Hey Daniel,

thanks for you positive words ![]() I’d actually be very interested in some behind the scenes visit!

I’d actually be very interested in some behind the scenes visit!

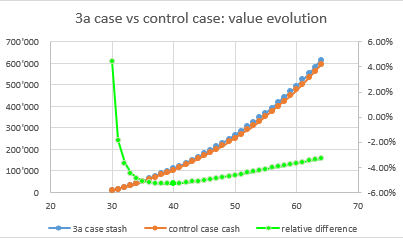

My primry interest is to have a some world portfolio (like my <0.1%TER portfolio) that would pay me a significant premium for the illiquidity that come with the 3a framework. here (excel sheet) i tried to simulate this, and adjusting to VIAC’s costs it looks like

so for the cost i like the development, but for me it looks like “not yet there”.

for the technical stuff i can just argue with my taste.

- i’d prefer a VTI over SP500: less TER, more diversification, but US domiciled (in case VIAC can’t qualify as qualified broker)

- I’d rather have a very small swiss allocation, according to the default world portfolio allocation

- if a big swiss portion is required, then I’d have SPI extra higher weighted such that Nestle/Novartis/Roche have the same weight as the top SPE extra positions

- I like that i don’t see CHF hedging, because on the long run hedging is a cost without benefit

- taking out the cash part from the fee and paying interest is a clear win over VZ (altough only 3% of the portfolio…)

on the big picture I am happy to see some new 3a solution that might make it interesting for me again!