Rough numbers:

- ~100k CHF in the bank (about 75k CHF now in savings account).

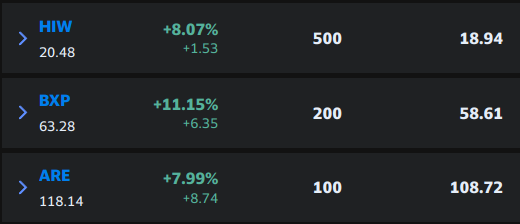

- ~20k invested in 3a with Finnpension. Red.

- ~10k invested in crypto (mostly BTC) Green.

- ~10k invested with Selma (since 2021) Red.

- ~2k invested with IBKR (started last month) -

Some notes. I am aware that the amount that I have in the bank is, let’s say, sub-optimal. I’m keeping a high liquidity because I might need them for a Real Estate deal in my home country. Nothing is lined up or even close, just something that me and my partner are semi actively looking into. I could invest them in IBKR and sell them if needed in 6months/1year but the way things are going it’s probably best to leave them in the bank, especially in CHF. It’s also not 100% needed, it would just decrease the amount that we would need to loan out, which given the current rates in the eurozone we want to minimise.

Selma is how I first invested, quite a bit in the red at this stage but such is the market. Haven’t really touched it since 2021. The plan is to use IBKR now. I could probably lump sum about 10/20k there + 1-2k per month. That’s is in line with what I said above.

The crypto investments I wouldn’t touch. I understand that it has a much higher % than it should in my portfolio but that’s just because where I started. If we look at what came out of my bank account it was actually a rather small amount.

I understand the idea but I’m not sure if I fully agree. Disclaimer I’m still very much new to investing so I’m probably wrong on most things, but here are my thoughts.

I wouldn’t say I have the highest risk tolerance (hence the initial question) but also definitely not the lowest/low. From my side at least there’s a difference in trying to time the market by selling/buying somewhat frequently (which I’m not planning to do) vs choosing a time or times to enter the market which is basically what I am asking about.

In the same note I also find it easier to hold while the market is in a down trend than to jump in at said time, especially when it seems like it just will keep going that way (so not necessarily to buy the dip). I have kept what I had at Selma and kept buying in to 3a even though both were very much in the red almost from the start ![]() . From crypto due to luck in timing I was very much always in the green, even though how much varied, greatly considering the crashes it had. I first bought in 2017 so it has been quite a ride, but considering I was basically always green it wasn’t that bad tbh.

. From crypto due to luck in timing I was very much always in the green, even though how much varied, greatly considering the crashes it had. I first bought in 2017 so it has been quite a ride, but considering I was basically always green it wasn’t that bad tbh.