Introduction

I’d guess it’s time for a proper introduction. Let me preface this post by thanking each member of the forum. You guys have helped me acquire great financial knowledge and become just a little less ignorant.

Big up to @Julianek for Fool to Wise and the post If I was an index investor; if you haven’t checked them out, I encourage you to do so. I also really appreciate @cubanpete_the_swiss “contrarian” apports to this forum, he came challenging the status quo with his Mechanical investment strategies which I greatly appreciate.

Early Life

Born in the Dominican Republic, I came to Switzerland at 14. My Stepdad actually FIRE’d at 58. He sold his Swiss business, moved to the DR for the sun, and lived a life I’m now trying to “version 2.0.” I don’t want to just leave Switzerland; I want to use it as a high-income base to afford going to the DR and Japan for months at a time.

The “Wage Slave” Epiphany

On my first introduction on the forum I talked about having time for my kids. Over the last 6 years this has evolved into just not selling my time and buying back my freedom.

Last year, I took a new and very stressing job with no extra pay. The façade of “flexibility” crumbled when I asked for a month off and was laughed at. It was a blunt reminder: I am a wage slave. I’m trading my life for someone else’s 9-to-5 dream.

Methodology & Risk

I follow my IPS to the T. I don’t rebalance by selling; I rebalance with new monthly cash. I’ve read Lifecycle Investing, but since my RE horizon is <20 years, I find the 2:1 leverage they suggest too risky for the Sequence of Returns Risk (SRR) I’ll face early on. I stick to a 1.2x leverage ratio. Which I deem enough to boost returns, not enough to get a margin call during a volatile event.

Net Worth, Salary Progression

You can check my Networth & Salary progression on the respective posts.

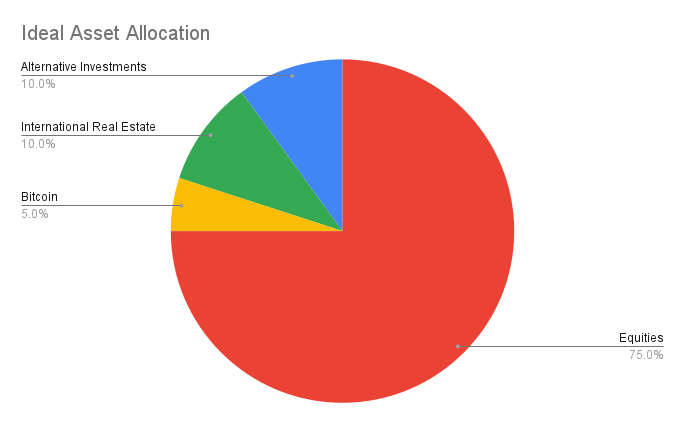

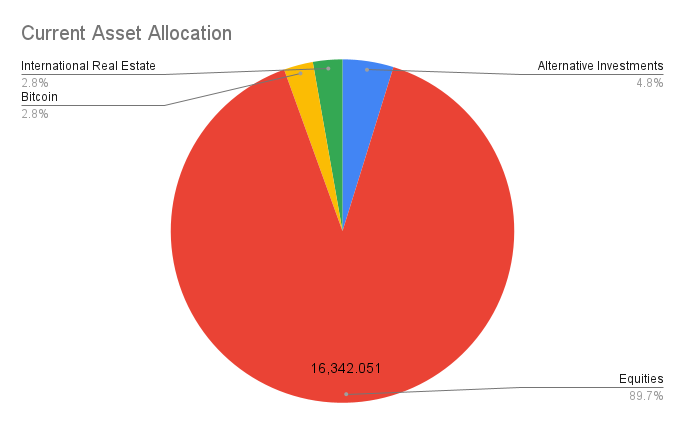

Asset Allocation Highlights

-

Japan Trade: After following the Japanese market for a few years now, I decided to take a margin loan and buy up the companies you see with CHF5.5K in collateral. I did it this way since I’m also betting on the JPY devaluing a little more, I got the loan at CHFJPY 195.752. The rules are as follows regarding this trade:

- If JPY margin rate goes to 3%, the loan is paid with the CHF collateral

- If CHFJPY goes to 190, the loan is paid with the CHF collateral

- If CHFJPY reaches 200 sell 1.5K to mitigate risk and take some profits

- If CHFJPY reaches 205.53 sell 4.1K

- The remainder will be paid for by the dividends

-

International Real Estate: Co-owner of a Bamboo Forest house in Hayama. Currently looking to buy into another Japanese project. This year I’ll probably do an operation on the DR too.

-

Global and country funds: The two funds are my 3A. CH is so big because it’s the first one I opened. I haven’t maxed my 3A in the last three years. I want liquidity.

-

Alternative Investments:Gambling, with cocaine and hookers.

- On a more serious note, I lent some money to a family member that needed it to convert a commercial property into a studio. It’s denominated in DOP at a rate of 14% annually (it might seem predatory for family, but it’s by far the best rate for them and me taking into account currency risk). He’ll finish paying in July 2026.

- Shitcoins also fall into this category.

- Same with Private Equity. Q3 this year, I might buy some shares in a friend’s business.

Thoughts on the current state of the FIRE movement

I have a lot of fun on r/Fire and adjacent subreddits/forums. People panic over whether $4M is enough. People have got delusional on how much money you require. Mistaking comfort and luxury for needs. But, I guess it’s just my poor and jealous mind speaking xD.

I still adhere to the FIRE principles of living below my means and reducing consumerism. Gaining true freedom, not by having a lot of money and be able to splurge in whatever luxury I want. But by living more like a Monk that may have little but doesn’t need to suck the king’s dick to afford living.

But, it’s easy to say this as a young person without kids. Either way, I’m finding that “balance” of being contempt with what I have and recognize that I’m already quite privileged.

Future Outlook

The current plan is to get to CHF100K net worth in 5 years. After that, save CHF20K and take a year off in Japan. Then, see what’s next in life.

To get there, the goal this year is to get rid of debt. Then, have CHF10K invested into VT. Continue exploring Real Estate in the DR and Japan.

Final Takeaway

My stepdad retired, moved to the DR, and had 15 of the best years of his life before cancer brought him back to CH. If he had stayed here “working one more year” for safety, he would have been sick and miserable. The subject that I really want to put forward by saying this, is wanting to encourage people to perhaps take a little more risk. Don’t sacrifice your short life for one more year of “safety” you might not even live to use.

I know you guys have everything calculated and can afford to perhaps take a little more risk and stop the analysis paralysis. Take that sabbatical or trip with your family and live your life. I really miss my stepdad, and it would have been a blast to plan my FIRE journey with him and all his knowledge.

P.S: Thanks for your time.