I found this ETF by chance:

ZGQ (BMO MSCI All Country World High Quality Index ETF) is domiciled in Canada, has a TER of 0.5%, and replicates “MSCI All Country World High Quality Index”, which I can’t find online. But I can find MSCI ACWI Quality. For completeness’ sake I also added MSCI ACWI

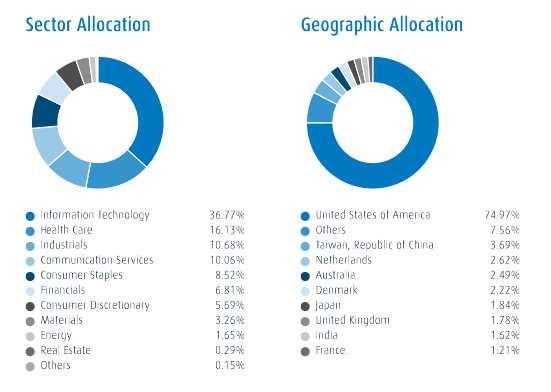

ZGQ: Allocation from 2024-01-31 factsheet

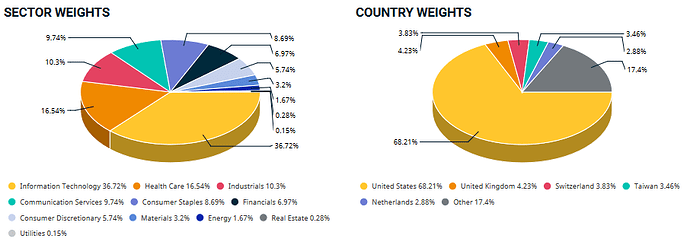

MSCI ACWI Quality: Allocation from 2024-01-31 factsheet

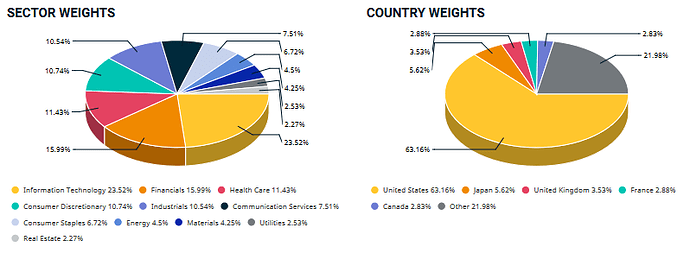

MSCI ACWI: Allocation from 2024-01-31 factsheet

Sectors for quality seem to be similar enough, but the USA is weighted even stronger. We can also see that EM is included (ACWI = World + EM). The Sectors differ much from the standard MSCI ACWI.

What about the return?

I had to convert ZGQ adjusted close data from Yahoo Finance from CAD to USD. The exchange rate was taken from xe.com. Yearly returns are calculated between the last trading days of the year.

I also add MSCI World Quality to the comparison. All index data is taken from those factsheets. It is GTR (Gross Total Return) in USD. ZGQ is inclusive its dividends before L2TW taxes on them.

| Year | ZGQ | MSCI ACWI Quality |

MSCI ACWI |

MSCI World Quality |

MSCI World |

|---|---|---|---|---|---|

| ETF | GTR | GTR | GTR | GTR | |

| 2023 | 32.33% | 33.03% | 22.81% | 32.97% | 24.42% |

| 2022 | -24.03% | -23.42% | -17.96% | -21.90% | -17.73% |

| 2021 | 22.42% | 22.50% | 19.04% | 26.10% | 22.35% |

| 2020 | 24.06% | 25.38% | 16.82% | 22.73% | 16.50% |

| 2019 | 35.75% | 35.96% | 27.30% | 36.70% | 28.40% |

| 2018 | -7.92% | -6.95% | -8.93% | -5.06% | -8.20% |

| 2017 | 27.86% | 29.02% | 24.52% | 26.64% | 23.07% |

| 2016 | 5.05% | 6.08% | 8.48% | 5.12% | 8.15% |

| 2015 | 0.29% | 1.98% | -1.84% | 4.25% | -0.32% |

| AVERAGE | 12.87% | 13.73% | 10.03% | 14.17% | 10.74% |

| GEOMEAN | 11.06% | 11.95% | 8.90% | 12.54% | 9.60% |

Looks alright. We got 3% additional performance for the indexes. The ETF still managed to get more than 2%. The index hugging MSCI World Sector Neutral Quality only got about 1%. I would have done a more direct comparison, but that data was NTR.

Additional thoughts

Canada is not ideal from a tax perspective. The USA will take their unrecoverable 15% L1TW on the majority of all dividends. Which would have been avoidable by having a US domicile.

Then the Canadian government takes another 15% on everything. If you can convince them that you are entitled to the reduced 15% withholding taxes, else you pay 25%. Possibly a broker can handle that for you.

IBKR seems to fill an NR4. Which seems to work like the US W-8BEN/1042-S.

To get a foreign tax credit on L2TW in Switzerland should be easy (regardless of IBKR’s omnibus account).

tl;dr: This product is somewhat good.