I think inflation will hit the US and EURO-Zone hardest, interest rates will rise there and the stocks will loose in consequence.

So I am reducing my $ and the € exposure and am also selling about half of my swiss stocks, I am currently buying asia, british and emerging markets and commodities.

I think the CHF will stay strong, the swiss national bank is not going crazy and so I keep my currency stash mostly in CHF. The Japanese Yen seems also rather undervalued…

I am quite curious to which commodities (ETF?) you are buying into? and to what % of your portfolio?

UBS ETF (CH) Gold (USD) A-dis, ISIN: CH0106027193

iShares Diversified Commodity Swap UCITS ETF, ISIN: IE00BDFL4P12

At the moment it’s around 2% of my portfolio but I will increase it to around 10% when I see an opportunity.

I also own a small amount of physical gold

Thanks for sharing the details, the iShare one seeems quite interesting and has a low TER. I’ve mostly seen commodity ETFs with higher TERs. I am also looking into having 5% of my portfolio into commodities as a inflation hedge.

In which scenario will those 5% make a meaningful difference to your returns?

sounds very much like micromanagement

6 posts were split to a new topic: Commodities as diversification

Could you maybe stop with the monthly updates of your net worth update and a direct link to your blog? It’s not really adding anything if only one column is added every month…

Disagreed. I like the monthly updates, gives insight how investments are going for others.

I think both of you are right.

It’s nice to see monthly projections for others in the forum that may not be tracking NW with that frequency.

But I also agree that in a general thread about NW evolution, it brings more value to see multiple people sharing NW (Alongside portfolio type and learnings) rather the same person showing a slightly different NW every month.

Can moderators separate the threads? One for yearly NW and one for those that are happy to share more often?

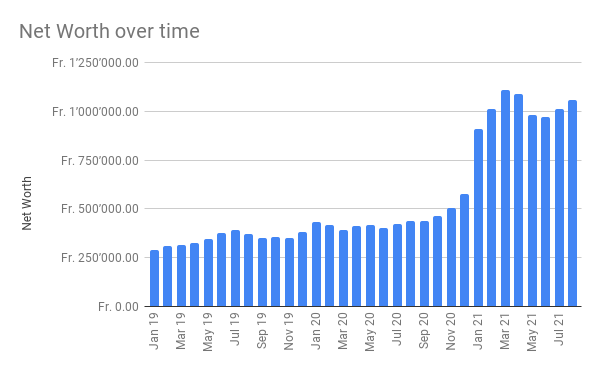

So here is my first financial net worth post.

Looked it up last weekend and realised that I have over 500k CHF in equities… so I am 25% done on my way to 2 million.

Then there is 100k+ CHF in Pillar 2, and another 70k worth of real estate.

Next update when I cross 1 million in equities likely in 4-5 years.

I’m not sure if there’s enough content for multiple threads. I track my NW monthly but post it here only quarterly (I think I missed my Q2 update though). I don’t mind other people posting more frequently because it can give more context to current events.

I also quite like to see the monthly updates, I would apreciate if more members would also do frequent updaes, it is sort of motivational

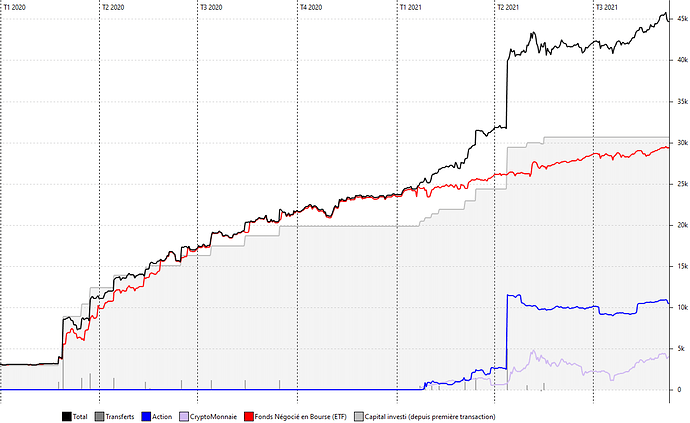

First time I post it.

I don’t include 3a (31k) and 2pillar 100k …

It’s not much and this year I have not been able to contribute a lot (only 3a). Burn out and reduced my %.

Fortunately I’ve been lucky with my tradings ![]()

Also i’ve started with huge debt ![]()

Strong move! Your health (mental and physical) is more important than any money in this world.

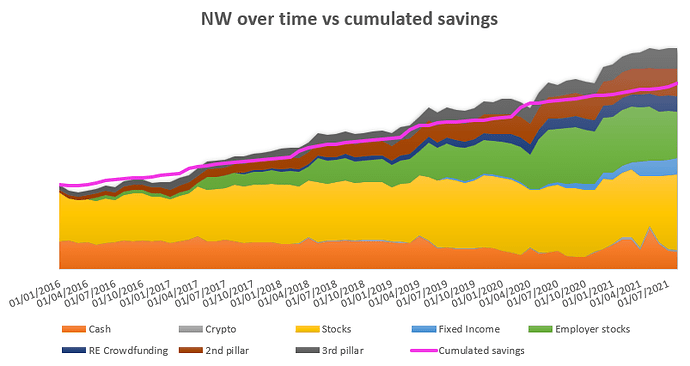

Ok, so here you are all with your fancy charts and insights and I’ve been just a tracking ant. After some scripting, prices retrieval, study of 2nd and 3rd pillar statements and even finding some “forgotten” crypto, I was able to produce this (as well as to semi-automate the data export from GnuCash so that I can keep this updated with the only effort of tracking transactions, not valuations).

I have less detailed information before 2016, so it is what it is. I have therefore equated cumulated savings and NW on Jan 1st 2016.

I have borrowed your idea of plotting the cumulated savings on top on the NW, which leads to the following interesting comments:

- I have changed my mind and I now consider 2nd and 3rd pillar as part of my NW. I should maybe apply a discount percentage to account for taxes if withdrawn, but that’s just a quick Excel formula so no pressure.

- At the beginning I would have been better off without investing as I was “losing” money.

- Despite wasting a lot of money cancelling my 3rd pillar insurance in July 2020, it is hardly noticeable now.

- Corona shock brought me down to a situation where if I hadn’t invested a cent since 2016 and invested everything then, I would be richer than today.

- My compensation plan was a risky one. I have since changed employers and I’m slowly selling those now vested stocks. The new employer does not offer stock options.

- Now that I have accounted for all the cash I have in different accounts, I realized that my equities asset allocation is way lower than I thought.

- Income from stocks, fixed income or RE is translated into cash unless re-invested, however that together with valuation differences account for the delta between the saved money and the NW.

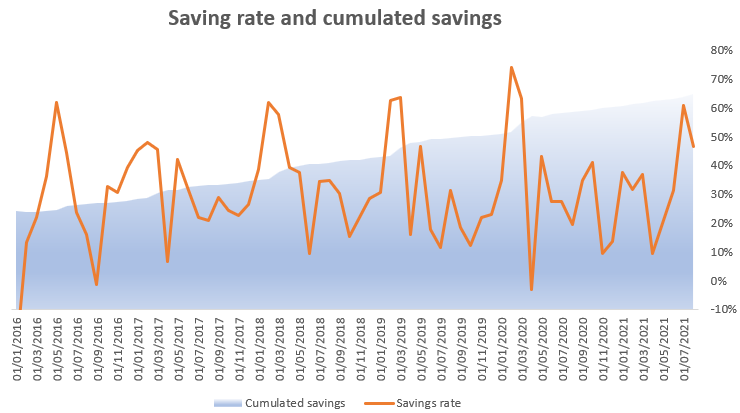

Although this belongs to my personal numbers thread that I will update as usual at the end of the year, my savings rate is really inconsistent:

Keep up the good work everyone and do no forget to enjoy life!

I wouldn’t put much thoughts on that. 2016 was a bad year, which you couldn’t have known at the time of investing (but only in hindsight) and timing 2019 (which was an awesome year), then the Corona-crash isn’t something us mere mortals are able to do repeatedly. Would you be richer than today if you hadn’t invested at all? And if, through an imaginary thought process, you would have not invested since 2016 and until last year’s crash, what other thought process would have had you change your mind and drop everything in once the crash had occurred?

That’s something I have noticed as well. Mandatory 2nd pillar contributions give a good conservative basis to our allocation, it’s actually hard to be very agressive without a high net worth in Switzerland.

I would like to share an update but I don’t want to shock you guys with my negative liquidity that I have right now

Come on, if you’re invested on margin, that can only mean that a market crash is coming very soon. We need that information, you can share it.