Ah OK. Got it. Average dividend yield for the S&P 500 over the last 4 years was 1.5% according to this table.

I calculated fees with the following assumptions:

- 10 year investment

- 200k lump sum investment at the start

- 2500 monthly deposits

- 1.5% dividend yield for US

- values without a calculation have been done with the

FVformula - it’s likely the free savings plan offer from neon runs out when FWRA has reached a certain AUM threshold, so I included a variant including transaction costs

| finpension DM | finpension World | Swissquote | neon (savings plan) | neon (normal) | |

|---|---|---|---|---|---|

| Custody fees | CHF 13’803.83 | CHF 13’803.83 | 10 years × CHF 200 + 8.1% VAT = CHF 2’162 | 0 | 0 |

| TER | CHF 2’623.06 | CHF 2’973.93 | CHF 5’261.04 | CHF 5’261.04 | CHF 5’261.04 |

| Transaction fees | 0 | 0 | (1 lump sum + 10 years × 12 months) × (CHF 9 + 2 + 0.85) = CHF 1’433.85 | CHF 200’000 × 0.5% = CHF 1000 | (CHF 200’000 + 10 years × 12 months × CHF 2’500) × 0.5% = CHF 2’500 |

| Reclaimed US WHT | CHF -5’922.88 | CHF -5’261.04 | 0 | 0 | 0 |

| Total | CHF 10’504.01 | CHF 11’516.72 | CHF 8’856.89 | CHF 6’261.04 | CHF 7’761.04 |

| Liquidation | 0 | 0 | CHF 9 + 2 + 0.85 = CHF 11.85 | (CHF 200’000 + 10 years × 12 months × CHF 2’500) × 0.5% = CHF 2’500 | (CHF 200’000 + 10 years × 12 months × CHF 2’500) × 0.5% = CHF 2’500 |

So the the difference between the best (neon savings plan) and the worst (finpension World) offer after 10 years is CHF 5’255.68, or about CHF 500 per year. Not that much of a difference, no?

Thanks for sharing

Will look into details

But if 500 CHF per year is a lot or not depends on the person and their comfort level. I have heard some people might change banks because one is free and other charges 50 CHF per year.

So I guess it comes down to the benefits vs extra cost. And if those benefits matter to the person involved. For example if one already have world ETf at SQ, they might not see this as a benefit to move money. But if someone already has FP account and want to consolidate , then they might see this differently.

Thing is that you also pay 0.5% (+0.15%) when selling with neon.

This applies to FWRA as well by the way.

Shouldn’t that also be included in the calculation?

You’re right. Although you could transfer the title to another broker (i.e. SQ) where selling it is much cheaper. I included it in the above table.

The calculation is not perfect anyway, as I assumed 0% performance over 10 years, which is highly unlikely.

Good shout!

Thank you @woody ![]()

it is already possible to transfer securities out ![]()

That is indeed what it boils down to. finpension offers:

- very easy to use interface to set up up to 10 different portfolios from a curated list of ETFs

- the ability to easily change asset allocations (“I’m going to add 10% REIT and reduce gold to 5%” etc.), this can be a blessing and a curse!

- free currency exchange

- cheaper access to private markets through insititutional-class funds

- restricted access (you can only deposit from/withdraw to an account in your name)

Is there something on that list worth 500.–? That is a personal decision, and there’s no right or wrong answer.

For me, the last point is quite important. To be honest, I’m starting to feel uneasy when thinking about having a portfolio of half a million CHF on neon. To be sold and transferred with a few taps, with the same app you do your daily banking with, on the device you carry around with you all the time?

When it comes to these things, sleeping well at night is an underrated criteria. I’m not sure I do with neon with the current security mechanisms in place.

Hello, I’m interested in the new finpension service. Does anyone have a code to send me in MP?

I think the main worry you are pointing out is exactly the benefit people earlier in their investing journey actually prefer. In few taps, you are invested.

I understand the concern that banking and investing app is same for few other Swiss brokers (Neon, SQ) but I also think you can always choose not to have the app. For example I only use SQ on laptop. I don’t use Neon so I cannot say if it’s possible to be laptop only or not. Having said that, again, this can be seen as a benefit as well. The one stop shop.

It comes down to individual preferences as you say and what matters most. Kind of proves the point why so many rich people invest via UBS/ZKB etc irrespective of their fees. Because peace of mind matters.

Aside from the aspect of registering securities in one’s own name and the banking license held by SQ, what is the benefit of buying ETFs like VWRL on SQ when Finpension’s offer, with its reduced fees, simplifies this?

Is there still a future for a buy-and-hold strategy on SQ given this type of offer?

For large portfolios, Swissquote with FWRA (or VEVE+VFEM) is still noticeably less expensive as both the custody and transaction fees will be more or less fixed up to 1 Mio. (at which point they’d be 0.035% p.a.).

As far as I can tell, the calculation above doesn’t account for the slightly higher Swiss taxes in the finpension solution due to being required to declare gross dividends to be eligible for the DA-1 tax credit. The DA-1 tax credit is still beneficial, of course, but might be closer to 0.1% p.a. than 0.15% p.a., depending on your marginal tax rate.

finpension invest is more convenient, of course, especially if your portfolio is more complex than just a single ETF. And Swissquote is relatively expensive for small portfolios. I think there is a market for both.

When talking about UCITS investments at Swiss firms. SQ is just cheaper. That’s it.

Finpension is more expensive. If you already know what you want to buy and just stick with it, then you need a broker with no or low custody fees and management fees.

Finpension is offering a good service but would end up more expensive for DIY investor. Over the years all these costs add up. Don’t get me wrong, I really like FP and use them for pension accounts. It’s just that for now, there is not enough for me to switch.

In this forum there are many discussions about advantages of US ETFs, the only reason was cost advantage over UCITS ETFs. The cost was around 0.2-0.25 % annual impact on annual basis. So this means such a difference matters.

If yes, then the 0.39% fees at FP should also matter.

Some details below

This is based on the idea that your personal situation does not change throughout your life as an investor. This is rarely the case in reality.

Some people get married, others divorce, and others lose their spouse. Personally, I am fully satisfied with my current choices, but I also need to consider my new situation and the fact that my partner is much less comfortable with technology and digitalization than I am. In this case, I need to weigh the costs against the ease of use and the administrative procedures required to retrieve the invested amounts from a foreign broker in the event of death (a kind of extreme and definitive example, but you get the idea ![]() ).

).

Totally get it.

But your question was about SQ. so not sure why would it be foreign. VWRL or FWRA or IMID bought on SQ is not with foreign broker.

Anyhow. I think at some point , I will end up using all of them ![]()

Yes, sorry for that. I naturally deduced to use IBKR when you mentioned sticking to a broker with minimum fees, even though it wasn’t explicitly mentioned in my previous post. Sorry for the confusion and thanks again for your insightful response ![]() .

.

I notice that there is a certain limit between simplification and extreme optimization, often related to the decision of whether or not to accept higher fees.

You are welcome.

I also believe when someone is starting to build wealth, they tend to overthink about costs. But as Portfolio grows, other elements come into play

- security

- familiarity

- peace of mind , etc

So I don’t think one need to stick to IBKR for rest of their lives. It’s cheap and effective but it’s foreign. At some point it starts weighing in on people ![]()

I mean you could always buy on IBKR and transfer shares every few years to SQ and pay the CHF 200 p.a. to sleep better (crossposting to the mattress thread? ![]() )

)

Coming back to the topic of private equity. Does Tony Robbins pull these numbers out of his ass?

First of all, the guy is trying to promote his book, so he is probably biased. Also PE often cites the IRR metric, which will always sound better than complete returns. The lower risk argument is also questionable, since assets are just valued much less regularly. Could do the same by hiring a wealth manager and only call him once a year to find out how my portfolio is doing.

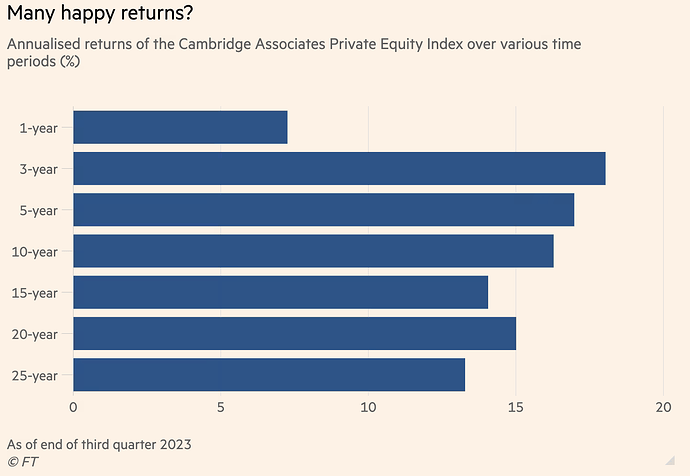

Here is a PE return overview taken from the Financial Times.

PE portfolios are heavily US weighted, so an appropriate benchmark is the S&P500 and not an MSCI World. 5y & 10y returns for S&P500 are 13.2% p.a. and 12.4% p.a. respectively (don’t have longer return periods at hand). So yes, PE has better returns, but I’ll take a wild guess and attribute this to leverage.

FT mentions a recent paper discussing PE returns and its beneficiaries: “Phalippou, whom Institutional Investor has dubbed “the bête noire of private equity”, published an incendiary paper titled An Inconvenient Fact: Private Equity Returns & The Billionaire Factory. As you might expect from the title it pulls zero punches, calculating that the only people to do well out of it (on average) are the private equity tycoons themselves.”

There is increasingly more talk about “democratisation” for people with less capital (1m+ to 20m) and access for retail investors. What makes people think that they will get the good deals & funds? They are probably just taking on assets from institutional investors that want to exit for a reason, or assets that are performing badly.

An example is Swissquotes unicorn AMC index, look at the index components and ask yourself why they are available to retail investors, maybe because the high valuations of the past are not there where they used to be?