Everyone here not owning a house and thinking about Japan’s inflation style, is going to keep everything in cash?

Unless you think that the stock market is healthy, I don’t see many other solutions.

I think there are different angles at play:

-

profile of mustachian. On average we are financially more educated than others. For others, there is no option. They only know one thing ‘invest in bricks’. For them, House prices over long period always go up. Moreover, they would not invest in stock market as considered too dangerous. Even tough LTV 80% = 5x leverage for real estate

-

portfolio. You need to ask yourself ‘Am I happy with my portfolio’. If you think stock prices are overvalue, either tilt or decrease stock:bond or stock:cash ratio.

Personally, I am concerned too and I am already tilted nicely to EU and EMs above my investment thesis. This weekend I checked growth YTD vs last year YTD and I am close to 25% with a large absolute gain. I decided to sit tight. I may just liquidate some Indian stocks as above 50% return and increase my cash ratio

- Mortgage as share of NW. I agree with my wife that we will be looking for houses but only passively and I won’t do any mortgage until I have a permit C and with at least ~20% of cash / stock aside after the deposit. E.g. 2mil house. 400k pillar 2/cash deposit, 1.6mil mortgage. Then at least I need to have 320k or even 400k cash/stocks in case something goes wrong I won’t go under. Plus I won’t be out of the market in case mr market blesses us with outstanding returns

Again, don’t forget the shift in demographics. There will be basically much less families than home/flat of 4/5 rooms. People buying now at 30 a home with kids will all trying to sell at the same time in 2050 to move to smaller home which would be easier to mantain/clean. But only few families will be left to buy, so the prices of larger apartments/homes will go down a bit almost for sure just because of the shift in demographics, see the chart here in this post from last year:

At least from what I’ve seen, people downsizing tends to be much later than 60yo (I mean a 60yo is still supposed to work for 5 years extra or more). Are there evidence that people downsize after kids left home? (People usually still want extra rooms for the grandkids and the kids visiting)

Maybe you’re thinking of the people who bought 20y ago? (which would be 80yo in 2050).

In my experience most people downsize at 70+.

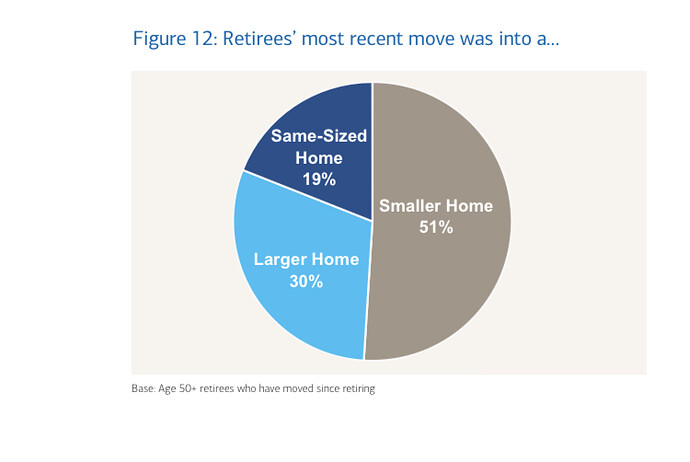

Some people never downsize. Some upsize. In the US. Some stats:

- 61 years old is time to think though down/upsizing

- 36% do not plan to move, rest either moved or planed - but we know not all May end up moving

- 51% downsize; 30% upsize; 19% keep same home

Couldn’t find info on CH. would be nice

Source: Merrill Linch https://agewave.com/wp-content/uploads/2016/07/2015-ML-AW-Home-in-Retirement_More-Freedom-New-Choices.pdf

Who knows if that shift will happen, or when.

If it were 1990 we’d be saying (we did actually say) hey in 2020 the massive baby-boomer peak birth rates will hit retirement - then there’ll be lots of big homes and few young families to buy them.

Look what happened instead, the expected peak of Swiss baby-boomers in 2020 has been totally flattened by immigration of people 30-50 years old.

Instead of a big peak at ages 60-65 in 2020 as was expected in 1990, we have a practically constant number of inhabitants for all birth years in the 30 to 60 age category. Equalling no surplus in “family-homes” in 2020.

And migration is far from over.

But then from your cool animation it seems not a lot of immigrants stay here after retirement, and some go back to their home country…so we have now 30% of population in prime age to buy which is foreign and may be go back in 20-30 years…putting their homes in the market, or by taking away buyers by leaving their home to their kids

It will be for sure interesting!

Btw basically all my Swiss friend who are working and living near their parents, around 35-45 years old with families, moved into the parents home and the parents downsized in a smaller apartment. Consistently.

Hey guys, tell me what do you think about this. It’s currently tempting to consider buying real estate, because with an interest rate of 0.6% it’s almost free money. But it comes mostly at a risk of the property dropping in value.

But not all regions are equally affected by price hikes, or? So what if instead of buying a house to live, in some less than ideal location (but still at an inflated price), you would buy a rental property in not such a desirable location?

How do the rules differ between mortgage on your primary residence and a rental property, anyway?

Would it make sense to buy a “cheap” flat or house using mortgage and rent it out? Of course, the question is if there are such places, that would be less exposed to a market crash. Would they rather be residential or commercial?

What’s the full package return on rental (taking into account taxes, repairs, etc.)? I thought it was super low, even after looking at the extra leverage. Can be nice diversification, but should it be >50% of your allocation (if you take into account leverage)?

If you find a good deal with high expect yield and you need some cash I could help out

I don’t know, is it? I thought that small low-end “student” flats generally have higher rental yield than those with higher standard. Let’s say you invest 200k of your own money and 400k of 1% loan into a 600k flat, that yields 4% annually. That’s 10% leveraged return on your 200k.

I was just asking hypothetically, wouldn’t know where to look for good deals. And I would rather not become anybody landlord.

Yes but there’s much more math around that purchase and running it for years/decades than just those few numbers.

I thought it was written about long and wide in this and other threads.

Even if you ignore all the other costs like maintenance, notary costs etc. those “10%” aren’t compounding. You’ll need 10 years worth of rent to buy the 2nd flat. And then again, there is no compound effect.

Sure, you can invest those yields in stocks. But you should still do the math with reasonable numbers.

What my point was: if you’re looking to buy a place to live, you care about location, your personal taste etc. If you’re looking for an investment property for rent, you mostly care about annual yield, which makes is somewhat easier to find.

I see the risks of real estate, but it is a source of steady, almost fixed, income. Yet I know I will not be able to buy an attractive place to live at the moment, as I’m bound by proximity to Zurich.

Yes, because at some point you will exceed your affordability limit. So you’re limited by the amount of loan that can be given to you. But cashing in a fixed 10% on a portion of your money doesn’t seem so bad, even if it’s not compounding. As you said, you can invest it into other things that will compound.

Real estate is more expensive. Expect to pay 30-40x the annual net rent. So for 20k/year that’s 600-800k. Lets assume it’s 700k and LTV ratio is 66.6%, so 2.9% rental yield. After interest and maintenance you’re left with ~1.5%. Leveraged it’s ~4.5%.

Edit: Thinking about the last couple of projects I realized with my clients, they ended up with a rental yield of ~3.33% on average. After interest and maintenance that’s still only ~5.5% leveraged.

Does this apply to every property in Switzerland? I saw some people either here on in English Forum boasting about yields of 4% per year. (@Zerte2 I think you own a rental property, care to chip in?)

Depends when you bought it. Prices rised sharply in the last couple of years (+10% in the last 12 months alone). I don’t think you’ll find 4% nowadays.

There are strong differences between regions, between recent and old (but well maintained) buildings, and case by case (depends a lot on who is selling and why).

But after almost 13 years of super easy credit, it’s more and more rare to get offers with >= 5% actual net rental yield (not taking leverage into account). Typically you see an advertisement for a “juicy” 4%… but… it’s comfort apartments in a rural area which are difficult to get rented, or a heavy renovation is needed soon, or only “potential” rents are listed, etc.