what is your poison?![]()

Basically huge gains and loss by beeing over leveraged. Specifically lost majority with shorting some stocks.

That does sound very sweet, when you put it like that, hehe. But 2017 to 2025 has a CAGR of 43% which points at roughly 2x every second year.

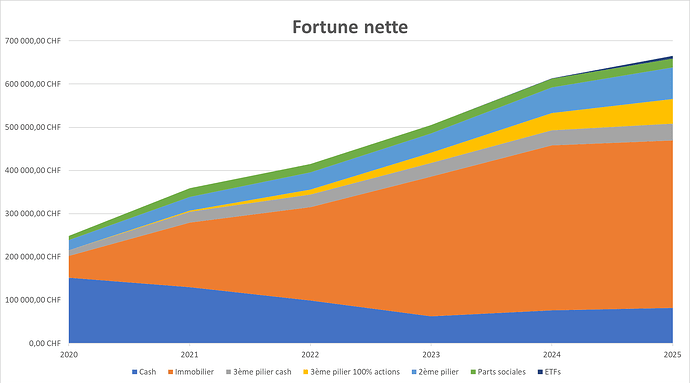

Almost 2 years since my last NW update, here is the current status:

Equity (including Pillar 3) above 1M. Crossed it a few months ago.

Pillar 2 (including vested benefits) around 300K

Hi,

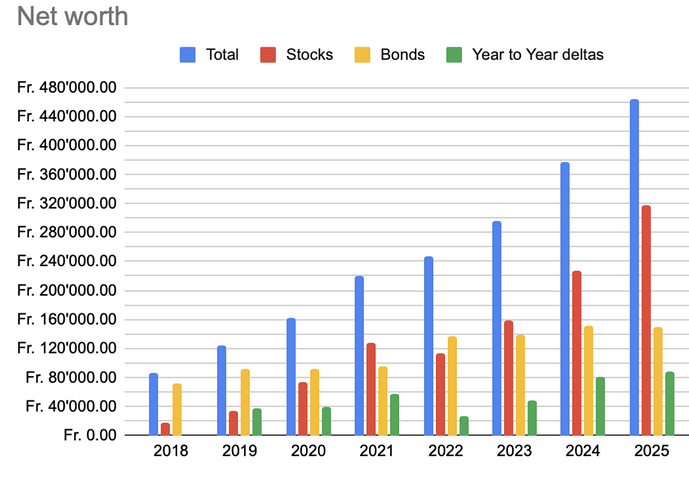

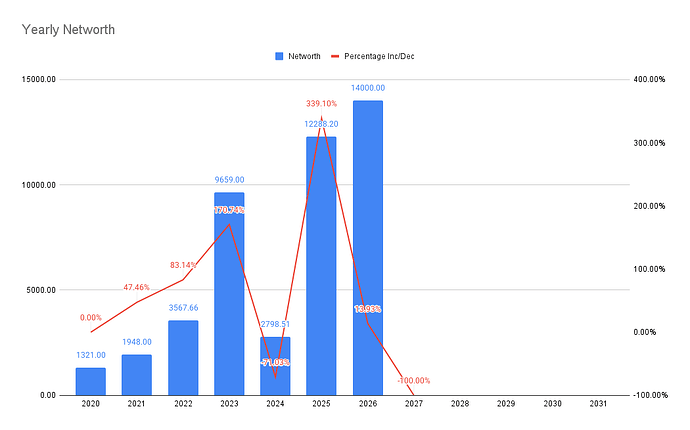

It’s inspiring to see everyone’s progress. I’m sharing our net worth growth for the first time. I’m happy with the progress, even though we had a lot of unexpected expenses in 2025. We hope to reach a million in 4 years ![]()

Hi everyone,

Glad to start contributing to the forum after following it since a while. 42 y/o working in tech in Romandie.

Considering the weak dollar and all the tariff drama 2025 did close better than expected with a +23% NW increase.

The stocks category is composed of an ETF portfolio (VTI, VXUS, CHSPI) + third pillar contributions using the VIAC global 100 strategy. Bonds are cash + second pillar.

My first post in this thread, as it is 1 year since I sat down and did some research on investing, discovered this site+forum, setup an IKBR account and made my first VT purchase.

Before last year, I didn’t really look closely at my finances as we had god income and didn’t worry about expenses, instead we saved money to buy and renovate our house. Also, in Switzerland you have minimal control over your pensions (Pillar 2), and even the Pillar 3 like most CH people I just went a standard indirect mortgage amortisation with life insurance through the mortgage provider so it is a black hole. I lived in the US for 7 year where I was much more vested in controlling my pension portfolio. Sadly, moving to CH meant I stopped checking on my US pension and was disappointed to see that the pension provider had closed all my positions and put them in some federal backed low interest paying account since I was no longer actively contributing.

I started a little cautiously in 2025, finally investing much more just before the Trump tariffs kicked in, which took some time to recover. Still, i is a lesson that time in the market is more import.

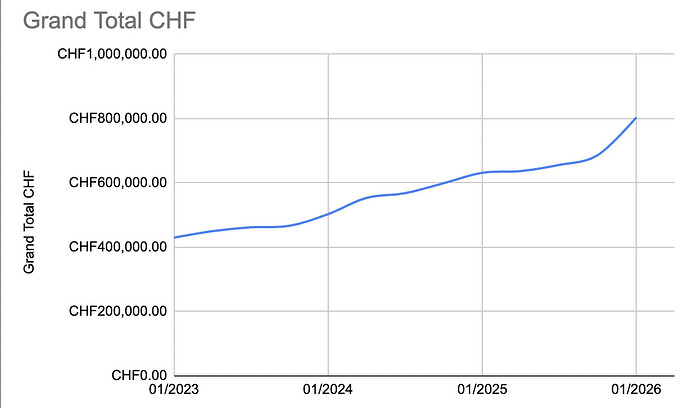

Total NW about 800K CHF, excluding real estate which is hard to measure without a valuation. Axa claims I have 660k CHF in assets, which is probably reasonable since the downpayment was nearly 350K in 2019.

I made a 10.5% return in my US pension (in USD, so not great in CHF). I was too cautious with lots tied up in treasuries + BOXX, and BRK.b was -4%.

My IKBR is up 8.5% in CHF. As explained above, i was very slow investing at the start of the year and then invested a lot early April. By the end of april I was down -12.5%.

Sadly I have some literal life changing events so I have no idea what will happen in 2026. My goal is just to live and take care of my children in the best way I can.

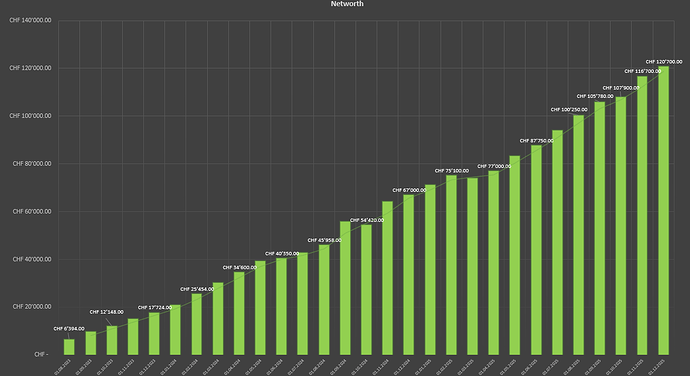

Well, 2025 was definitely an interesting year!

I experienced my first real “crash” or “flash crash” in April due to the orange man.

While I did get more panic than I anticipated, I still managed to come out of it with a net gain through market-timing (not recommended I know xD).

In 2025 I invested a total of CHF 45’000 into VT , which I am happy with given my net salary of CHF 67’000.

A cool side effect of my market-timing is that I also got cheap USD.

My VT position in USD is now up a total of +24%.

In CHF terms in my case, its still a total gain of about +21%, very happy about that!

It pains me when people here share their amazing gains in USD, only to then realize they are heavily devalued or even lost in CHF terms.

Now that I am over CHF 100’000, I already feel a difference psychologically, it feels good.

Until I remember that even with this exceptional performance, FIRE is still 10+ years away…. I just need to ignore that fact and I’ll be fine lol.

The chart begins where I got my first salary in 08.2023. I’ll turn 24 this year.

Bloody hell! You survived on 1k/month? (I think I recall you said you’re living with your parents but still, this means they cover all your expenses except coffees/bus tickets etc, right?)

Keep it up for 10 years, that’s the cut-off point when compounding kicks into gear and starts really working for you instead of you for it!

Thanks, will do a new graph that is more structured. That real estate amount is basically our primary home and the more I think about it, the longer I feel it doesn‘t really fit into the FIRE plan. That million being part of our 2,5mio FIRE target is difficult, because 2,5mio would be enough to support our lives but I wonder if 1 mio is blocked with the primary home, the FIRE amount should be higher. Otherwise it would be realistic to reach the goal already within the next 12-18 months…

How do others see this that own a real estate as a primary home?

If you have your home, then you don’t have rental expense which decreases your overall expenses. Your other assets need to cover your non-rental expenses.

In your case, 1 mio covers rental. Your remaining 1.5mio covers everything else, say at 4% gives you 60k per annum budget.

So then I should clearly go over my expenses and bring them down.. or increase the target.

Because let‘s calculate „simple“ - today I pay 14‘000 per year in interest for the mortgage - and I don‘t get a direct return from the 1 mio invested. If I would sell the house and put that million in the market I could take 4% / 3300 monthly out of it to cover rent. This basically means our primary home is a liability and not necessarily an asset in FIRE terms..

This is why the gross yield is important. People often overpay for homes which is why it ends up being more expensive than renting. On the other hand, if you look long term, you avoid rental inflation.

It’s also why gross yield is important. Try to aim for 5%-6% gross yield. So if rental for an equivalent home is 3k per month, then you should pay no more than 720k. Of course, you might adjust this to take into account taxes, low interest rates you can lock in, etc.

Of you accept you are paying a premium for the luxury if living in your own home.

Just posted an article on a fixed salary working like a bond - maybe helps you avoid too much dead weight. Just a thought.

Hm, I like the approach but it is kind of conservative, no?

I primarily bought because my calculation was (Rent - Interest - Nebenkosten) / (Downpayment + Purchase Costs). Essentially what I save in a year as a return on all costs associated with purchasing.

For me this return was 8.3% given the low interest rate I got*. I felt that was a no-brainer. And in hindsight, very lucky, because by all estimates, value of my place has gone up 70% by now already.

* But using your approach it would have been comfortably less than half that, so under 4%. Maybe approaching 4% if I compared it to what renting itself would cost, but I think that’s unfair, as I would have stayed in the then current place which rented for a bit less.

I believe you’re missing maintenance costs (for the long term accounting; you might be in a brand new place now though)

This is a cost comparison. You basically do:

(full cost of rental - full cost of ownership) / (capital outlay)

I also run this calculation. It can be tricky as tax is a big factor to include (wealth taxes, eigenmietwert, interest deduction (and restrictions if you have to repartition), AHV property value uplift when early retired/unemployed, etc.)

The other tricky thing is to factor in interest rate changes we are in low interest times and so if you take current low interests and project them forever, you get a very optimistic view.

You can use 2 methods to compensate, one, have year by year interest forecast and run an IRR calculation (I do this), or you can use an average mortgage rate calculation, which historically is 4.5%. I also do a hybrid calculation where the savings from my 10 year fix reduces my ‘downpayment/acquisition cost’ then I use the average rate for the calculation.

How does your calculation look under these methods?

We are in a historically low interest rate environment which has pushed up housing prices. It is unlikely that anyone buying in the last few years would have a sound investment on a standalone financial basis, but of course, your own home can be considered consumption to some degree.

Could it make sense to consider everything in inflation-adjusted numbers and real interest rates, in the assumption that the long term average of real interest rates is more stable? Real estate appreciation doesn’t necessarily follow headline inflation, however, it might be easier and more robust across different inflation/interest rate environments. I haven’t really thought this through, though, so there may well be a reason for this to not be useful in a comparison.

For new buyers, I would probably just skip this part from the calculation as it will be mostly eliminated.

Thank you for making me double check, cause 1k/month including taxes sounded unrealistic even to me as I pay for everything else normally, just without rent.

I see now that I also transferred CHF 4’000 of my existing Bank-Savings throughout the year, and my total income was closer to CHF 69’000.

So while I did invest 45k into VT this year, I effectivly saved more like CHF 41’000 of CHF 69’000 income, so ca. 60% savings rate.

But from now on, I’ll have to pay 300/month as rent which I am fine with of course.

Sadly no raise for this year so my goal for 2026 stays at 45k saved, end of 2027 I want to reach 200k+.

Two years later, after some bad decisions, debt, a few trips, some joblessness, and a lot of fun. I’m back to square one.

Basically lifestyle creep and using my investments to cover some months of my life when looking for work. This year I’m looking forward to being more dedicated and get to a net worth of CHF23K.