MSCI, FTSE and Solactive get a new playmate – SIX also enters the index market. In short: they try to offer lower fees and higher automation.

is there an ETF that tracks this index

MSCI USA Quality Index

and I am not talking about the sector neutral iShares MSCI USA Quality Factor ETF

No …… (20 char)

There is one for MSCI Europe Quality though.

Bloomberg leads me to: ETF FACTS (bmo.com)

It names itself as the BMO MSCI USA High Quality Index ETF - USD Units, but the factsheet says it tracks the MSCI USA Quality Index. There’s also an equivalent ETF by the same company denominated in CAD (see full list here). And an equivalent hedged one (hedged in CAD, presumably) for those of us who like to pay insurance.

Information provided as is. I personally would not invest in this, given the fees and the size of the ETF.

As a prospect (not yet, but considering) shareholder of BMO* I believe you should definitely look into this and consider investing large amounts given those juicy fees (to BMO).

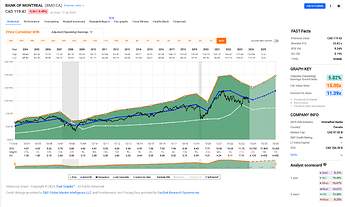

* BMO FASTgraph (sorry, couldn’t help myself):

thanks for sharing

yes, I too will also pass on this considering the fees of this one

surprising that no major player has any offering for this index for retail investors.

If you want to see it loosely then FUSD is not a bad substitute.

Finpension now appears to offer the “iShares Edge MSCI World Quality Factor” ETF in its new investment solution: https://finpension.ch/app/uploads/factsheets/IE00BP3QZ601_fact-sheet_de.pdf?t=2024-08-14

Yeah, that is the one that follows MSCI World Sector Neutral Quality Index. I prefer the index that is not sector neutral, especially since I also hold other factors.

Any reason to switch from CSIF (CH) III Equity World ex CH Quality to iShares Edge MSCI World Quality Factor?

The CSIF (CH) III Equity World ex CH Quality is only used in 3a and there is no equivalent ETF which we can use for private wealth. Therefore I went with the iShares Edge MSCI World Quality Factor for my private wealth.

Thank you, but my question was more about if there are any reasons to switch from CSIF (CH) III Equity World ex CH Quality fund to iShares Edge MSCI World Quality Factor when deciding for the componence of a 3a portfolio.

Update: I just noticed that the 3a available index funds are different from the ones from the Invest solution funds, hence my question was irrelevant.

Because 3a funds are linked to pension and have tax advantaged treaties with other countries while normal investments don’t have such privileges

Hi, I’m a beginner and I’m using Finpension 3a pillar with the quality fund and so far I’m happy with it.

It seems it’s not easy to find a pure quality etf outside pillar 3a, I read a lot of posts online but everytime I end up wirh different options ans opinions such as QUAL or wisdomtree quality (high ter tough)… may I ask you a couple of quality etf to invest in? I’m talking about long term investing, at least 15 years.

Or do you think that looking for quality outside my choice in 3a pillar makes my investment strategy too much risky?

Thank you for your time

for the lovers of MSCI World Quality (not quality factor, not sector neutral shenanigans), this may be of interest to you:

AQLT: ishares msci global quality factor etf Factsheet - misleading name, see benchmark

TER: 0.2

Benchmark: MSCI ACWI Quality Factsheet

this is an interesting find so there is a chance finally to have a quality ETF outside finpension3a

I am correct in reading that is equivalent to that?

Yes, they are equivalent in a way that Finpension 3a has MSCI World ex CH Quality, while this fund is MSCI ACWI Quality.

The difference is CH and EM: in the ACWI quality, CH is 4.41% and looking at the ratio of US in 2 indices, EM is ~8 %.

None of them is sector neutral.

Thanks, I was looking for country region breakdown and was unable to find emerging market % in the MSCI ACWI Quality.

I currently have 2 quality ETFs - 1 for Europe and 1 for USA but this seems a better solution providing both better diversification and ease of management of having everything in 1 ETF.

What do you think to be 60% VT, 40% VYMI (Vanguard International High Dividend Yield ETF).

The goal is to be less tech heavy and USA heavy, more europe/asia diversified.

US domicile seems like a terrible choice for an ETF holding high dividend ex-US stocks. This would be gifting 15% of the (high) dividends to the US while still being exposed to US regulatory and estate tax issues, and the US WHT might increase in the future.

Assuming we are talking about taxable account investments & during accumulation phase

Is there a reason to use high dividend international ETF vs normal Ex/US ETF?

In accumulation phase, high dividend yield can reduce your post tax income as a Swiss investor because it’s taxed at marginal rate . Unless you have some assumption that high yield ETF will return higher returns vs normal ETF, I suggest to rethink.

Net return = total return (capital gain + dividend) - tax

In long term expected total return for most diversified equity portfolios is similar. It shouldn’t matter if they are higher dividend yield or not.