That’s a bold statement, are there data on this? The Nissan Leaf and Renault Zoe don’t target the same customers as Tesla models. I’d buy a Leaf, but not a Tesla (and would be interested in an EV but absolutely not in self-driving and data gathering features). I know I’m but a single data point myself but “big chance” of every current automaker but Tesla to go bankrupt feels an overstatement to me.

Only hearsay. I didn’t investigate this on my own. I heard that the incumbents sell EVs at a loss, so they don’t have the incentive to sell too many, and that the Chinese have razor thin margins.

This goes back to what I said earlier. Everybody has trouble to find enough batteries right now. The demand for EVs is surging and it takes a lot of time and effort to build more batteries. Tesla is not releasing a cheaper EV and postponing all other EVs, because there is enough demand for the Model 3 & Y to satisfy their current battery supply.

So Tesla is not making cheaper EVs because it is not feasible or profitable yet, and I’m sure the legacy manufacturers will struggle even more. So we just need time for the supply to catch up with the demand. Actually, they say that currently the biggest bottleneck is lithium You can’t just build a lithium mine overnight. You need permits, battle environmental group, etc.

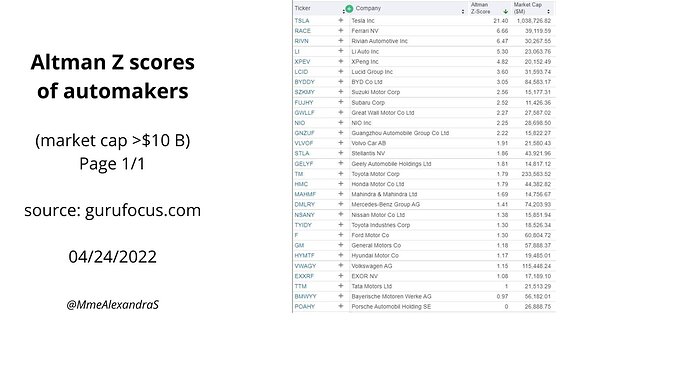

Altman Z-Score shows the financial condition of a company and the risk of going bankrupt. Under 1 is bad, 1-3 is “danger zone”.

13 posts were split to a new topic: [COFFEE] A bar fight on Apple products

I tried to order a BMW i4 via the Hungarian BMW today.

- estimated delivery is 18 months (but even this is not guaranteed, just estimated)

- you are free to cancel your order after 6 months or continue HODLing at your own delivery risk

- 15%(!) down payment (vs 200 CHF for Model 3/Y), the rest is paid based on the EUR rates whenever the car arrives.

- not even an aspired manufacturing date is known

But hey, you can configure 12 different seat materials, 8 wheel designs, 15 external and 4 internal color shades, and about 3 dozen options on the car, making it… just impossibly slow to manufacture. ![]()

And the i4 is not even a real EV, it’s an ICE chassis with batteries and an electro-motor.

Feels like socialism again.

…and in the future you might have to pay monthly subscription to heat the seats.

(note: it’s not as bad as it sounds but sad anyway)

I wouldn’t try that for insurance reasons. Better not to buy at all.

I’ve read elsewhere that it’s basically an old idea, just modernised with subscriptions and software. Someone mentioned similar “features” in old cars, where the functionality was installed, the only missing part were switches. Once you knew that, you just had to install the switches to have it.

This is utterly ridiculous and I hope the market will penalize them dearly for such stupidity.

It should be fine to pay for stuff they also need to source (eg. SIM card, navigation updates or other human services). But things you have already bought in hardware should be bought once and for all.

Almost everything will become subscription based service sooner or later. Users have proved they are OK to pay their phone (with AppleCare on top), their storage, all their entertainment services now on a monthly basis, so why not extend to everything they can? You can’t blame them.

Actually for the specific case of the heat seater, as you don’t use it all year long, if it is deducted from the price of the car, why not. That way you can drive the Mustachian way and freeze your a** off every now and then to reduce costs ![]()

It‘s a current trend - and one that will likely receive a backlash eventually.

How, why? What are the downside (from a company/service provider perspective), and what are the means of actions from the customer side?

Note : the “users can rebel and just stop consuming” is not not a valid one and just an utopia, in my opinion. Everyone is too deep formatted to be good consumers now… en route for Idiocracy…

I think you put the tinfoil hat a bit too tight on your head. The renting/subscription model is so prevalent, because people actually do think it’s a good deal. Before Spotify, you had to buy individual albums. Before Netflix, you needed to rent individual movies. Both services are a great deal for music/movie lovers.

Regarding the sub to get a new iphone every 2 years, I don’t know why people do it. But I don’t think the possibility to buy a new phone will ever disappear.

Now think about not having to make the stressful driver’s license, no need to buy the car, service it, garage it, pay insurance. You just tell the app where you want to go, and the taxi arrives in 5 mins. No driver, so you get your privacy. People could save a lot of money.

I’m not saying it is a good or bad model. I’m just commenting the fact that “it will backlash”, I just don’t see how.

As you just said, it is now a well admitted model, and more in line with the way people consume today (easy, fast, impulsive…). And it is financially really interesting for companies as well. So no reasons not to see this model keep flourishing.

Nothing tinfoil or anything.

I was referring to this:

I also don’t think it will backlash. Maybe if people decide they don’t want to watch movies at all, they will cut their netflix sub and replace it with nothing (I’m considering this, I feel like I already saw the best movies and the new ones i don’t care about that much).

None, in principle.

Recurring subscription is very good companies.

I‘m not saying consumer will stop consuming. But they may prefer non-subscription pricing.

Don‘t get me wrong, companies have, in many fields, only recently been enabled to charge subscription pricing for (non-consumable) functionality. And the pricing model is here to stay. We most certainly haven‘t reached its apex yet.

They are - but for consumable goods or experiences. While I‘d say a singular ride is a consumable service as well, seat heating is arguably not.

I can imagine there will be people feeling „I‘m paying full price for the car - and the manufacturer is trying to nickel and dime me for basic functionality that should be (and technically is!) included! That‘s extortionate.“

And I can also imagine someone, some manufacturer including it in their cars „for free“ (with the purchase price) and market the heck out of it.

Also, from observation, people like to own cars. If renting services is so great, why isn‘t car rental/sharing more prevalent?

True. You could argue that the same thing happens when Intel makes a chip, tests it, and then they lock some threads on the less performing ones, but also on perfectly good ones, and sells them a i5 and i7. You could say “hey, I paid for that piece of silicon, why is it not fully activated?”. It’s just sometimes more economical to make one product, but nerf a batch of them, and sell it as two different products with two different prices, in order to reach a larger market. If company X gave heated seats to everyone without a premium, they would make less money, if they raised the price for everyone, that would make fewer people buy it.

Good question. I think it’s a matter of convenience and cost. So far, to rent a car, you need to sign the papers, pay a lot of money, and return the car as soon as youre finished, so that the next person can use it. You need to get to the rental place to get it. It’s just too much hassle and costs too much money to do this on a daily basis. But eg mobility, where you can access the cars around train stations is already a more appealing alternative. I think once you have the option to call an “uber” that will arrive in up to 5 min, day or night, and take you to the city for less than it costs with the SBB, then many people will ask themselves “why I should I even own a car?”.

Caveat: it can never be cheaper than the SBB (thanks God I have to tell).

Not even publibike is cheaper.

And ppl in CH don’t need a car to “go to the city” but rather to go skiing, hiking, visiting friends who live in Kt AG and so on. These are most of the time much less convenient/affordable than mobility.ch which is a “IKEA/moving car rental” service for most.

I’m a non-parent, can you explain why having children makes it necessary to have a car?

Bonus points if you can answer from the perspective of a city dweller. I live in Zurich city, and use mobility perhaps once per 3 months and can’t really imagine why having children would change that, though I appreciate that there are lots of “unknown unknowns” when having children.

For context, I have a few friends with kids living in Zurich who claim that they need their cars, but I basically don’t believe them and think everything could be done with public transport or e-bike + trailer.

I agree with that statement. However a better city design (like in the Netherlands) would help greatly.

Even if we are already blessed with one of the best public transport systems of the world.