus is to move avay to less expensive banks. This mostly holds for theiy 3a funds, but i never looked it up in detail. so no advice from my side here

- Any advice on how to start out?

yes: first take some time and read up on the topic “passive indexing for private investors” until you have a clear picture on the whole thing. find some recources here. Once you have a clear picture on what your long term strategy is, set up an account with some broker (you find a couple of threads in this forum about this topic) and execute it.

normal low cost brokers require you to do the transactions yourself, which (in case of a montly occurence) might conflict with the idea to keep transactions costs low. If you don’t want to be involved other than a monthly wire transfer, a robo advisor (Truewealth) might be interesting for you.

Hi nugget, thank you for your reply!

I assume by maxing out you mean paying the highest possible per year like the chf 6’768 in UBS?

Ah so I also need to research on which institution to start my pillar 3a. You did mention that UBS pillar 3a does not seem to be recommended.

Yes I have been hearing about this for a while. However I am a doctoral student which allows me to keep an account with free maintenance. But I will read up more on what to do and where for pillar 3a.

Thank you for the link however it seems most of the books are in German. I will check if I can find translations, but do you have a list for english speakers?

Could you elaborate a little bit more on what work is expected for going with a broker instead of Truewealth? It does sound like Truewealth is what I am looking for, but MP’s blogpost is really intriguing (from the link you posted)

Thanks again for the links. I am also slowly going through MP’s blog from his first entry onwards, and well it’s quite daunting as there are so much I don’t know about the investment world.

I’d strongly advise against pillar 3a unless you’re reasonably certain that you’re going to withdraw the money in next few years, such as for emigration abroad or property downpayment. Understand, it’s a game between you, the tax office and the banks, and it’s rigged in banks’ favor from the start.

The only upside for you in this game is the tax savings, so be sure to estimate it well: it’s your marginal income tax rate minus withdrawal tax rate in the future. If you’re student, your tax rate is likely very low and thus there’s little for you to gain from pillar 3a.

The downsides to 3a are that you cannot take the money out except in very few cases, savings interest is absolutely miserable, and fund-based accounts are relatively expensive and inflexible.

The best and one of the cheapest offers on the market I’ve seen is from Vermögenszentrum, which allow you to go 80% stocks and choose your own investments. But even they charge rather high 0.68% fee + ETF’s TER.

0.68% fee compounded over 30 years means you’re giving up on almost 20% of your investment over this time horizon!

I don’t recommend truewealth for similar reasons. Fees compound and really eat into your retirement money. There’s nothing that they really bring you onto the table unless you’re lazy and can’t be bothered to track your investments and login to your broker every month to do a couple of trades

I disagree with @hedgehog.

my spreadsheet returns to me a 6% or CHF 30-35k advantage on a 30 year long commitment for 3a for the given parameters. The argument that it is so much worse compared to an independent account does not hold, at least not as claimed by hedgehog.

You omnit the 17% bonus on each down-payment and wealth tax excemption, that in the case of zurich already kicks in at CHF 70k.

however true is, 0.68% is by far not optimal. Butthere are other, more important reasons to (not) engange into 3a than performance.

@ATourist:

@6’768: Yes, that is the maximum tax excempt amount unless you are not connected to a pension fund (2nd pillar). dont put in more than that. the number is ttally independent from UBS, regardless of existing accounts with UBS.

@books: look closer at the list, important lectures are by R.Ferri and bogleheads. all in enlgish

@broker vs. bank vs. truewealth: work required with a standard broker is logging in every now and then and manually select and buy new shares and rebalance your portfolio. more costly solutions such as VZ and Truewelth charge you a little money to cover these expenses and do this selection for you, up to a certain degree.

there are so much I don’t know about the investment world.

very good insight! educating yourself is the best investment of all! I started with the same feeling and at drastically changed…

I have some good news. Swisscanto has launched the fund “Swisscanto (CH) Vorsorge Fonds 75 Passiv VT” CHF

with 75% of stocks and a TER of 0.33%.

https://products.swisscanto.com/infoservice/fr/retail/fundDetails/overview.fundid-1673.navMenu-L2luZm9zZXJ2aWNlL2ZyL3JldGFpbC9yZXRhaWwtZm9uZHMvdGFnZXNrdXJzZS9wb3J0Zm9saW8_.html

Currently, the fund is offered by ZKB https://www.zkb.ch/de/pr/pk/vorsorgen-nachfolge/saeule-3-a/sparen-3-wertschriften.html

The fees are:0.25% on subscription, 0.08% on redemption,transaction fees:0.65% and 0.30% custodyfee.

The fees from ZKB are quite high, but the fund is from Swisscanto and could be offered by other cantonal banks soon.

Interesting update!

let’s see how this develops

thank you, interesting.

Since ZKB bought Swisscanto, let’s see when it comes to other banks…maybe they want more monopoly.

Nice to see finally something moving

Lukb told me that this fund is not available and I’m still waiting the answer from BCV. Let’s see if Zkb opens this fund to other banks

Hello to everyone! I’m new here. Hope that my contribution will be of value to the community.

First of all I would like to say THANK YOU to all of the Mustachians in this forum. It is one of the best comprehensive gatherings of serious and well informed people who respect each other!

I’m currently in the phase of finding out whether a 3a pillar is something worth consideration.

@Nugget: great spread sheet! Really useful and at a glance vehicle.

I might be wrong, but I think the option of 3a pillar depot (i.e. with VZ) should not only consider tax savings compounding over the years vs fees vs non-3a-investments, but also:

- the cushion of 1200/6768 = 17% immediate return on the 3a annual amount should be very much considered as a premium.

- annual tax savings should be invested in your broker account immediately (1200 CHF @ 5% avg.)

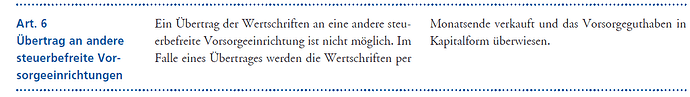

- in the nearest future (most likely) there will be more products available on the market (low costs, better ETF baskets available, etc.). One should not forget that switching between 3a products is possible and should be relatively cheap. The securities will have to be sold though.

- swapping from one 3a product to another one in the future with a stash of money x already sitting in your 3a account will boost your CHF returns assuming the product you will be swapping to is cheaper and offers other benefits (otherwise you won’t be swapping anyways)

- agree with @hedgehog (one of the past threads on 3a pillar) that the tax benefit is being slowly eaten away by the fees over the years of continuous contributions and hopefully positive returns. If the tax savings are being looked at as separate savings which can and should be invested, than it won’t happen in 8 years or so. According to my calculations this sad break-even is reached after some ±20 years.

Please comment.