Hello - i have been saving 200 CHF a month for each of our two children in our bank account. UBS of course picked up on this and convinced us to redirect these funds to a Children’s Investment Fund. We did not know much about standard commissions and fees but after reading a bit more about this, we are convinced there may be a better way to invest their money. Does anybody have any top tips here? thanks!

Hey SwissChalet,

congrats! it is a very good sign that a) you put back money for your kids and b) you actually care about what is done with it, e.g. fees etc and try to get informed!

please have in mind that this is no professional’s writing! I believe one must put the effort into learning and understanding about investing to a certain degree. otherwise you are better off just trusting your financial advisor than putting your money where you have no idea about.

I think you can do two more things to clarify the situation: first, can you provide a name of the UBS fund, its properties and constituents? second, can you indicate what you intend to do with the money? important here is the duration until when you want to make use of it, or, how many years until the money will be needed to pay for something. Also you need to figure out for yourself your personal risk tolerance level. Is your approach a fixed financial goal or “as good as I can get it”?

based on that you can think of alternatives or mixtures of them: the lowest risk&return version is some savings account (Iguess that is where you started off initially) or swiss government bonds, best suited for short term. intermediate risk&return is investing in other bonds or real estate, some people would add here commodities as well, better for not-so-short term. even more return but also risk offers investing in stocks, for long term investments only. Your UBS fund probably is a mix betwen these things. Aim for so called passive investing rather than active management.

Finally be aware that in finance there is no “free lunch”, so asking for more return always leads to more risk to bear. There are 3 kind-of exceptions. First: Taxes. As long as it is legal, minimizing taxes is always a bonus that comes in risk-free. Second: reducing costs & fees. Usually higher fees don’t result in higher returns, so reduce the costs wherever possible! Third: Diversification. It is THE trick to actually lower your risk but not your returns, and you should consider informing yourself about it! The latter two are the reasons why mustachians mostly invest via ETFs

now this is all very unspecific, but as you go through the process of making up your mind the questions above will be important!. Once you have the impression to have a clear idea on their answers, you should go ahead and look for a suitable investment. eventually some people here can guide you there, but don’t expect a “trust me, buy this procuct, it is the best”

That is as far as I go for now, let’s see what comes up!

Hi there,

same here, I’m saving 200 francs for my daughter on a monthly base. We invest it for her through Postfinance, in their Global Fund with TER of 0.79, which could be better but is not too bad considering the low monthly amounts. No additional charges. It’s fun to see her investment grow! Currently, she’s up 4.6% - will use to provide education for her, in 20 years or so.

Thanks for your replies nugget and samuck!

The UBS Strategy Equity Fund (LUX) is what they sold us. I now look more closely at the fees which are:

UBS gets 0.77% recurring distribution fee

TER is 1.96% (assume this does not incl UBS’s fee above)

and the buy-in entry charge is up to 3% and so far we’ve been charged 1.5% one month and 1% in other months (each month we pay 200 into the accounts and they invest 197 or 198 of it).

So basically i am getting screwed and just tonight i wrote to my UBS advisor asking to sell the funds. Yes i’d like to buy some passively managed index ETFs and i am long with a high risk profile. Kids won’t need access for 15-20 years. I guess my original question was whether there was something child specific (tax sheltered) or if i am best just investing as i would my own money and distribute to them later. I have yet to set up with a Swiss trading platform but need to look into that asap. Does PostFinance offer a good platform? many thanks!

Hey SwissChalet,

it appears to me you already know about what high fees are and apply this to that expensive UBS fund.

Well, among the Swiss Banks UBS and CS are the big ones and usually the most expensive. I myself are at postfinance. They do have a trading platform that is fine for buying anything at least quoted at SIX Exchange.

for a monthly plan worth 200 the minimum fees of CHF 25 for a purchase are exorbitant, deductable from the yearly depot fee of CHF 90 (so up to 3 purchases dont create additinoal cost). I think the lowes fees for single ETF purchases in switzerland are at swissquote with CHF 10.

I dont have any knowledge about saving plan funds, children funds or tax consideration of those, sorry!

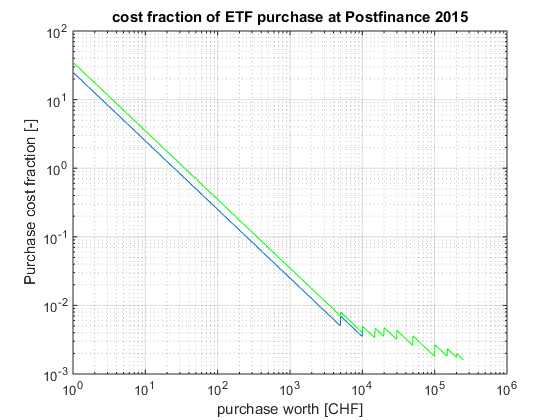

for myself I calculated the fraction of purchase costs with postfinance last year:

and therefore decided to buy chunks of just below CHF 5000Gosh @SwissChalet what a great question!

You made me realize that we stupidly transfer CHF 50 for each of our child on a crazy standard savings account!!!

TODO: close these accounts, invest all this in ETFs and track the children stash via YNAB!

Thanks again for starting this thread!

Hi SwissChalet, I’ve opened a children account for my daughter with Postfinance. Other financial institutes offer the same. I still pay taxes on it, but the money is reserved for her and will move over to her once she is 18 years old. With that account, I can save cash at a somewhat better rate, and I can also invest in Postfinance mutual funds, which should obviously provide a better return.

Alternatively, give truewealth a try. Pretty good option for newbie investors with small but regular amounts to invest (like our kids)

Hi SwissChalet,

For my kid, I’ve initially invested 12k CHF (to kick off compounding interests earlier) in the Vanguard VT ETF (0.14% TER) and will add 1200 CHF per year at his birthday.

If family wants to give him money, I will ask if they prefer to put it on his bank account at PostFinance or that I invest it for him in the above ETF.

Tax wise, the invested money is mine and I will report any dividends/interests earned on my tax report until he turns 18 or is able/willing to handle it by himself.

I find that PostFinance funds, even if convenient to invest in, have high Expense Ratio (though lower than UBS) and usually a home bias to Switzerland which impairs their diversification (ex: PostFinance Global Funds).

@_MP, is YNAB able to fetch information from Swiss Banks/Brokers, or do you plan to do manual imports? Could you share your experience in the “Budgeting software” thread?

Why have you chosen VT traded in NYSE arca instead of Vanguard FTSE All-World UCITS ETF ?

For the moment, I haven’t found any software which can find info from swiss bank or swiss broker

VT vs Vanguard FTSE All-World UCITS ETF (aka VWRL):

1- The index followed by VT covers much more stocks (7000 vs 3000)

2- The expense ratio (0.14 % vs 0.25%)

3- The possibility to recover US Taxes with DA-1 whereas they probably disappear with VWRL as it’s EU based and overall there’s 50% of value in US stocks (I would need to check deeper unless someone knows from a reliable source).

4- The size of the fund (6Billion vs 0.9 Billion) → lower spread between buy/ask + more probability that the ETF will exist in few years.

5- The base currency is anyway USD and I can convert my CHF/EUR in USD at a spot price with Interactive Brokers

6- VWRL in CHF on SIX involves the Swiss stamp tax and has higher spread (last time I’ve checked) than its EUR/USD/GBP quoted version.

I could have replaced it with VTI+VXUS ETFs (Total ER 0.09% with 50/50 allocation) but I chose simplicity over cost as this is planned to be a +20y investment.

Ireland based funds holding US equities have a 15% tax on dividends.

So you’re explaining if you fill the form w-8ben, the dividends will only be taxed at 15%

and with the form DA-1, you will receive a tax deduction of the amount on your swiss taxes or you will not be taxed on this income?

Currently, my broker has never asked me to fill this w-8ben form.

You will find some info on these threads:

https://www.bogleheads.org/wiki/Nonresident_alien_with_no_US_tax_treaty_%26_Irish_ETFs#cite_note-17

http://www.turtleinvestor.net/get-to-know-dividend-withholding-tax/

Yes for US based funds. For IE based funds they already request these 15% back (out of 30%).

If the US or IE based fund holds ex-US securities, those are taxed differently and I have no clue how much and which country is best at optimising it.

Of the renaming 15% withheld by US IRS (that’s my understanding as layman)

You’ll definitely be taxed but for US based funds containing exclusively US equities but:

a- with W-8EN you divide it by 2 (30% → 15% see page 24 Article 10: https://www.irs.gov/pub/irs-trty/swiss.pdf)

b- with DA-1 the remaining half is used as a Tax Credit (good for you) and hopefully (just guessing) the Confederation can use it to balance Tax with US residents owning assets in Switzerland (Good for CH residents).

Thanks for the bogleheads link, it seems a big puzzle to solve when multiple countries’ equities are hold under a single ETF. It would be nice to have ETF providers publish how much income tax is withheld (even an average, or better country based).

Note: The above should probably fit in the Tax section of this forum to keep this thread focused on differences/tips when investing for Children.

For my child’s portfolio (time horizon ~ 20 years), I have chosen a 50% bonds and 50% stocks allocation. I wanted to be overweight on CH market to avoid currency effects.

Broker is TradeDirect but you may have a look at Degiro now that they are available in CH. I would definitely avoid Postfinance, their fees are too high.

I directly bought bonds instead of relying upon an ETF for this part, Julius Baer bonds with 4.5% coupon. For the remaining portion, I focused on dividends growth. I picked SCHD (Schwab US dividends) and the last part was allocated to two Swiss stocks with reasonable yields, namely Novartis (NOVN) and La Baloise (BALN) In summary, 50% bonds, 10% SCHD, 25% BALN, 15% NVS. I see NOVN and BALN as good opportunities to have stable dividends but also a fairly low-risk growth prospect. The portfolio is not aggressive (no micro caps, no innovative biotechs or trendy “Über”, FANG-like stocks, etc.)

I had picked CHDVD (iShares CH dividends) at the beginning, decided to sell it when it went to 104. Now it’s back to high 90’s, so I bought it but for another portfolio which is less “buy and hold”.

@albert,

Thanks for sharing your experience.

I have few questions as I am in the same boat  trying to plan as best as possible for my child:

trying to plan as best as possible for my child:

- Did you open the broker account under your name or your child’s name? Does it make any legal difference ?

- Are you happy with TradeDirect fees/website & tools/support ?

- What methodology did you use to select the bonds? What if Julius Baer defaults on its debt?

- Why do you steer your portfolio to earn dividends vs capital gains as the former is taxed and the later is not?

Hi, sorry for the delay. Yes I opened it under my name for the moment to make things easier, in 18 or 20 years, I am pretty sure the portfolio will be at another broker, maybe I’ll change the owner at this moment. TradeDirect fees are OK for an account of at least 5000 CHF, if you play with Swiss equities and make one or two transactions per year, though I think that Degiro is definitely something to consider as well as Corner as pointed out by an article on Mustachian.

I am more a stock “specialist”, the bond world was a bit new… To select the bond, I wanted Swiss-based bonds, then screened by yield, and important, I excluded everything that tended to be “junk bonds”. For me, everything above 7% is starting to smell bad, so I picked something that was similar to what you would get with a good dividend on a stock, ie. 3-4%.

I excluded everything related to low capitalization. Julius looked good, stable bank with good growth and robust Moody’s rating “Aa2” (end 2015). There was Raiffeisen as well. If it defaults… well you have this problem with all companies but remember that bonds holders have a higher priority than stocks holders when it comes to legal issues and debts.

For the fiscal point of view, I have to admit I did not investigate very deeply this part of the equation considering the small volume of this portfolio.

Just one more thing, the portfolio (with only 1 bond) was initialy at Postfinance but I was upset by their new fees strategy, I switched in June this year. TradeDirect happened to provide a free portfolio transfer from the previous broker and 3 months without transaction fees (<1000 CHF), it was a cheap way to buy some core stocks along the initial bond. TradeDirect also had bonds (while Corner does not), otherwise I would have probably moved the portfolio to Corner (dont know if they would have offered the transfer from Postfinance).

By picking stocks providing good dividends and a steady stream of income, I also had in mind that this would cover the yearly holding fees of the brokers (currently 40 CHF per year on TD). The bond coupon itself provides 225 CHF per year

Hey Albert,

thanks for your contributions!

I want to catch your attention for 3 more points:

- since you want some bond in your portfolio, why would you not go for some bond ETF, effectively maxing out on diversification? like iShares CHF Corporate, or mid-term Goverment bonds? it is certainly much more predictable than individual bonds, not to say, safer

- bond produce their return primarily in coupons, which are taxed (at least at your income tax level). Take this into acount!

- from the passive investment point of view, 20 years easily allows an 80/20 stocks/bonds allocation. however if you made up you mind thoroughly about this, then ignore this comment!

Thanks Nugget for this feedback, your points are very interesting.

- Yield on distribution for iShares is 1.47% according to their factsheet. While I agree on the diversification and safety, I find this yield a bit “meh”. However this would allow a better rebalancing of the portfolio as you pointed out in (3). I’m stuck with a 5000 CHF single bond that provides a good yield, represents 50% of the portfo but that I can’t cut to have a 60/40 or 80/20 balancing.

- You are right, I tended to focus on the portfolio itself without considering the fiscal issues.

- I have read a lot of stuff on Seeking Alpha about portfolio allocation, there are so many views that it’s hard to find out the best one. Most models are related to big portfolios, US “401” retirements strategies, etc.

I really need to rethink about this, having a few bonds would maybe be ok for a 200k portfolio where you can diversify with blocks of 5000 CHF representing a few % but maybe it’s not suitable as such in this small account.

I’d like to open a broker account in the name of my son, a minor. Got refused by Cornertrader, Postfinance and Tradedirect. Cash offers a savings plan for minors but with very limited ETF’s on offer. Was anyone able to open an account for a minor where ETF’s are available? I’ve seen offers from brokers in Germany, but not sure how that would work taxwise. Thanks

I have a CornerTrader account for my two children but keep it in my name. We previously did the UBS accounts and funds but the returns are not great… I have looked into this quite extensively in the UK and here and have not found that you are allowed to do this.