Noted!

(being laconic is not allowed on this forum)

When I read conditions for a lombard loan at SQ, they clearly stated that it can be used only to buy securities, so it is not a replacement for an emergency fund, unlike a loan from IB.

It is still possible, just more cumbersome and expensive.

1.Sell securities

2.Withdraw money

3. Buy the securities back on margin.

Here another review of Yuh from Moneyland: Yuh: l’application bancaire de Swissquote et PostFinance - moneyland.ch

As discussed in this thread, Yuh seems to be a good solution for people who want to start they journey in a trading platform with low amount, however, Yuh will stay expensive in comparison of DeGiro or IB.

Review by The Poor Swiss

Yuh have added a bunch of new Equity ETFs to their offering just a couple of days ago, including a CHF-hedged “Global Blue Chips” ETF (IWDC) and Irish-domiciled U.S.-sector ETFs (XLFS, SXLV, XLBS and SXLK).

But…

I’m very sure there’s at least on US-domiciled newcomer: ILF.

Yuh implemented recurring purchases. Monthly or weekly cycle. A premier among Swiss retail brokers I guess.

Still, with 0.5% own fee (min 1 CHF) + Swiss stamp duty + currency exchange eventually seems too expensive to me. On the other hand, if you buy in CHF (for example CHSPI) or in preexchanged EUR, it is less than 1% issuing commission typically charged by banks for their shitty investment funds.

They’ve also implemented Google Pay.

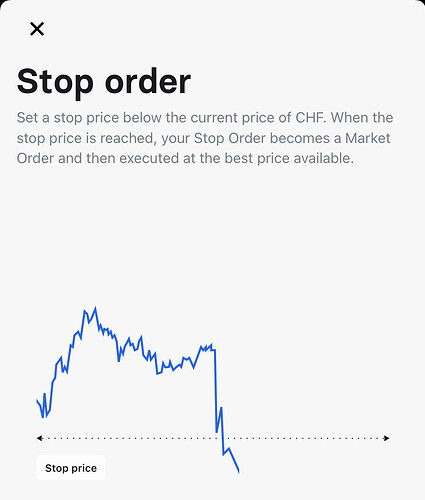

I just find an interesting feature on Yuh and seems nobody has mentioned it on the Internet yet

you can exchange your currency at a target rate, sort of like a limit order for Forex exchange,

if I am correct, we can’t even do this with IBKR

However, I just tried twice to place a limit order and they tell me the platform has an error so I haven’t managed to put my orders. Then I tried with market order and it worked…

On Revolut, you can create a price alert when an exchange rate reach a specific target.

You can even configure a limit order and a stop order to exchange your fund in a specific currency at a specific rate.

Thanks, good to know!

you said it yourself market order, I was talking about limit order ![]() , I don’t know how to place FX conversion limit order with IBKR

, I don’t know how to place FX conversion limit order with IBKR

thanks for sharing the knowledge!

You can set limit orders to exchange currency in IBKR too

And they seem to have implemented standing orders for bank transfers.

if you mean limit order on Yuh, I confirm. I used it recently

Anyone heard when the new Plans will be available? They said 2022 but I didn’t find anything anywhere.

Now they promise 0.25% p.a. interest on CHF and EUR cash balance up to 25k (not clear, all together or each currency separately).

They told me Yuh will stay free at least in 2022 and 2023, but I don’t know what will happen after that.

Separately, according to the press release. USD rate will be 0.5%

2 posts were split to a new topic: Best interest rates on CHF deposits