I looked at the list of the companies in the ETF and it looks a lot like my watchlist (exept that I don’t invest in India, Taiwan, Japan, South africa etc, nor in banks or petrol)

The limitation with an algorithm is that something new can come along and break it. I own the MSCI Quality fund in Finpension but I have reservations about whether it can continue to outperform, especially after the run up in the past year.

Nvidia is the biggest position in the index. It has had huge ROE and profit growth so the “Quality score” will be very high. However there are debates about the future (how deep is Nvidia’s moat?) which the model does not capture, and whether the valuation is too high due to speculation

Fundsmith annual letter to shareholders discusses it, may be worth reading before taking the plunge (Fundsmith had 0 Nvidia in 2023). Another consideration is that 0.5% fee is quite high for non-active fund management

Regarding nVidia, I have been thinking the same about its inclusion in the quality index, and like Terry Smith’s noting of “breaking with tradition” in the market’s deciding that it will be nVidia and Microsoft running the AI show. There’s an ongoing question of opportunity cost, of course, perhaps Terry Smith is foregoing the opportunity to lessen risk, it would be consistent with a long-term strategy. Or it could be a cop out to address shareholder FOMO!

Regarding your second point, whose 0.5% fee are you referring to?

I was referring to the Quality ETF that @Helix discussed in a couple of posts above. 0.5% fee seems high for non-active management

This is very useful work and thanks for sharing it. Sometimes I am amazed by the quality of knowledge that people on this group have.

My view is following. think sometimes we mix two expressions - passive investing and index investing.

I believe the real « passive » investing would refer to the fact that a person buys all the stocks in universe and expect the global market cap weighted returns over time. VT might be the only ETF that actually does that. I think very few people are completely passive. Everyone has some sort of active bet.

Everything else is a sub set of passive investing but still have some aspect of active bet on something

- using only S&P 500 and expecting S&P 500 returns can be considered passive but it is an active bet on US large caps

- using full US stock market and expecting US stock market returns (here the active bet is on US market)

- picking a factor and only invest in that factor could lead to active bet on that factor

Now the specific index investing makes passive even more specific . One can argue that investing in all the companies of MSCI quality is passive investing. It is but then expected returns are limited to market weight average of all companies in that index. And investing in msci quality would inherently mean that one believes Quality factor to beat overall market in long term. Even though they don’t select individual stocks, they are selecting a criteria. Is it passive, index or active ? Maybe all of it.

Same discussion can be made for Small cap value index. It is an active bet that small cap value factor will outperform total market over long term based on factor investing theory. In fact between 1972 to 2024, small cap value outperformed full US stock market by 3% on annual basis. This is huge over performance but i am not so sure if this would be the case for future too.

I am not actively picking stocks myself but I do have an active tilt towards India and home bias towards Switzerland. So i can be called active - index - investor with passive mind set ![]()

![]() (relatively) new kid on the block: Xtrackers MSCI World Quality ESG UCITS ETF 1C

(relatively) new kid on the block: Xtrackers MSCI World Quality ESG UCITS ETF 1C

No inclusion in ICtax so far though (and it’s accumulating).

ESG to me instantly disqualifies any fund, as it lowers expected returns.

…unless they actually increase returns?

(The index before costs, that is)

expected returns =/= realized returns.

A few years are also just a fluke in investing. This is also highly likely to be general ESG hype, with all the funds popping up and investing proportionally more in ESG companies, driving their price up. This is also precisely why expected return is lower in the future, as those are overvalued due to it.

Which is a function of being slightly overweight on US and large cap tech than MSCI world? And even then it is only .38% higher annualized since May 2012 which is the as far back as their index fact sheet shows - which is precisely the time (last decade +) when US and large cap tech has outperformed everything else.

Edit: index returns, without expenses.

True. But what’s your reasoning for why they should have lower expected returns?

Possibly.

Contrary to most other factors that drive stock valuations, a relative increase in funds’ allocation to ESG-screened is a foreseeable factor - and as long as it holds true, why shouldn’t we take advantage of it?

If we know, funds/people will be more inclined to buy “ESG” stocks than “non-ESG” stocks, why shouldn’t we do the same and benefit from their increasing valuations?

On the other hand, the increased demand may be priced in already - in which case we’re back to square one.

The negative scenario is investors actively turning away from ESG investments and shifting back to non-ESG investments. Is that likely? I agree that ESG investing is a trend or “hype” (if you will). But is it likely that investors will deliberately turn away from it?

First, I’d argue that very large institutional investors are (or will increasingly be) driven by politics and legislation that encourages or forces them to invest sustainably.

Second, most people want to support “good causes” - that’s what makes the ESG marketing so clever.

As per MSCI data, since 2007 annualised following are the returns from index perspective. I tried to pick an index which have slightly longer term data and also a bigger filtering to select ESG leaders

28-Sep-2007 to 30-Apr-2024

MSCI world -: 6.95%

MSCI world ESG leaders -: 7.10%

Both are quite diverse funds. However we should look at the results keeping couple of things in mind

-

The outperformance is driven by Quality and Momentum factor. So the question is, what is driving outperformance? Fact that these are ESG leaders or they have a higher weight to some big US companies or the exposure to Quality and Momentum stocks

-

If the TER of an ESG index fund tracking ESG leaders index is higher than standard index fund, then the advantage seen above would be washed off.

As with any market timing, you can’t time when the very possible reversal will happen and then you are in it.

The best predictor of future returns we have is valuation though, and this would predict ESG doing worse over the long run.

Although the effect will probably not be as big. But I just don‘t see any reason to allocate to a factor fund that‘s at the same time ESG screened. It kind of cancels each other out in my view.

My view towards ESG - the kosher one anyway - is that I once bought margarine instead of butter for a recipe I wanted to make and had credible suicidal thoughts.

I’m getting an itch to build a position, small one maybe 5k each, in VEUA and FUSA. FUSA for the quality factor. and VEUA to boost good European companies as a counterweight to FUSA. Any opinions?

Yeah, who am I kidding, eff that, I meant FUSD and VEUR for the dirty dividends and the adrenaline rush of moving money from one pocket to the other and then reinvesting them incurring more fees along the way. I’m a degen too in some ways, this is one of them, I get a kick out of reinvesting free money, even if it’s not free.

What about this one, is it still sector neutral? Could not find explicit information. JPMorgan U.S. Quality Factor ETF-ETF Shares | JQUA | J.P. Morgan Asset Management

„Tracks the JP Morgan US Quality Factor Index

Utilizes a rules-based approach that matches Russell 1000 sector weights and selects stocks based on quality and profitability characteristics“

What about an ETF like QUAL?

It tracks the MSCI World ex Australia Quality Index. I mean it‘s without Australia and traded there, but so what. ![]()

It‘s an old ETF, quite some AUM and trading volume. From the description it seems to be not sector neutral (or I missed it).

Hm it performed very similar to VOO - I think I missed something.

Some withholding taxes, maybe?

Sector allocation also seems to match up with non-sector-neutral quality. As @nevsky says, withholding taxes. Distributions are at about 1%, and Australia withholds 30% non-treaty rate. I haven’t checked if Australia’s tax treaties are any good for the dividends paid to the fund.

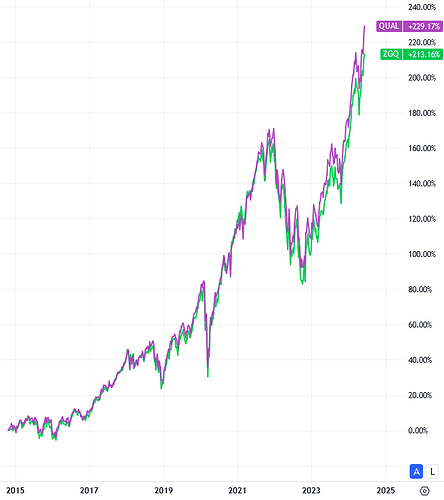

Total returns in USD compared to ZGQ which replicates the same index: