I would like to hear your opinions in the topic of real estate. It has been brought up before, but this time I’d like to back it up with data and some nice charts.

To put things in context, currently I’m 90% invested in VT and 10% in CHF. Might switch to VTI+VXUS, as suggested by @hedgehog, but the basic principle is the same.

If all goes well, I should reach financial independence in 6-8 years, before I hit 40. When the time comes, that I decide to, at least temporarily, stop working, I would like to have something more tangible than just an ETF. Thus I’m considering to invest a portion (maybe 20-30%) into real estate. Whether it will be in Switzerland, Poland or somewhere else, I don’t know.

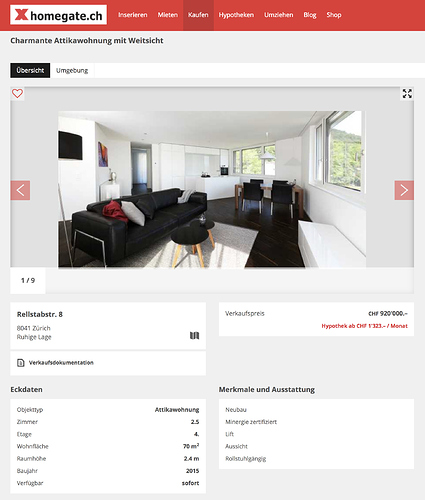

I’d like to focus on the Swiss market, because my girlfriend’s parents would like to contribute to buying her a flat. The current prices make them suggest really remote locations, where a young active person would not really like to live. So I’m interested as to how the situation might develop in the future.

Here are some charts as food for thought.

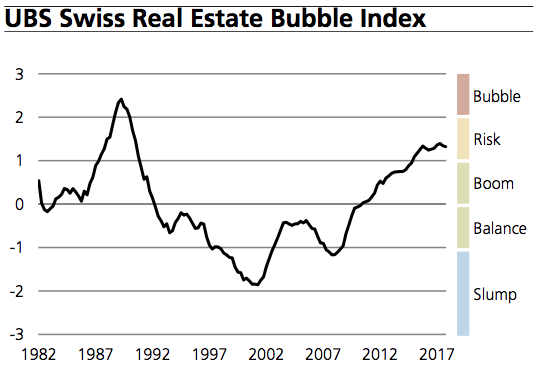

UBS Bubble Index. According to it, we’re in a risk territory, so it’s not the best time to buy. But the changes go really slowly, so we could wait another 5-10 years until it’s OK to buy.

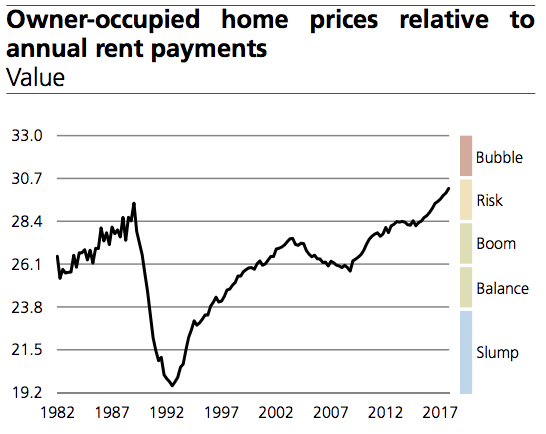

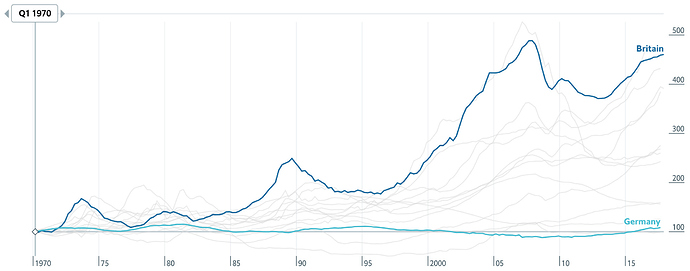

Price to rent ratio. UBS: Home prices are high, relative to rent. The long-time average ratio is 25, so a rental yield of 4%.

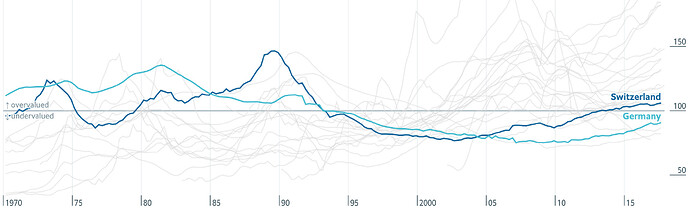

However, according to the Economist, it’s barely overvalued.

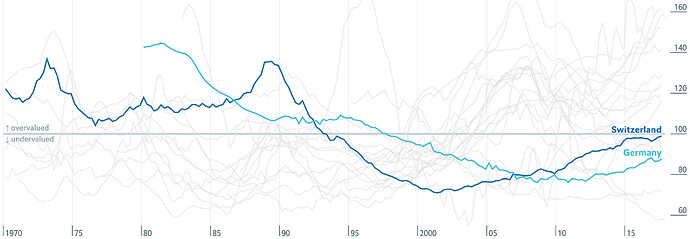

And if you look at price to income ratio, then it suggest that homes are undervalued! I wonder what is the reason for this discrepancy.

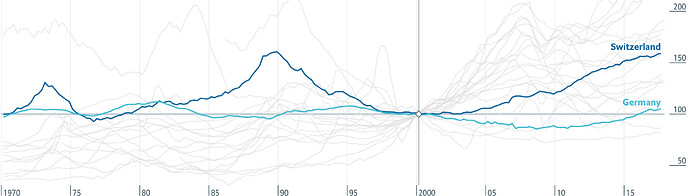

Finally, real home prices (inflation adjusted). It looks like home prices got much more expensive compared to other goods since 2000 and they are at their previous peak of 1990.

Sources:

. Buy Utility, Rent Luxury, so simple. Just to confirm,

. Buy Utility, Rent Luxury, so simple. Just to confirm,