[under construction]

[panned: tax rat formulae for use in excel/ computation]

Here I want to collect any information relevant for taxation in Switzerland. It has 2 parts: first taxation regarding Income and second taxation regarding investment.

Content:

- income related Taxation

- Investment taxation

- Consumer Taxes

1) Income related Taxation

Income Tax

If you are a swiss person, have a C permit or earn above CHF 120k per year you will be taxed with the normal income tax system. There are Tax calculators for all Kantone from the federal tax authority, as well as several calculaters by the cantons.

Take your last years income, and substract all deductables (get started here) and find the taxable income. Now your income tax is made up of 3 parts:

- “Einfache Staatssteuer”: you have to dig your canon’s tax tables to find that. Depends on income, marial status, Kids, confession,…

- “Gemeindesteuer”: take your Statssteuer and multiply it wit the Steuerfuss of your Gemeinde

- Find the “direkte Bundessteuer” according to your salary from this official calculator. A table can be found at the end of this document (the direkte Bundessteuer should be valid like this in all switzerland, not only Zurich)

- The findal income tax is the sum of these three taxes.

If you don’t declare your taxes the authorities will make assumption based on the last years. be warned, these assumpions are not exactly beneficial. so sit down an do your tax declaration ![]() Also keep in mind that you recieve tax bills. this means you are technically able to spend all your income and later be unable to pay the tax. This usually gets you in very bad situations,so put aside the expected taxes right from the beginning!

Also keep in mind that you recieve tax bills. this means you are technically able to spend all your income and later be unable to pay the tax. This usually gets you in very bad situations,so put aside the expected taxes right from the beginning!

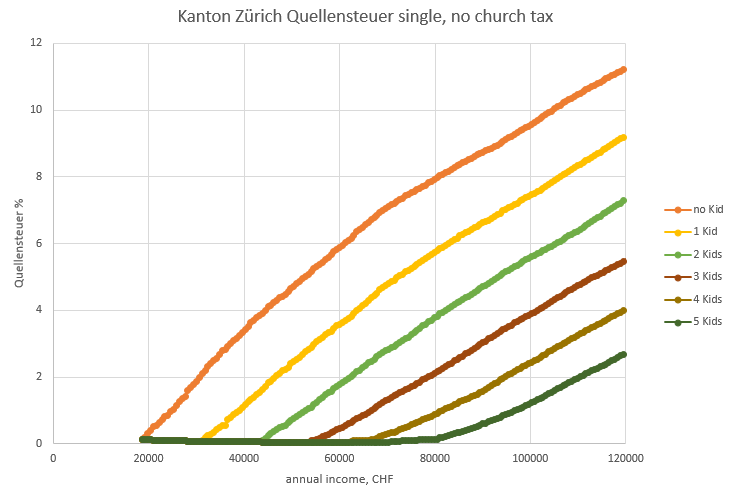

Quellensteuer

If you are not subject to the standard taxation because you are a foreigner without C permit and below CHF 120k in salary, then you are instead taxed with the Quellensteuer (“source tax”) system. It is much simpler: your canton has a table that says how much of any monthly payment directly goes to the tax authorities. Yes, it is applied on a monthly basis. That means if your salary varies between the months, an optional tax declaration might refund you a bit of taxes for few effort.

The complete data set can be found here including documentation on how to read it.

For Kanton Zurich to be found here in a more readable form. I put some of the tables together into an excel sheet:

2) Investment Taxation

Capital gains

The great things about Switzerland is that capital gains are fully tax-free! This makes investing in Switzerland insanely attractive. So if you put CHF 1M in stocks and you sell them later at CHF 2M you pay zero taxes! However, most stock and bond investments come along with dividends:

Dividends, Coupons, Interest

Swiss based Stock Dividends, Bond Coupons and interest on your cash are generally taxed. The Idea is that they add to your income and are taxed as such. But since those companies that keep your stocks, bonds and cash usually don’t know about your income, Switzerland makes you pay incredible 35% Tax called Verrechnungssteuer when these incomes happen. You are then intended to declare these incomes with your next tax declaration, where the difference between the upfront Verrechnungssteuer and your income tax will be refunded.

So basically, Dividends are taxed on your income tax level, but you have to wait for the Verrechnungssteuer to be refunded a couple of months.

Foreign dividends are not taxed. Be sure you still declare them, because legally they are an income that you must declare. No guide on the grey zone of tax evasion should be given here ![]()

![]() BUT: due to double taxation treaties (Doppelbesteuerungsabkommen) they might not need to be declared 100%. To find out exactly, check the official tool.

BUT: due to double taxation treaties (Doppelbesteuerungsabkommen) they might not need to be declared 100%. To find out exactly, check the official tool.

Interestingly the swiss law makers created the so called Kapitalrückzahlungen (Capital refund) in 2008 which works identically as a divided (is distributed by companies per share) but is not subject to taxes. You should not add these to your tax declaration ![]() Find and compare the following 2 examples of the Vanguard all World ETF vs. UBS SPI ETF (big thaks to Grog for pointing this out)

Find and compare the following 2 examples of the Vanguard all World ETF vs. UBS SPI ETF (big thaks to Grog for pointing this out)

In this very interesting NZZ article a summary is given about foreign source taxed that can be re-claimed. The essence is

- get the DA-1 form of your cantonal Tax Authority

- with it, claim the “claimable” fraction of foreign source taxes

- for those parts of your dividends beyond the DA-1-claimable fraction, have alook at the Federal Tax Authority, they provide links and forms to directly claim back taxes from foreign tax authorities.

further interesting lists of interesting aspects:

Handelszeitung (german)

Stamp Tax (Stempelsteuer)

The stamp tax applies on any purchase of stocks, funds, bonds, derivatives etc. that you buy with your bank or broker. It amounts to 0.075% of the purchase value for swiss based products and 0.15% for foreign based products. This has a slight implication on the distributing vs. accumulating topic, since reinvesting distributed dividends are subject to this tax. however, broker fees usually dominate the costs of purchasing products, so you dont need to wast too much thought son the Stamp Tax.

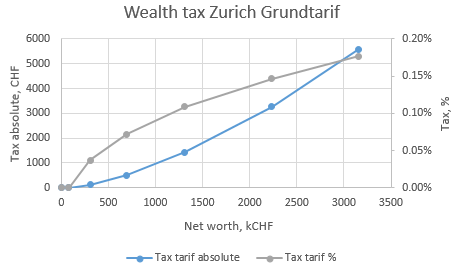

Wealth tax

In some cantons wealth taxes apply. Find the (german) federal law here.

It can be calculated (for Kanton Zurich) with the official calculator.

Help for gathering other canton’s data is much appreciated!

Wealth tax is typically of the order of 0-2‰. in zurich it starts with zero at 77’000, CHF 300’000 are taxed around 0.4‰ (CHF 115) and the 1‰ mark is somewhere above CHF 1’000’000. Wealth tax aplies to the summ of all your cash stocks, real estate, anything that has a value. Important exception: Pillars 1, 2 and 3a are exempt.

interesting ktipp article (german) (thanks to @grog) on what about deductables of vermögenssteuer

Kapitalauszugssteuer

applies to money from säule 3a and Säule 2, if recieved as lump sum (not as a rent,hm? (Source?)

Postfinace has a very handy calculator here (thanks to MrRIP)

if you dont want to only find out you numbers but what-if, check out the tables & graphs sheet from MrRIP

Since the Kapitalauszugssteuer is progressive it does make sense to distribute the cash out over several years. This can easily save you about half of the taxes.

more details on Säule 3a can be found here

3) Consumer Taxes

Consumer Taxes are typically quite boring. They are “god-given” and you cannot do anything about it. There is a list of exceptions like child care, commuting expenses,…

The most imortant consumer Tax is VAT or Mehrwertsteuer (MwSt). It is 8% for almost everything and 2.5% for food and basic needs. One speciality is The Hotel Tax of 3.8%.

Then there are special additional taxes with the idea of guiding peaple away from some products (Lenkungsabgaben) for example on Tobacco, Alcohol, fossil fuels and others.

##Addendum

50 interesting tax aspects by Migros bank

Outro

I hope you now have some idea on how to go about taxes, especially in your finacial planing. If you think I mesed something or want to add something, please go ahead! make a comment, ask questions, help me make this post evn more useful! Thank you!

i did not look into taxes for couples. Sorry! but I will gladly add this information once we have it here!

i did not look into taxes for couples. Sorry! but I will gladly add this information once we have it here!