I’d argue 3a is not an expense, it’s your money from left pocket to right pocket - still your own money, just now invested.

Monthly fix cost budget for a couple living in Geneva area:

| Libellé | CHF |

|---|---|

| Rent and heating | 1524.00 |

| Extra heating and water | 8.67 |

| Internet Fiber | 44.15 |

| Power | 30.00 |

| Swiss - Taxe Serafe - Radio et Television | 27.90 |

| Personal tax | 2.10 |

| House insurance | 17.20 |

| Laundry | 20.00 |

| ASLOCA | 43.78 |

| Cautionfees | 1.67 |

| TOTAL CHF | 1719.00 |

| My system is not as detail as the other for the remaining. |

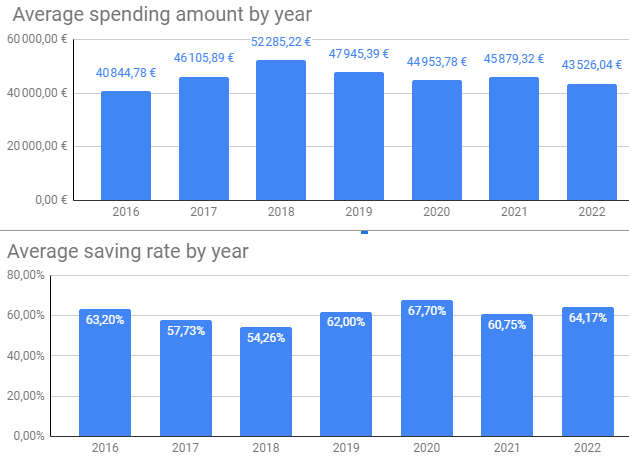

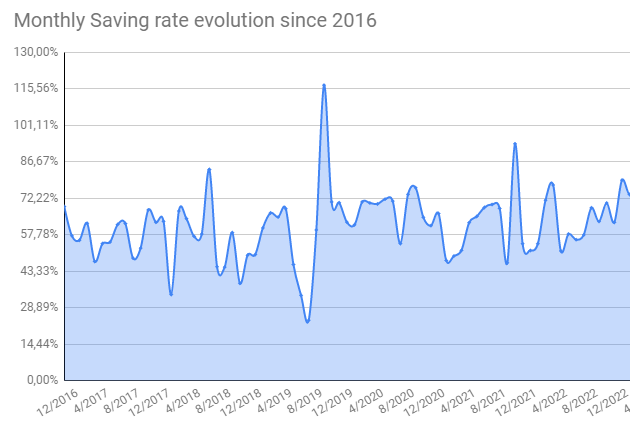

My average saving rate is stable around 64% without kid but I expect it to drop dramatically as we are expecting a chlid beginning of Q2.

Daycare will cost a fortune but I expect joy.

A bit of conservative projection for a family of 2.

| Safe Withdrawal Rate (SWR) | 2,70% |

|---|---|

| Target Annual Expenses | 55 000,00 € |

| Target Net Worth to FI | 2 037 037,04 € |

| FI ratio | 45,81% |

| Guardrail to go back to work (drop 30%) | 1 425 926 € |

Wow, I am sincerely impressed.

Nice, well done!

Btw how do you save 115%? ![]()

What’s your formula for the savings rate?

(Btw2 you can append the year in front of month for the last x axis, should be easier to glance)

Still not at ease with the charts but I will try to improve it with the years.

The 1 bedroom flat is a LDTR in Geneva so I got low rent for 5 years. I got lucky to get it during Covid time and lockdown as we got no connection in agencies this country. Everyone was leaving Geneva in 2020.

The agency refurbished it completely will insolation so they got discounted tax rate on this rent for few years as well. Win.win as I do not spend much on electricity bill (A+ equipment was installed).

The rental association ASLOCA help to negociate and keep it low.

I am accounting only our revenue stream so the bump was unexpected donation after our wedding. Same with tax reclaim. How do you do it ?

Late 30ies, cohabiting, no children, living in Zurich, renting (rent split 50-50).

2022 expenses: 38497 CHF. -0.37% compared to last year. Doesn’t include taxes.

Just did the numbers. Double income couple in Zurich city with kid. Total spending CHF 161k, breakdown roughly:

- Rent & utilities 47k

- Daycare 32k

- Travel & trips 26k

- Furniture 8k

- Groceries 14k

- Healthcare 12k

- Transport 6k

- Restaurants & bars 6k

- Purchases for daily life (clothes, electronics, baby stuff, etc) 6k

- Sports subscriptions 2k

- Gifts and various other spending 2k

After-tax savings rate 30%.

Baseline spending after daycare and furniture ~120k, which includes an expensive but spacious and comfortable city apartment, and 35k of entirely discretional spending (for our own sanity). Therefore don’t put any effort in optimizing costs like groceries, seems hardly significant.

How big is your family ?

Number of children could give me a expected budget increase ![]()

Probably too many details but here I come:

Double income couple with a toddler living in Zurich’s silver coast. No car.

Total spending 168k ![]()

Savings rate 30% after taxes

A lot of one-time purchases in clothes, furniture (just moved to new flat) and electronics.

Groceries increased quite a lot. Probably due to inflation + new grill + relatives visiting for a few weeks.

Counting the days until kindergarten starts ![]()

| Main category | Sub category | 2021 | 2022 |

|---|---|---|---|

| Food | Groceries (cleaning and toiletries) | 9,057 | 14,126 |

| Food | Restaurants, coffee and snacks | 5,988 | 7,038 |

| Housing | Rent 4.5 rooms | 36,305 | 41,457 |

| Housing | Electricity | 418 | 541 |

| Housing | Furniture, decoration, non groceries | 7,252 | 6,319 |

| Housing | House appliances | 0 | 1,506 |

| Housing | Cleaning company | 1,407 | 1,379 |

| Housing | Moving expenses | 3,603 | 0 |

| Insurance | House insurance | 301 | 0 |

| Insurance | Personal liability insurance | 150 | 0 |

| Insurance | Legal insurance | 297 | 297 |

| Insurance | Travel insurance | 72 | 72 |

| Insurance | Rescue insurance | 80 | 80 |

| Insurance | Other objects insurance | 110 | 105 |

| Taxes | Serafe / Billag | 280 | 335 |

| Taxes | Tax consultant fees | 249 | 0 |

| Taxes | Taxes provision | 21,604 | 21,500 |

| Taxes | Customs | 63 | 258 |

| Taxes | Witholding Tax | 900 | 1,004 |

| Transportation | Public transport | 1,863 | 2,675 |

| Transportation | Taxis, Uber | 0 | 21 |

| Medical | Health insurance | 11,322 | 10,589 |

| Medical | Pharmacy | 2,118 | 1,817 |

| Medical | Dentist | 1,070 | 730 |

| Medical | Medical bills + physio, massages, glasses, etc | 2,323 | 2,263 |

| Travel | Transport, accommodation, food | 12,960 | 7,012 |

| Telecommunications | Mobile phone subscriptions | 610 | 410 |

| Telecommunications | Internet subscription | 1,022 | 600 |

| Telecommunications | Subscriptions (Netflix, news, etc) | 1,248 | 988 |

| Telecommunications | Software | 86 | 179 |

| Telecommunications | Electronics | 0 | 1,669 |

| Personal expenses | Clothes and shoes adults | 3,953 | 8,003 |

| Personal expenses | Hairdresser | 1,147 | 1,460 |

| Personal expenses | Cosmetics / Beauty care | 1,330 | 731 |

| Personal expenses | Sports | 445 | 664 |

| Personal expenses | Gifts | 1,017 | 1,695 |

| Personal expenses | Leisure | 92 | 1,233 |

| Personal expenses | Books | 190 | 425 |

| Personal expenses | Education | 0 | 187 |

| Personal expenses | Family support | 320 | 172 |

| Personal expenses | Lottery | 95 | 125 |

| Personal expenses | Bureaucracy | 36 | 195 |

| Personal expenses | Charity | 240 | 20 |

| Work expenses | Work Expenses | 0 | 206 |

| Children | Daycare 4 days a week | 27,360 | 25,320 |

| Children | Clothes and shoes | 3,000 | 1,280 |

| Children | Extracurricural activities | 10 | 312 |

| Children | Toys | 435 | 242 |

| Children | Equipment | 205 | 261 |

| Others | Others | 105 | 0 |

| Banking, investments and savings | Financial subscriptions | 184 | 231 |

| Banking, investments and savings | Banking fees | 201 | 145 |

| Banking, investments and savings | Broker fees | 120 | 120 |

| Banking, investments and savings | Banking fees currency | 109 | 107 |

| Total | 163,351 | 168,103 |

One ![]()

Apart from daycare, ‘normal’ costs (groceries etc.) went up only by 3-4k per year. However, we’re spending considerably more on comfort: bigger flat (5k/y), cleaning lady (2k/y) and eating out (3k/y).

Should a second kid come around, we’d need a car. Including parking I guess that’s at least an extra 10k/y. Add another kid in daycare and we’re probably looking at (tenporarily) 200k spending per year… ![]()

Aka lifestyle inflation. ![]()

Hello everyone,

Our household, my wife and I without kids. Working in Vaud canton and living in Fribourg :

| Variables | CHF 61 249,68 |

|---|---|

| Food | CHF 12 022,77 |

| Non-Food | CHF 2 638,20 |

| Mobilité | CHF 6842,14 |

| Medical | CHF 564,18 |

| Dons/Cadeaux | CHF 3 683,51 |

| Sport | CHF 4 209,54 |

| Abonnements | CHF 1 020,00 |

| Téléphone/Internet | CHF 1 320,59 |

| Maison | CHF 3 182,82 |

| Services | CHF 30,26 |

| Vacances | CHF 9 058,02 |

| Activités entre amis | CHF 3 440,82 |

| Vêtements | CHF 1 425,46 |

| Autres/Divers | CHF 3 008,86 |

| Restaurant | CHF 4 602,16 |

| Véhicules | CHF 4 200,35 |

| Fixes | CHF 53 309 |

|---|---|

| Loyer | CHF 19 680 |

| Lamal + complémentaires | CHF 6 720 |

| Assurances véhicules | CHF 2 312 |

| Impôts + taxes | CHF 24 597 |

| Total | CHF 114 558,68 |

|---|

Thanks a lot @Mr.RTF for the GGsheet ![]()

As in any area with a very high cost of living, having kids indeed is a lifestyle choice ![]()

Let’s revive this thread!

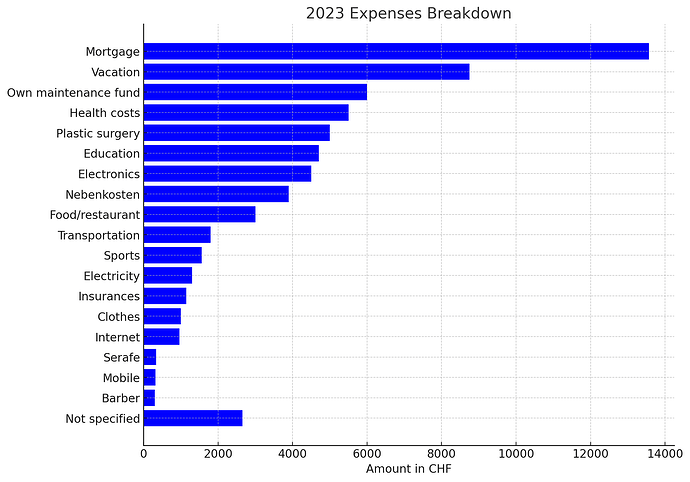

Time to look back at the total expenses for 2023:

- Family of four in a mid-sized Swiss town, living in a rented apartment

- Total yearly expenses CHF 148,000 (w/o taxes) - up almost 20,000 from last year

- Saving rate (w/o taxes): 38%

Biggest items:

- Housing 36,800 (moved to bigger apartment)

- Groceries 16,800 (down a little bit)

- Health 16,400 (stable)

- Holidays 15,500 (stable)

- Cost of rental apartment 10,500

- Eating out 4,800 (stable)

- Mobility 3,300 (stable)

Still not very frugal, alas.

Sounds good.

We are a family of three living in a bigger city, both parents working part-time.

After tax, we spent 2023 a sum of roughly CHF 97000.

Biggest items:

- rental apartment 23000

- insurances 14500

- groceries 12500

Monthly expenses is around 15k for 5 people. So that’s 3k per person per month. This is not counting any taxes or social contributions. Quite large due to daycare costs for 2 small kids.

- Gross salary: CHF 119’800

- Net salary: CHF 109’500

- Taxes: CHF 14’700

- Spent: CHF 66’300

- Saved: CHF 28’500

Breakdown:

- Mortgage: CHF 13’570

- Vacation: CHF 8’750

- Own maintenance fund: CHF 6’000

- Health costs: CHF 5’500

- Plastic surgery: CHF 5’000

- Education: CHF 4’700

- Electronics: CHF 4’500

- Nebenkosten: CHF 3’900

- Food/restaurant: CHF 3’000

- Not specified: CHF 2’655

- Transportation: CHF 1’800

- Sports: CHF 1’560

- Electricity: CHF 1’300

- Insurances: CHF 1’150

- Clothes: CHF 1’000

- Internet: CHF 960

- Serafe: CHF 335

- Mobile: CHF 320

- Barber: CHF 300

(made with ChatGPT)

My girlfriend covers food/household/cats. So that’s why my food costs are only 3k.

Sorry, but how is it possible to pay 9% income tax?

My taxes are 13.4% of my net salary? 11.4% for Gemeinde/Kanton/Bund and 2% for military. I live in AG.

By having a low income or making use of deductions to lower the taxable income.