tl;dr: There is no important relationship between an asset (e.g. gold) and its denomination (e.g. CHF).

Listen to reason

Reason 1: The asset you hold

If you buy 1 kg of gold, you hold… 1 kg of gold. It logically has the same value regardless of what currency (CHF, EUR, USD, etc.) you bought it with.

Reason 2: Arbitrage

Let’s say you could get more value by buying or selling your gold in one currency than another. For example:

| Asset | Denomination | Price |

|---|---|---|

| Gold | CHF | 10 |

| Gold | EUR | 20 |

| CHF | EUR | 1 |

The EUR and the CHF are worth the same. Clearly, we want to sell our gold for EUR, since we get 20 EUR instead of just 10 CHF. That 20 EUR is worth 20 CHF, which is worth 2 Gold. Wow, we doubled our gold!

No, we did not, because nobody is going to sit on the other side of this infinite money glitch. If this moves even slightly out of balance, the arbitrageurs come in with high volumes to profit from the imbalance. They will do so until nobody wants to trade at the imbalanced prices anymore.

Arbitrage prevents the denomination from mattering. Caveat: Where arbitrage can’t take place (e.g. capital export controls) the value of an asset can diverge between disconnected markets.

Irrelevance for different assets (and currency hedging)

Bonds

Have a look at those nice fixed maturity ETFs. Undeniably, you will get the return of the underlying bonds, if you hold to maturity. The same as if you had bought them directly (± trading friction). But you will see US Treasury ETFs traded at XETRA denominated in EUR.

Should you then hedge EUR to CHF, if you live in Switzerland? No, of course not. The principal and coupons of those underlying bonds are USD. So there is an argument to be had, if USD to CHF hedging would make sense.

Currency

You leave Switzerland for good and sell all your CHF for USD, because you want to travel. After some time you are ready to take roots again, and your choice is Spain. You still have some USD left and want to convert it to EUR. Does the CHF/USD fx-rate matter at that point in time? No, the USD/EUR fx-rate matters. Not because of the denomination, though. It matters because you hold USD, but spend EUR.

So should you have hedged your USD back to CHF just because that was the denomination? No, EUR would have made sense. But neither did you know that you would settle down in Spain, nor how much money you would have had left. If you did, you would just have converted it directly to EUR when you left Switzerland. Or even better, bought some EUR bonds with appropriate maturity (maybe directly with CHF, because it does not matter).

Stocks

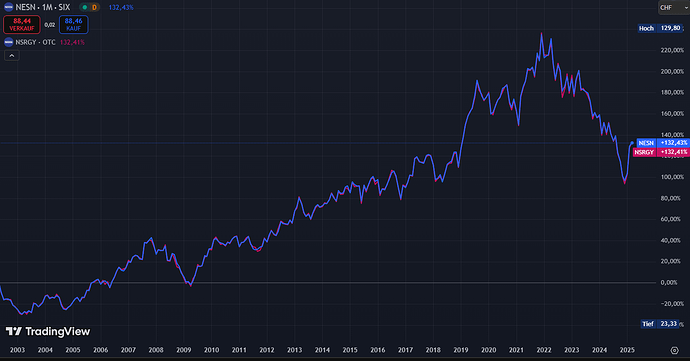

Should you hedge Nestle’s CHF denomination to EUR (since you now live in Spain)?

-

Do you think most of its business takes place in Switzerland? Probably not. There is of course a relation between a business and the markets it operates in. And there is also some relation between a market and the currency used in it. But are those strong correlations? How strong?

-

Does it have much debt in CHF? Maybe. And if it did, how would you have to hedge that? Careful, it’s a trap: you have to hedge the other way around. Since you live in Spain that would be EUR to CHF.

-

Maybe the company did already hedge the currency risk. Wanting to reduce risk of wages in one currency and earning from consumers in another currency.

By analyzing this in depth for each company, you might find a somewhat sensible currency hedge. The time is probably better spent elsewhere. But hedging the denomination currency is certainly wrong.

PS: Nestle is also traded OTC as ADRs in USD. Hedge that.

Commodities

Straight forward as we have seen above for gold. Should you hedge any currency to another here? I think you know the answer by now: NO!

Don’t confuse this with commodity futures. They are essentially short the quoting currency of the index or price they track. If you buy GC futures (gold), you will be short USD. You can compensate that by holding the equivalent amount of USD in your account. But if you so fancy, you could be short silver instead, by selling an equivalent amount of SI futures (and frequent rebalancing). Then you will be long gold, short silver, and long whatever collateral you give CME.

Are currency futures, options, swaps, etc… evil?

That is not the point. Currency hedging has a place, when you are actually exposed to different currencies and need / want to shift that risk to another currency. Maybe because you have an opposite risk there (think wages against sales in different currencies). But the denomination currency is never one of them.

It has also a place in trend investing. There are accessible but quite advanced and not always transparent investment opportunities in Managed Futures.