Here is another bit of information that fits into multiple threads on this forum…

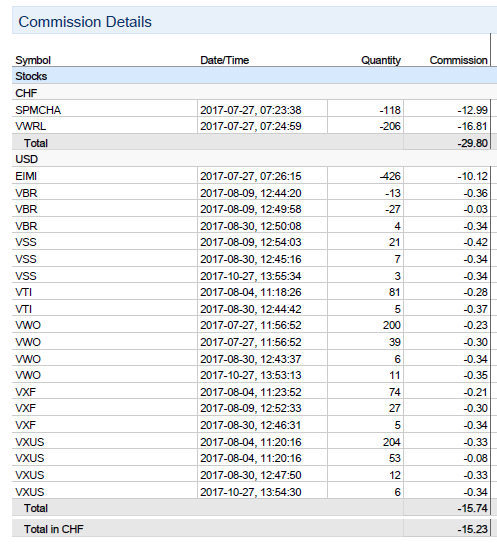

after 3 months of monthly rebalancing by adding funds with my new IB portfolio, i can present commissions paid so far. commissions dominated by selling my former CH & IE- based funds that i transferred ti IB from my former broker (SPMCAH, VWRL & EIMI). the vanguard trades average out slightly below $0.30 per trade, where the volumina ranged between $100 and $10’000. amazingly low cost! howevers, soon i’ll be charged chf 10 per month ![]() which in turn are over- compensated if i wanted to do the same monthly funds adding with Corner Trader

which in turn are over- compensated if i wanted to do the same monthly funds adding with Corner Trader ![]() gogo, $100’000 should be rachable by end of 2019!

gogo, $100’000 should be rachable by end of 2019!