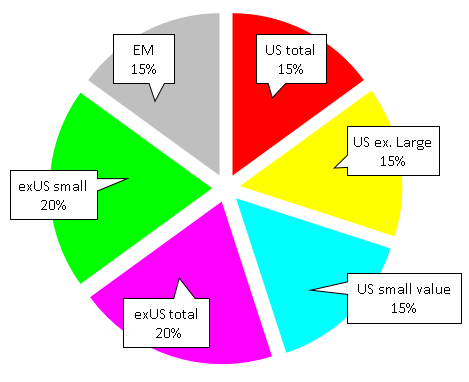

So, here I come up with the last draft of my new portfolio. the old one is here. By extending my investment universe to US based Vanguard funds, It is now much more consequent in terms of how my dream-portfolio looks like. Again, this would be an equal amount of $$ in every liquid stock in the world, with some value weighting. 100% stocks, at least for that part of my stash that i can freely define (unlike pillars 1,2,3):

- 15% VTI: US total stock market

- 15% VXF: US ex large cap (US minus SP500)

- 15% VBR US small value

- 20% VXUS exUS total stock market

- 20% VSS exUS small cap

- 15% VWO emerging markets

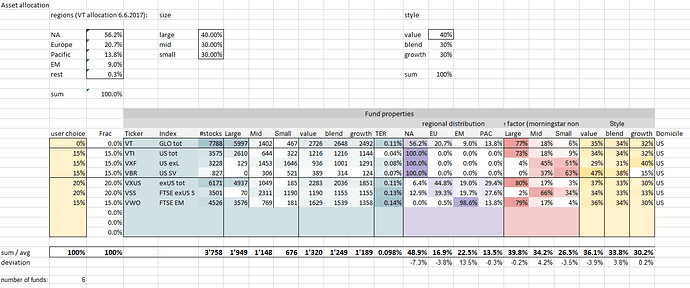

with a total expense ratio below 0.1% ![]() and an weighted average of 3’700 stocks per ETF

and an weighted average of 3’700 stocks per ETF ![]() but be aware of some overlaps.

but be aware of some overlaps.

the regional distribution is close to that of VT, with EM somewhat overweighted:

- 50% north america

- 20% Europe

- 20% emerging markets

- 10% rest

- rest: others

the size factor is clearly different, with mid caps overweighted and small caps significantly overweighted: 40/34/26 where VT has 77/18/6.

I also want to overwight Value stocks, but when i wrote down the value-blend-growth distribution according to morningstar, I found i cannot do too much about it unless i sacrifice diversification and low TERs. VBR seems the only value fund that does ok with both, but is actually not that valuey, according to altruist advisors. it has about 50% value stocks according to morningstar, somewhat more than 1/3rd.

I also dropped the home bias since SPI stocks are already contained in VXUS. Nestle is the top position there, and roche & Novartis #4 and #5 ![]() my beloved SMPCHA simpy shatters at the diversification argument.

my beloved SMPCHA simpy shatters at the diversification argument.

I have not commited yet as i feel no pressure, so i keep tweaking here and there. any suggestions welcome ![]()