As far as I read it is not supposed to make a meaningful difference in terms of more return but I was planning to invest into commodities in order to protect my portfolio using commodities as inflation hedge. It has been discussed around here: Inflation is hitting US

if you can make 50 - 100 k with one trade it might be well worth the time, but yeah I guess it’s no longer the “passive path”

How much percentage of one’s portfolio would make sense to have invested into commodities in your opinion? Maybe 10%? or even more?

I think it depends on your conviction in a certain asset, i know people who went 100% into crypto, and they had a great returns in the last few years. the MSCI world was a phantastic index in the past but i believe the world economy has changed and it will not perform well in the future, it will crash heads on into the next crisis. i invest in many different assets and i don’t mind observing the market on a regular basis and adapt your my portfolio accordingly, If you do that i think 10% is fine. if you want to be 100% passive, it probably doesn’t make much difference

This is all fine, but offtopic.

Hi Folks,

commodities are horrenduously high already. Gold crashed 2,5% (in EUR) yesterday, lowest level in a while.

As commodity fund I settled with IE00B53H0131, 0,34% TER CMCI index from UBS and DE000A0S9GB0 for Gold.

Check some of Ben Felix videos on Gold, Asset Alocation, Diversification and Idio(t)sincratic risk. Facit is that it is very difficult to do better than the market, which is the best investment, always. Your results outcome distribution will just spread out by getting out of the All World Equity strategy.

This is not a citric, as I do the same and buy lots of single stocks and so on, so do what I say not what I do, but the more assets the worst the outcome seem to be the result of research.

Sorry @Cortana for continuing the off topic, feel free to move to a better tread.

Thanks miriade for the hint about Ben Felix videos, I watched a lot of them a year ago but it did good as a refresher to watch a few of them now again. That one is interesting for example: https://www.youtube.com/watch?v=7gkQHSW3hkE

He is an advocate of factor investing/diversification where in this video he mentions that it is in his opinion clearly beneficial due to increasing the rate of return and lowering standard deviation of one’s portfolio. So basically Ben’s message seems to be that you should diversify by factor investing. He does go into commodities in that video though.

I had a topic about this problematic of commodities.

In short, the problem is that what you buy is not commodities but futures on commodities that the portfolio manager is rolling over time. We sell the futures once they are at maturity and we buy new futures with the cash obtained. The problem is that the futures are always a bit more expensive than the spot price which means that statistically you loose money at each rotation. Sometimes you could win but usually you loose.

Thanks for the link and hint. Is this what you refer to called “negative roll yield” ?

Yes, the technical word is precisely *negative roll yield". The topic is quite well documented and has to do with the fact the markets are mostly in contango and less frequently in backwardation.

I see… having browsed through a few commodity ETFs I have noticed that some of them provide a sort of “protection” to this negative roll yield as well as speculation. Are these ETFs less affected by contago market price of futures?

For example, I cite below the index description text of the UBS ETF (IE) CMCI Composite SF UCITS ETF (USD) A-acc ETF (CCUSAS.SW):

“The UBS Bloomberg Constant Maturity Commodity Index extends beyond short dated futures contracts and diversifies investment across the maturity curve. By providing investors with access to “Constant Maturities”, it not only gives a more continuous exposure to the asset class and avoids the speculative activity that can surround monthly rolls of traditional indices, but can also minimize exposure to negative roll yield, making the index more representative of the underlying market price movements.”

Source: UBS ETF (IE) CMCI Composite SF UCITS ETF (USD) A-acc | 11926603 | UBS Switzerland

Bla Bla Bla…

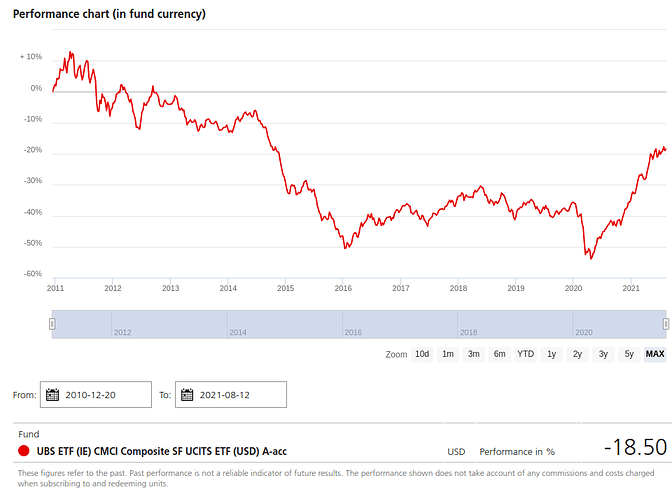

A curve tells more than thousands words

The rise since the covid crisis is due to a shortage of natural ressources.

No, home office does not produce any steel.

But on the long run (for a typical passive investor) this product is mostly loosing value.

Happy investing!

Yeah, I see your point, short-term one might be able to get some profits out of commodities due to some external factors (e.g. pandemic) but on the long-term it does not make any sense for us passive and long-term investors as it is loosing money due to futures prices being mostly contango. I think I will simply stay away from commodities.

For the fun of it I found the “marketing” factsheet PDF regarding how the UBS Bloomberg CMCI index tries to tackle the negative roll yield issue:

I like the curve increasing for short duration but decreasing for longer duration.

In this example: A curve lies more than thousands words.

Yeah, it serves them quite well to have depicted that line in the graph 3 times longer for the price decrease (backwardation) than for the price increase (contango).

Also I don’t quite get the logic on the top right graph with the numbers 1 to 4 because based on their graph they show an example with buy in point 1 which is later in time (based on the X axis) than the sell point 3. It does not respect their time to expiration X axis… but maybe it’s me not understanding it.

This UBS fund doesn’t “tackle” roll yield. They are just reweighting monthly, roll small amounts frequently to avoid low liquidity issues, diversify across tenors for more diversified exposure and liquidity. Fine ideas but you will still run into the big problem of long term commodity exposure.

Roll yield is more complex than that Investopedia/UBS definition. You pay it every day while holding a futures contract not when rolling to a new one.

A better way of thinking about it is just as the cost of carry of the underlying commodity. If you are holding and rolling oil contracts in perpetuity then the implicit cost of storing that oil, insuring it, financing it, etc. is being deducted from the future contract value each day.

These markets are only really directionally tradeable with shorter term trends. For that you need to spend your career understanding global flows and probably be working at a big firm with insight into proprietary data.

As a retail/passive investor forget about commodities.

Thanks for your explanations, it is an interesting topic and always happy to learn something new. Although the digger I deep into this topic the less likely I find it a suitable investment for us all. The only way to get some return out of this asset class seems to be short-term and based on an external factor.