I’m just stunned. I thought he’d do his usual push back to stop markets getting ahead of themselves, but he was just limp. How can this not trigger a massive santa rally?

Well it’s just temporary… Until @Cortana dips in I’m keeping my powder.

I’ve reached the bottom of the dip a couple of days ago …

… but I still didn’t feel like buying yesterday or today despite having some dry nachos on the sidelines.

I’ll see myself out, sir.

I thought that the markets were already a bit over-bought and over-extended before Powell’s speech. Now it has gone crazy for the last couple of days.

Are you looking at selling the rally yet? Or maybe you’re still buying?

Still buying, it’s a classical Christmas rally.

Took some profits today.

Bought 5.5k of VTI today, already down 1% ![]()

And there we go, like clockwork. ![]()

Would you mind next time telling couple of hours before, not after?

Luckily I took more profits today before you made your buy! ![]()

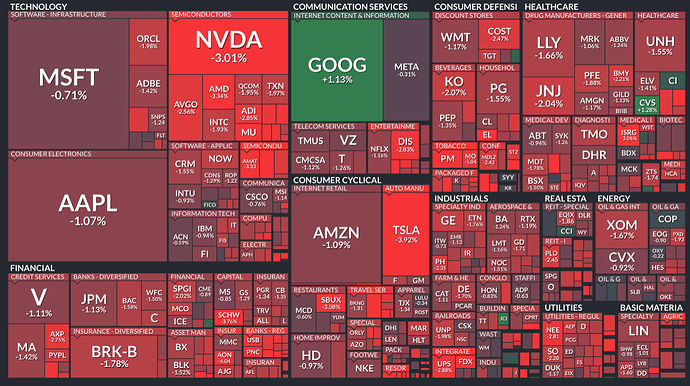

I didn’t realise it was so ugly at the end of the day:

Getting paid tomorrow, settling bills and buying as usual.

Indeed, that would be most helpful ![]()

2 posts were merged into an existing topic: Benchmarking The Market

An update about the sentiment situation.

https://seekingalpha.com/article/4669662-there-are-still-too-many-non-believers

Can you post the text? I can’t view it here.

EDIT: I managed to view it. In short: people are still too bearish and so bull run has further to go.

I largely agree with this and it has been the continuation of the story of the past few years: investors climing up the wall of worry. Of course, that wall will lead to a big fall at some point, but when that happens is an unknown.

Yep, however last week the S&P500 Fear and Greed Index crossed into “Extreme Greed” territory. News headlines are all over the place, some are exuberant while some are predicting the next market crash. They predicted 10 out of the last 2 - or however the saying goes.

As for me, happy to be deep in the green, I will listen to uncle Warren’s advice to be fearful when others are greedy and will pool some cash. Had some big expenses early in the year, plus filling my 3A, with a few more on the way so it will happen organically anyway, even if it is TiMinG Th3 M4rk3T ![]()

Are you planning to keep it in cash or convert it in other investment vehicles ?

Cash for say 3 months is my plan.

@Cortana bought this week?

My cash is ready. ![]()

This time it was my fault. Bought heavily on Friday and Monday and the sub-sector I invested in dropped 5%+ in 2 days.