Hi Mustachians (Edit 2022-04-19, received an unclear reply from Yuh)

Short version:

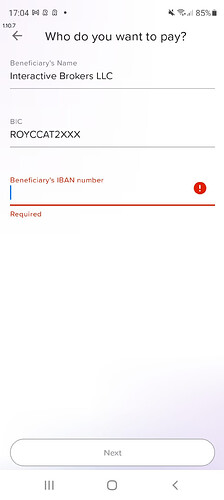

The issue is there is no IBAN for Canadian bank and my app Yuh(digital bank) needs IBAN to process the transfer.

Recap:

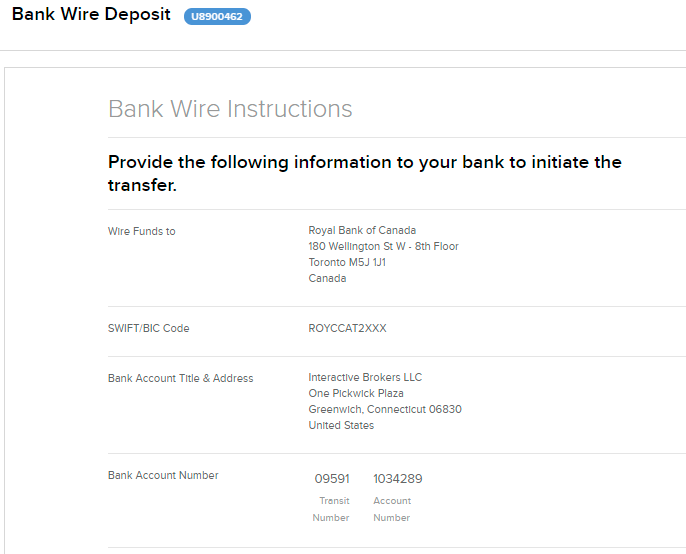

I need to transfer 70k CAD to fund my IBKR account from the app Yuh, and on the Bank Wire Instructions generated by IBKR, there is no IBAN as it’s Canadian bank

*Provide the following information to your bank to initiate the transfer.

Wire Funds to

Royal Bank of Canada

180 Wellington St W - 8th Floor

Toronto M5J 1J1

Canada

SWIFT/BIC Code

ROYCCAT2XXX

Bank Account Title & Address

Interactive Brokers LLC

One Pickwick Plaza

Greenwich, Connecticut 06830

United States

Bank Account Number

09591

1034289

Transit Number

Account Number

But on Yuh you have to provide a IBAN to be able to make international transfer, I tried both with the simple account number and the Transit number+account number or BIC+ Transit number+account number but nothing works,

How did you manage to solve this?

Thanks

I also searched the Forum before asking the question and found this post, but I haven’t seen a clear answer to his question:

@boschika boschika

Did you have the same problem as me? Have you found a solution? Thanks

I have also found this artcile and tried with the suggestion but Yuh doesn’t seem to recognize the account number ‘0003 0959 1103 4289 00’ so still blocked

https://www.liveca.ca/blog/how-to-send-a-wire-transfer-to-canada

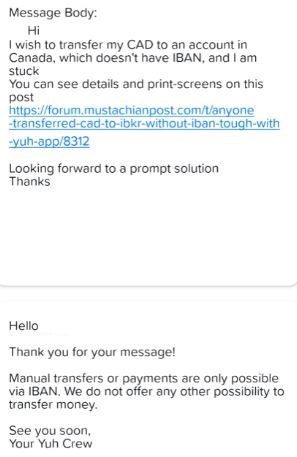

I received a reply from Yuh, maybe their reply is concise, or maybe the person hasn’t read this post at all. Here is our conversation record:

I can’t find an easy way to reach IBKR support

Edit 2022/04/21

I am travelling in Canada now, I went to a RBC branch yesterday as I also thought about withdraw my CAD in cash and wonder if there is a solution to pay IBKR directly as they have their CAD account with RBC

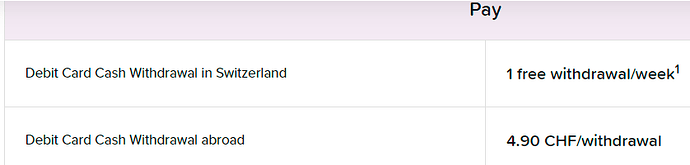

Yuh hasn’t specified any max withdrawl limit outside Swizterland, only shows it costs 4.9 CHF

but the staff told me I have to have an account in Canada to be able to pay IBKR and their ATM will not allow me to withdraw 70k CAD, and they can’t open an account for me because I don’t live in Canada…