Really? 69? not 70 or 68?

This year (and last) is really the year of the 69. I see it everywhere (dammit)

I checked it, its CHF 69’420.67 to be excact ![]()

add 2 cents and the internet would explode.

edit: yes i know 67. I’m old school

Because of the other Whales in this thread I first thought 1 = 1’000 so I was like:

Damn, what did this guy spend 10 million on in 2024?!

Not just square one but somehow you arrived in the future ![]() How come you already know your networth 2026?

How come you already know your networth 2026?

At your age, traveling and having fun may rightfully take precedence over heavy FIRE activities. Once you earn a decent salary and don’t inflate your lifestyle too much, the networth will rise much faster with your invested savings.

It’s not exactly square one. I’m considering the post I made two years ago as square one. Net worth actually regressed 222.- in two years.

Finally, I am joining the Party here ![]()

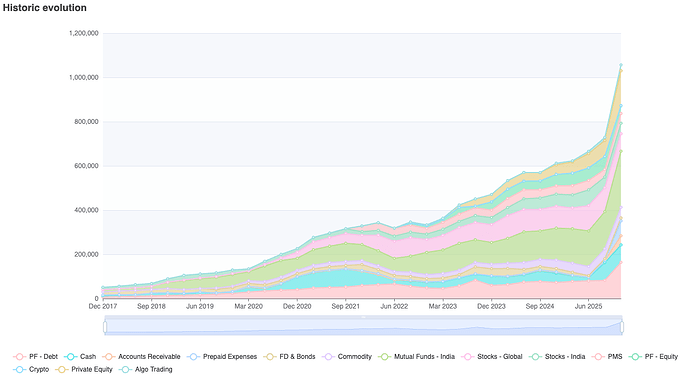

Here is my growth from Dec 2017 to Dec 2025.

Dec 2025 is special because I decided to combine my wife’s portfolio.

Here is the interpretation of the separate components:

PF-Debt - 2nd and 3rd pillar (not invested in the market)

PF- Equity - Market-based 2nd and 3rd pillar

Accounts receivable - Amount blocked somewhere. In this case, mainly from UBS, we just bought a house, and UBS will refund the reservation payment

Prepaid Expenses - Minor component just to keep track of recurring spending like SBB Halbtax Plus

FD & Bonds - Debt-based instruments yielding interests

Commodity - Mainly gold

Mutual Funds - Kind of ETFs (focusing on Indian stocks)

Stocks India - Personal managed Indian stocks

Stocks Global - Personal managed NON-Indian stocks & ETFs

PMS - Professionally managed Indian Stocks

Crypto - Negligible

Private Equity - Non-listed companies

Algo Trading - Money involved in algo-strategies

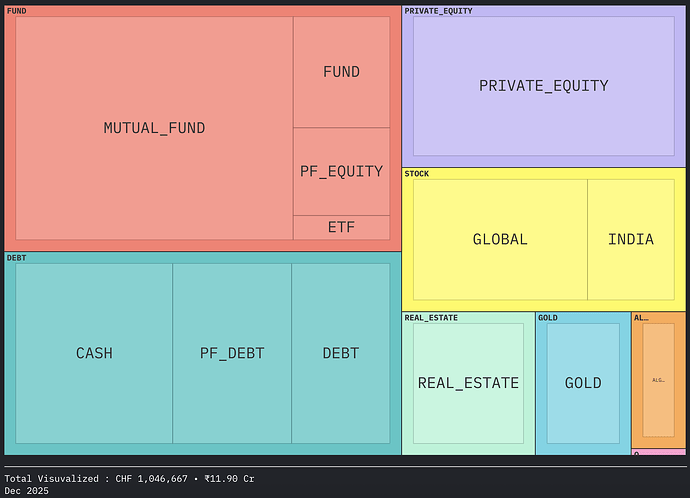

Current asset allocation:

There is still a bit of a naming mismatch, as I did not intend to share when I created them.

Looking forward to your feedback. Happy to share my investment philosophy and other aspects as we go forward! Please also DM me if you have any suggestions/offers/ideas.

It is brand new and Nebenkosten include maintenance costs. Both actual ones (e.g., repair) as well as a Teuerungsfond.

It isn’t perfect, no. But perfect is the enemy of good enough.

I have a 10 year mortgage. I am very happy to sell (if not done so at that point) if I am unhappy with the new mortgage. I will certainly move away when/if I retire early. Somewhere where taxes are lower and I am closer to the mountains. So that point also doesn’t apply.

It is unlikely that anyone buying in the last few years would have a sound investment on a standalone financial basis

Can’t agree with this. Was it optimal? No, what is, but it was very good. My 8% is not even including the increase in value.