very itneresting bojack!

I’ve found this link on the bundes statistik page:

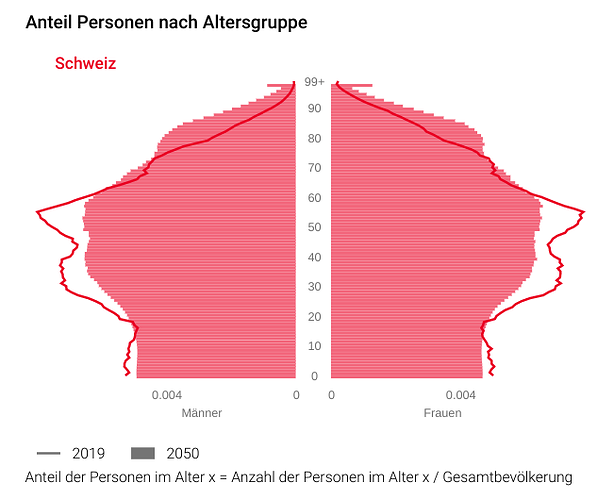

you can clearly see the difference between 2019 (red line) and 2050 (fat chart). there will be an huge gap in the age where people buy family home (30-50 years old) and a hugh surplus of older people that would need smaller apartments/altersheim.

I wonder how that would play out. But people born in 2015 will have an huge choice of family homes/flat 5+ rooms that older people will be leaving. So my daughter basically ![]()