Pension:

- 3rd pillar is maxed every year but thats only 7k and goes into equities

- 2nd pillar isn’t worth buying back until 50+ years old given the opportunity cost of 1% return

Cash/Bonds:

- Sure, if you feel equities are overvalued and a crash is coming. But if you get this wrong its a pretty huge cost. And timing a crash is near impossible.

Gold:

- Has done very well recently with world “de-dollarisation”, non-US central bank buying, and expectations of rate cuts. But then its also at all time highs… And its a “non-productive” asset as it doesn’t actually create value. In fact, it has negative productivity because you have to pay for storage, insurance, and financing costs. So to me this again has to be a trade > investment.

Different stocks:

- Meaning non-US?

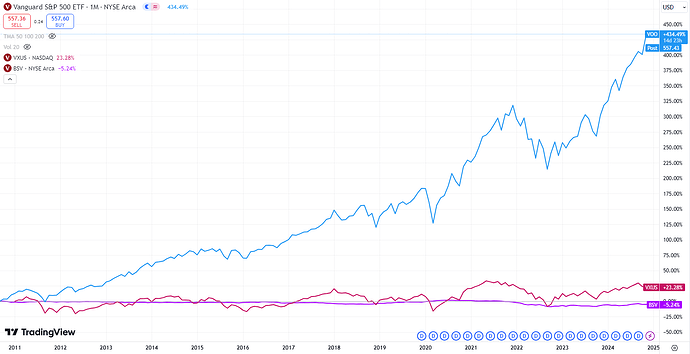

Probably diversifying into ex-US stocks and bonds is logical to “de-risk”. But feels like it can be such an opportunity cost of returns given the amount of money happy to pile into US stocks + 4 years of incoming Trump pumps. And the “when the US sneezes, the rest of the world catches a cold” adage is more true today than it has been in a while so diversification may just cap your upside without protecting your downside.

Abandoning US stocks any time over the last 15 years would have been just about the worst portfolio decision possible.