It’s been 2 years now that I am with IB, time for a recap!

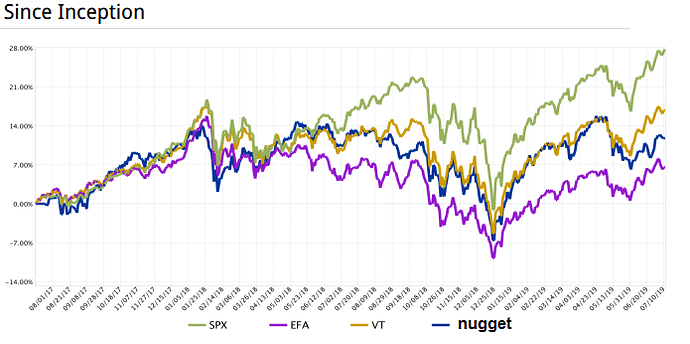

My portolio ist still aiming for “having the same $$ in every liquid stock” and can be found here. A 2Y-comparison vs. SPX, VT and EFA looks like

so clearly, betting on SPX the las two years would have more than doubled my returns.

However I am a passive indexer with my portfolio on auto-pilot, so i will just ignore this and let my portfolio ride for the next 20, possibly 60 years ![]()