+1

Tracking your expenses is useful to estimate your expected expenses once retire and also determinate you FIRE amount based on your safe withdrawal rate.

However your current taxes won’t be the same as a retiree.

+1

Tracking your expenses is useful to estimate your expected expenses once retire and also determinate you FIRE amount based on your safe withdrawal rate.

However your current taxes won’t be the same as a retiree.

Or if you live/earn in a high tax canton and are looking / would consider moving cantons for primary residence yet not necessarily moving jobs…plays into overall expenses. But I totally see both ways of thinking…

Switching canton is increasing your income (you get to keep a higher percentage of it). At least that’s how I see it.

Totally see both filters, both are logical to me, and I must be schizo since some days I look at it in one or the other ![]() …depends on if work or my neighbours are bugging me more

…depends on if work or my neighbours are bugging me more ![]() …income impact could be the same but not the trigger.

…income impact could be the same but not the trigger.

![]() Remarkable!

Remarkable!

There were at least 3 parties (my birthday, wifeys birthday and my goodbye party from a job) in Restaurants/Bars that did cost 1k CHF each due to the amount of guests/alcohol.

Couple living in canton of Bern. Taxes not part of %.

Couple household, splitting rent 50/50, I pay a big junk of the other cost and there’s also a lot paid for next years vacation already hence it being so high. Other includes not recurring costs like new electronics, education, larger gifts. The cost is just for my consumption. Everything is 100% my cost apart from Groceries (about 75/25), Eating/ Drinking out (70/30) and vacation (70/30)

Do you own your home? Or are you living in a Genossenschaftswohnung? How is housing so low for two people?

I think it’s funny that eating and drinking out is higher than housing ![]()

As I mentioned housing is only my 50% part

Multiply by 2 and you have the real cost for the appartment.

Oh so the pie chart and the 76k is only your spending!

That’s what I tried to get across with this:

Here my 2022 update (family of 4, kids 16 and 14).

| Category | Yearly | Monthly |

|---|---|---|

| Car / transports | 2’724 | 227 |

| Clothing | 2’384 | 199 |

| Free time | 3’090 | 258 |

| Groceries | 8’311 | 693 |

| Health | 18’073 | 1’506 |

| Holidays | 17’141 | 1’428 |

| Household | 16’879 | 1’407 |

| Other | 2’404 | 200 |

| Restaurants | 1’976 | 165 |

| Work | 3’426 | 286 |

| Xtraordinary Expenses | 58’043 | 4’837 |

| 134’451 |

Not dramatic if not counting last item ![]()

Is that car rental, or how can it be only 227 CHF per month?

And what was the extraordinary expense? ![]()

Possible.

Depends of course what car and how much one drives.

My (owned) car turns out to ~250chf/month, unless I am missing to account for something.

Includes:

You could argue I should include “depreciation” too, but to be honest in the last 2 years it barely lost anything according to market prices. ![]()

But in @weirded’s case it might indeed be combined rental & public transport, since the categories seem merged.

Well, the car is an EV. In 2022 we didn’t have any maintenance costs (tyres were changed in 2021).

I’m accounting only for “fuel” from external charging points. We are charging quite a lot at home but we don’t have a separate meter and I’m too lazy to do the manual calculations and remove that fraction from the housing costs ![]()

We are building an RV (better: we are having one built for us) so that expense will appear in 2023 as well… ![]()

Hi everyone,

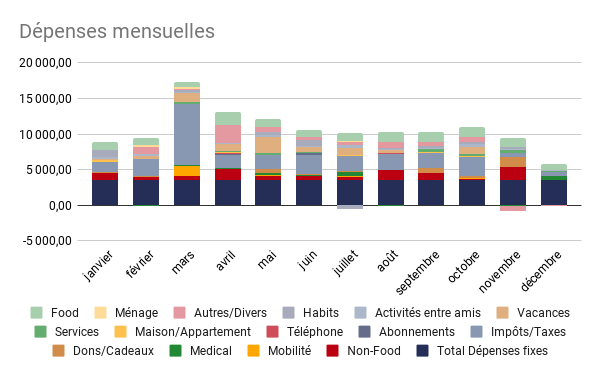

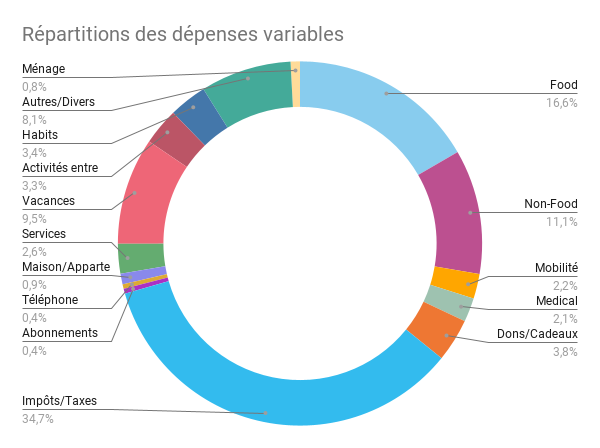

Please find below the expenses of our Household (maried couple with a baby):

| Total Dépenses variables | Effectif |

|---|---|

| Food | CHF13,998.29 |

| Non-Food | CHF9,298.75 |

| Mobilité | CHF1,854.12 |

| Medical | CHF1,786.05 |

| Dons/Cadeaux | CHF3,223.17 |

| Impôts/Taxes | CHF29,206.05 |

| Abonnements | CHF367.00 |

| Téléphone | CHF341.50 |

| Maison/Appartement | CHF793.45 |

| Services | CHF2,218.60 |

| Vacances | CHF7,982.38 |

| Activités entre amis | CHF2,757.26 |

| Habits | CHF2,828.37 |

| Autres/Divers | CHF6,790.65 |

| Ménage | CHF698.20 |

| Bébé | CHF1,703.03 |

| Dépenses fixes | ||

|---|---|---|

| Loyer | 2,346.67 | 28,160.00 |

| Ménage | 250.00 | 3,000.00 |

| Assurance maladie | 869.50 | 10,434.00 |

| Internet | 0.00 | 0.00 |

| Téléphonie | 58.00 | 696.00 |

| Compl. CSS | 45.00 | 540.00 |

Total dépenses annuelles: CHF128,676.86

I do like graphs ![]()

Do not hesitate to challenge my expenses, I find them not so mustachian for this year… Next year won’t be great either but that is another story ![]()

Best wishes for 2023 to everyone, take care!

Just drop the taxes then you’re sub-100k, which is pretty okay I guess.

2022 yearly spend / Family of 3 in Zürich city, 4.5 rooms flat

Amounts are approximate as bloody PostFinance pulled the plug on e-Cockpit and I had 2 months in between with no tracking until I switched accounts fully. ![]()

36’000 accommodation and furniture

12’000 groceries

18’150 childcare

3’000 domestic help / cleaning

10’000 health insurance

1’600 comms and media

6’000 Mobility incl petrol, parking, repair and servicing of 1 car + public transport tickets

5’000 Holidays

7’000 Personal spending (Sport, Electronics, Leisure tickets, etc.

(+10k personal one-off)

Sum 99’000 without taxes

(10k more than last year ![]() but it’s coming fully from extended Kita costs)

but it’s coming fully from extended Kita costs)

Expense Report 2022, total of 20K expenses.

Household of two in Zurich, only my own expenses.

This year 39k, biggest differences as follows:

The rest of the increase in spending (2k) is spread over many categories.

Detailed data, as output by Ledger (I’m one of the few people that prefer ledger-cli over Beancount):

39,155.319 CHF Expenses

6,883.000 CHF 3a

382.200 CHF Clothing

345.400 CHF Dining

1,811.500 CHF Education

249.399 CHF Fees

23.399 CHF Broker

226.000 CHF Other

354.000 CHF Gift

1,093.850 CHF Health

1,556.540 CHF Holiday

1,963.730 CHF Household

5,060.200 CHF Insurance

4,827.200 CHF Health

233.000 CHF Other

558.050 CHF Leisure

841.000 CHF Memberships

2,834.500 CHF Travel

14,993.950 CHF Utility

179.700 CHF Hosting

214.500 CHF Internet

260.200 CHF Phone

75.200 CHF Power

14,096.850 CHF Rent

167.500 CHF Serafe

228.000 CHF Various