I could not find a thread on mechanical investments, so I start this one.

Here is a simple definition: Mechanical investing - Investment strategies - Moneyterms: investment, finance and business explained.

The book https://www.google.ch/books/edition/What_Works_on_Wall_Street gives some ideas and testing results. However, they vary from edition to edition and may be kind of biased.

Most people here invest in ETF and that is OK. There are ETF that use mechanical investment strategies, some indices do too (I think the NASDAQ100?). But I always felt that I can do better by adjusting some of the rules. Most indices contain companies that I would not touch with gloves and just leaving those out should (and did for me) give better performance results.

I tried out a lot over the past decades and Internet tools help a big deal today.

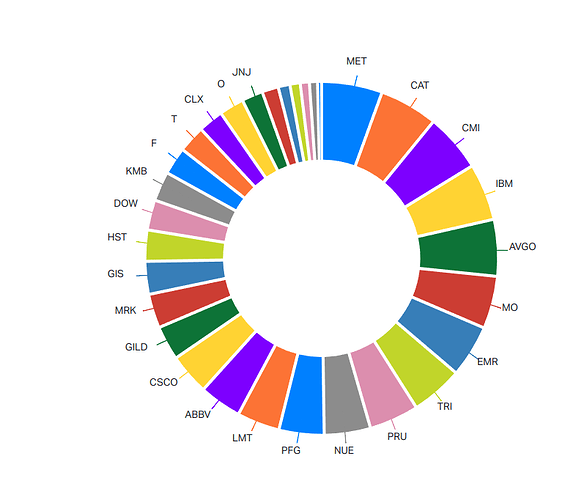

Since 11 years I do a mechanical dividend strategy with a target of low volatility and high cashflow. The XIRR performance (included 15% dividend tax) over this period was exactly 10%.

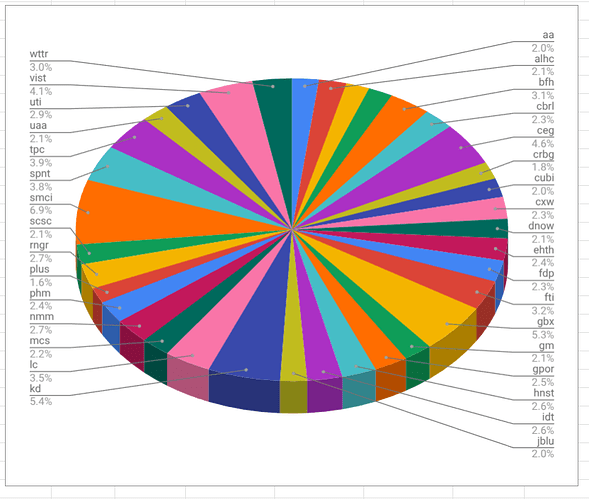

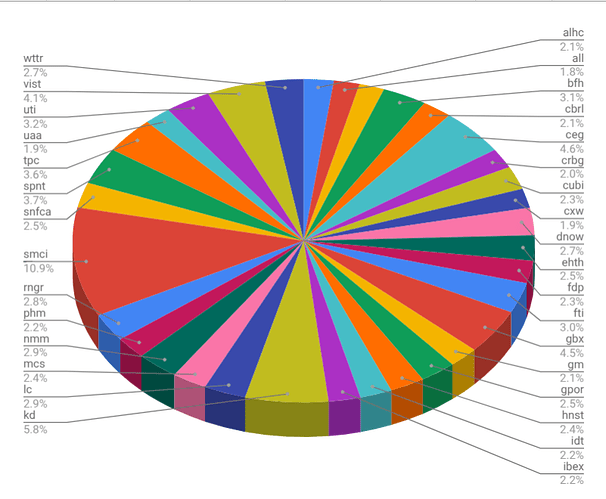

Since 5 years I do a growth-and-momentum strategy with a target of high performance with high risk. The first year was a loss of 2% but even with that loss the XIRR performance is 27.54%, meaning it made me tons of money.

The most important thing on mechanical strategies as to any strategy is to stick with 'em. You should define almost every possible detail, every outcome and it should always lead to exact instructions of the action you have to take. As detailed as possible.

I’m happy to answer all questions related to mechanical investment strategies. I probably won’t give away every detail of my growth-and-momentum strategy, did cost me a lot.

BTW: if you find an ETF that has all the mechanics you need… go for it. Doing it yourself may be more profitable, but everybody, really everybody including me myself, makes mistakes. And those are expensive…