Feel free to check on comparis.ch or houzy.ch I do see other similarly sized apartments in that new price range right now.

Saving 6.2k in an expensive month ![]()

btw you take into account 3rd pillar but not 2nd? Why the different treatment?

Because it’s unclear to me how much of it will be accessible at early retirement age, and most of it is probably not available at 45 or whenever I plan to hit my FIRE goal. So I just ignore it. Currently it would be around 200k CHF in 2nd pillar.

But that’s the same for 3a, so with this argument it should also be taken out.

I am truly impressed by how you’ve managed to earn 17k as a security engineer. I’m in the same industry, leading a team of security engineers, and my earnings are “only” 12k. I‘ve never came across a security engineer getting more than 150k/year. But wow, it must‘ve been a F(M)AANG company?

Respect and best of luck in your continued success.

Since July I’m the CISO and Head of DevOps in one person, so quiet some work/responsibility… I could probably earn more in crypto but after 3 different gigs I rather take something less volatile.

But it is still part of your net wealth.

In my FIRE calculation I only use my fund value as a target, but come retirement age I add the projected amount I receive from 2nd pillar to that.

You have more allocation to crypto than equity?

Whats your allocation within crypto?

My crypto allocation is roughly 90% BTC, 6% DOT, 4% KSM

Correct but it’s not scalable due to restrictions of that particular program (google for 1KV Polkadot/Kusama)

How does your ETF Portfolio look like? Can you also share more informations how you got the mortage for 0.6% from 0.9%? How did you negotiate it down and which bank was it? Was this your first mortage? Can‘t find the blogpost anymore.

I‘m in the process of buying something soon so i‘m extremely interested in those informations.

ETF portfolio you can find in any post. It’s 90% VT and rest in different stocks. The mortgage I’ve renegotiated one year in advance at the absolute bottom of the interest rates cycle. Right now 1.25% with Raiffeisenbank is the lowest I’ve heard.

Alright, i didn‘t see the allocation on my mobile device. Thanks for the insights. I‘ll have a look.

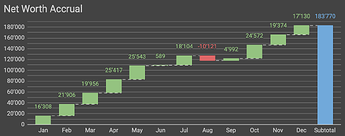

Let me kick off the yearly updates. (I do my tracking on the 15th of each month)

2024 summary

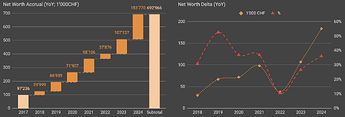

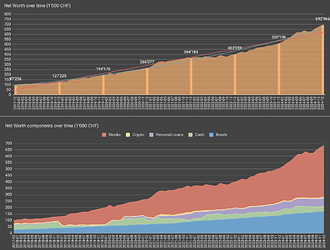

YoY: +36% / +184k, with:

- 51k savings

- The rest is investment portfolio’s fault (e.g. IBKR 33% YTD)

Key events:

- Q2 got married, wife slowly moving over

- Q3 slowdown due to moving apartments (+rent pumped +50%

)

)

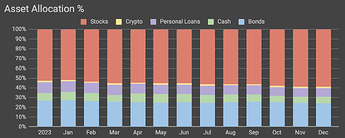

Asset allocation at year end:

- 58% stocks (IBKR, 3rd pillars, company shares)

- 24% 2nd pillar

- 9% personal loans

- 7% cash

- 2% crypto

Zooming out

Best year so far. ![]()

This year has spoiled us violently.

I’ll be happy if the next one is half as good.

Happy 2024 ending everyone, and have a healthy and wealthy 2025!

Congrats. That NW chart is nice. If it was a stock, I’d be buying it!

Very nice return and congratulations on the marriage. You have quite a sizeable share in personal loans, care to elaborate? I am especially interested in how you manage the risk and how you price it (interest).

You can say that again…

If it was a stock it’d be priced at 50x forward earnings … ![]()

17 posts were split to a new topic: Thoughts on portfolio diversification [2025]