Today I have a more chaotic portfolio from my first investments last year. I need to redo it, and write down a clear strategy!

The goal is clear: maximize returns for my retirement that I currently plan in about 35 years. Full risk and return! I plan to go 100% stocks with some CH-bias. small and value weighting, as far as available on the ETF market.

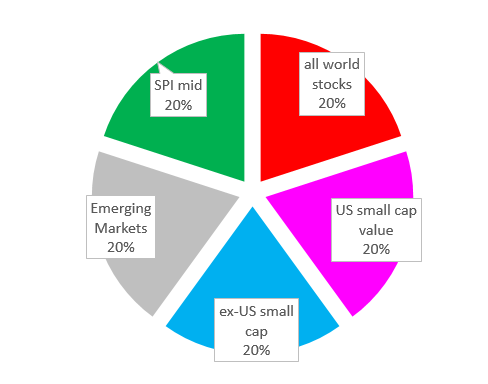

something like

- 20% All world (most lage & mid cap): Vanguard all world ETF

- 20% international small value, for example europe Vanguard FTSE All-World ex-US Small cap ETF, US domiciled

- 20% US small cap value:Vanguard small cap value, US domiciled

- 20% emerging markets iShares Core EM IMI

- 20% SPI mid, UBS SPI mid for some home bias and CHF exposure.

Rebalancing: rearly or whenever fresh savings are available.

besides that I own:

- the short term cash i need for living

- pillar 1: bond-/ cash- like

- pillar 2: bond- like

My ideal portfolio would be an equal amount of CHF in every company on the planet. However, I can only invest in what is offered via ETFs. From here, my ideal portfolio would be close to Merriman’s ultimate portfolio (see first post). Unfortuanately most of these ETFs are US domiciled, where the $60’000 cap comes in. So I boil it down to these 5 stock assets where rather reasonable ETFs exist. There is an Emerging Market small cap ETF, but a 0.74 TER is above my personal threshold. All in all 5 ETFs seem to me the higher end for my 50k depot, already 2 more than the lazy 3-fund portfolio.

I like MP’s 3 fund portfolio because of it’s simplicity, but the bonds don’t fit my ideas. I like the ultimate portfolio for its combined diversification and small value focus. however, it looks like ultimate only for us residents, and not feasible for starters.