But if you only care about (current) yield and neglect all other aspects you risk that the yield will decrease in the future if your chosen location loses its attractiveness. I’m happy with a low yield in a city like Zurich where chances are jobs will always be in good supply.

@Bojack, I think you are absolutely correct on the following:

-Yields are lower on nice properties in nice areas

-1 bed places have higher yields but tenants change more often, meaning more vacant periods and repairs

As others have said the problem is that yields are so low.

For perspective I think the situation in free market USA is very different. I believe it is possible to use leverage to buy investment properties yielding above long term average interest rate (5%) so that risk is well covered. Rents there are not controlled, they don’t have the concept of tax on deemed rent nor such high purchase taxes.

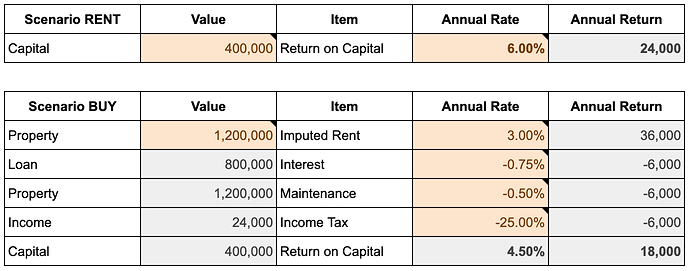

I have updated my RENT vs BUY calculator to compare the return on capital. What do you think? Do the numbers seem plausible?

0.5% maintenance is on the low side. Plausible when rather new, otherwise I would calculate with 0.7-1.0%.

I know, but I discounted potential value appreciation. Also, if you count 1% of 1.2 million, you’d need to spend 1k on maintenance each month, or 120k in 10 years. I know, with a house, you’re potentially looking at replacing the kitchen, bathroom, fixing the roof, etc etc. You think a long-term average would really steer towards 1%? Maybe with a flat the maintenance is a bit lower, as there are many common costs.

With a flat you have to pay into the “Erneuerungsfonds”, usually in the 300-500 CHF per month range. But yeah, maintenance costs should be a little bit lower in total.

I would be on the safe side, just to be sure. 0.7% maintenance in total as “Nebenkosten” isn’t included in the net rent.

Yes I’ve also thought several times about looking for a rental property in USA but we’d also have to take into account the higher inflation and devaluation of $ vs CHF, no ? Would numbers still remain appealing once these factors are taken into account?

Correct, but if you can get a mortgage in USD you have a partial hedge.

I have property in the US, I am happy to have it now but would not do it again. Hassle of dealing with another country in different time zone being one reason, and relying on property managers

What are the issues with property managers? I was thinking that they take their slice of the cale (i.e. some % of the rent) but then they take care of everything.

Did you open a LLC to administer your property? Where did you buy ?

This might deserve a dedicated thread…

I suggest to include also the one off irrecoverable costs with ownership. Mortgage certificate, notary fees, already you start with a drag of 3-5% in first year depending on canton. you also have property taxes, insurances, management expenses for rental that should be higher than 0.5%.

my personal opinion is it only makes sense to buy at this prices a property for you to live in. It reduces out of pocket costs, and provides a “sense of security”. if you want to buy an investment property, I think it’s a very concentrated and highly leveraged risky investment.

Indeed this is going off topic. You just need a good one who is realistic and practical as you rely on them. I had some who were proactive and looked after the property like their own. I had others who promised the world but didn’t solve problems and I had multiple evictions. Culturally people in US are positive and enthusiastic but sometimes the result is to over promise. In US it is also more common for people to not pay debts, they can drop off the keys and walk away. They just get their credit score ruined for a while vs in Europe you would be made bankrupt.

Yes regards having LLC

Hey 5.5% leveraged is worse than CrowdHouse

Seems to vary a lot depending on the canton. In Zurich the notary fee is something like 0.1%.

So, I watched it. My comments:

since 1978 (American) income hasn’t gone up, but prices of goods and real estate have

The theory is, that’s because of globalization. Jobs have moved overseas, pulling billions of people out of poverty, partially at the cost of the middle class in the US. Big steady immigration in the US also played a role.

maximum rental income X maximum leverage

I don’t know if this is anything new in the US, but in Switzerland it’s been like this for decades, or? You can keep your loan at 65% LTV ad infinitum.

Then he gives his reasons for why houses will cost over $10 million:

1. population is growing

2. people move to urban areas

3. people want to live alone

4. owning more houses

5. new housing not keeping up with demand

6. more expensive to build (materials, labor)

7. inflation

8. leverage

My comments:

- ok, but population is not growing everywhere and you need immigration for it to keep growing

- on a global scale, maybe. Also, young people starting their careers will do this. But people who have enough money to buy a house will gladly move out of the city, especially if they can work from home.

- true, people don’t marry and don’t have kids. but I think this also makes us unhappy, we are social beings by nature.

- that means, people who have accumulated capital, earn money with it, and can afford to buy even more capital. I wonder when do we reach a tipping point and people revolt. You remember this slogan “you will own nothing and you will be happy”? I guess this could be the reality for an increasing portion of the society, if things continue.

- probably regulations play a role here

- is this gonna be true forever, or is it just covid-related?

- this is just a repetition of point 6

- yes, leverage is a big factor, and one that I still struggle to grasp. What is he talking about, that Colgate is 72x leveraged? Where does the money come from, anyway? When I take 1mil mortgage, the bank just produces this money. This makes all other money worth a tiny bit less, each time they print more. Why is this at all possible?

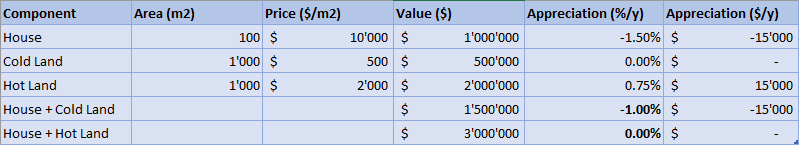

I gave it some thought. Actually, you can split a real estate into many components: land, building, appliances, plants. But mostly land and building. And these components have clearly different characteristics when it comes to depreciation and maintenance.

- LAND. Clearly, land needs no maintenance. Yeah, you need a garden to take care of, but that’s not land. It’s the land component that is an appreciating asset if the location is good.

- BUILDING. Buildings break and go out of fashion, it’s the building that depreciates and need maintenance.

So if you own a flat, you have the title to a tiny been of land under the building, and the bulk of your ownership consists of the building. An old ugly house in Kilchberg is the opposite. I wonder if this is taken into account when calculating maintenance cost.

I would say so in general. Better count 1.5%. However, it’s for a non-speculative zone.

In a hotspot, real estate prices can be (easily) 4x higher than in a colder spot for a similar object, but maintenance costs are probably the same (that’s just a guess).

Does this not coincide with what I wrote above? A “hot area” is an area where the land has high value. And since land needs no maintenance, the % of maintenance/total_value will be lower.

Let’s say we take the same house, which in itself has a value of $1’000’000, and put it on a 1’000 m2 piece of land. In the “cool” area the land is $500/m2, and in the “hot” area it’s $2’000/m2.

Could it be, that in a hot area the depreciation of the house would be totally offset by the appreciation of the land?

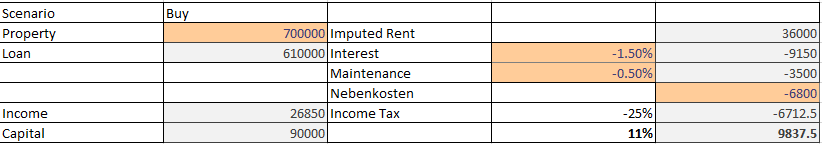

How did you get a loan with LTV of 87%? You know, back in the day there was no LTV 80% requirement in Poland. They only checked if you’re able to pay interest. Please calculate the annual return on capital of such investment. ![]() Of course, the more you leverage, the higher the return. In this case it was an infinite leverage, as no capital was needed. I struggle to implement any return-on-investment logic for this case.

Of course, the more you leverage, the higher the return. In this case it was an infinite leverage, as no capital was needed. I struggle to implement any return-on-investment logic for this case.