It also raises question whether people really understand what they’re investing into (I assume the 5% comes from the folk wisdom that it’s the long term expected return from the stock market that’s often quoted in this forum and elsewhere). I hope they really understand it doesn’t have the same risk profile than their bank deposits.

So they add some (more or less hidden) fees and make it profitable, and they don’t need to leave the market. That’s how the free market is supposed to work. People can leave if they’re unhappy (but it’s likely other banks will follow with increasing fees given the costs).

Don’t pay for it (I’m also happy about my free banking package), but also don’t expect it to stay that way forever (at least while the interest rate are in the deep negative). I’d guess there’s always going to be some free banking option, but the lower limit on negative interests is likely to continue to drop.

I don’t know where you work, but besides for their charity arm (which usually has some PR benefit), most company don’t keep losing money on a product just for fun (can be a loss leader to funnel into high margin product, or gain market share, but long term I don’t know any company that would keep losing money voluntarily).

I don’t get this attitude to banks. Without them nothing in the world would work. It’s as important as the internet.

I don’t hate banks… I have for them the healthy (at least I think) amount of mistrust that anyone should have with something they don’t really understand.

Anyways, the point was : why should I pay for something when I can have it for free? That was my whole point.

The whole discussion went out of hands, but my idea was for it to be really, really low-time consuming : “Hey, do you know a bank that can give me for free the same things my bank makes me pay?”

“Yes, it’s XYZ” or “No, unluckily all the banks suffer from low interest rates and they can’t afford to provide such services for free”

And that’s totally fair, I do the same ![]() . But earlier people were arguing that banks somehow have lots of margin and are just being greedy on consumer deposits

. But earlier people were arguing that banks somehow have lots of margin and are just being greedy on consumer deposits ![]()

Exactly.

BCV, on the other hand, seem to be thinking they can or do provide some added value over their “free” competitors. And accordingly, they’ll be charging something for a certain service they provide (that we all costs money to provide).

Yet the customer has a choice. So no reason to call that “rude” or "rip-off, is there?

Don’t get me wrong, I do like and use “free” products ![]()

Many restaurants or clubs around the world do charge a cover charge.

Sorry to somehow spark the debate again, I just can’t help it.

Which tells me that in the current circumstances, they aren’t really able to make money with money, hence why they don’t want too much cash to be parked on the accounts of their clients. It’s ok, the business model is changing, I get that. Simply, I do take notice and since some competition seems to be able to perform better than others on that front, the original question of “hey, I used to get things “for free” and now I’m asked to pay a fee, are there alternatives I can use” seems to fall fully within the kind of optimization we usually do around here, hence why I don’t understand why we have turned this discussion into “hey, banking fees are normal, do you want to work for free?” when it’s not about that, it’s about using competition to get better or the same service for cheaper. Or do you think the low TER on our passive funds doesn’t make things hard for fund managers and that, hence, paying higher TERs would be legitimate because “do you want to work for a low wage?”

On the payroll argument and because I can’t help being cheeky, I’m sure there are a lot of people paid by the insurance industry. I don’t see anybody here saying it’s fine to use expensive, suboptimal and opaque 3a mixed investing/insurance products. If chasing for lower fees and better performance on one side is ok, doing the same in regards to banks should too. Bonuses come with performance, they have to be earned.

We are talking about 2 CHF per month, not about a product that will cost you 100-200k in the end (3a insurance scam).

They definitely can, on the retail side they’re very happy to get you to invest in their 1% TER funds or some mortgage (that’s always where they made money, deposits is just one way to get a relationship started). The main difference is that deposits used to be at least not a loss business (the deposit interest used to be slightly lower than the risk free rate).

3a insurance scams are the only way besides real estate for stocks-shy average people to get more than bank interest rates returns on their savings. They need the insurance to provide them confidence and knowing the least amount that is promised to them in the end helps them to give in and get started. It’s absolutely not optimal but it’s way better than sitting on the sidelines spending everything or with cash sitting on a bank account. It does serve a purpose too and can pretend to some form of legitimacy.

I know I’m a contrarian in this view but I’ve just spent a crash course on self-employed finances with people who don’t look at their second pillar benefits and think having a salary means all of it should be spent, which is the mainstream view in Switzerland. For as much as I dislike most insurance 3a products, they do serve a purpose for those people.

Edit: in case it’s not clear, the part of 3a insurance schemes that you “loose” in the first years actually buys insurance coverage, which is not free either. That we don’t get to use it because the risk doesn’t materialize doesn’t mean we shouldn’t have to pay for the service. There again, the risk profile of these plans isn’t the same as a 100% stocks investment strategy.

That’s why they actually ARE scammers when they propose foggy products (like I’ve seen with directly managed funds with 1-2% annual fee and 1-2% TER) to people that do not understand them, without explaining the alternatives.

In medicine we would go straight to the judge if we proposed à hip replacement instead of some NSAID only because it is way more financially interesting for us.

But other fields, other rules, I suppose…

Anyways, if 2CHF/month is not relevant, then why charge it? BCV has around 30000 clients, let’s say 50% of them has the formula with +2CHF monthly fees = + 30 k CHF /month in their pockets.

But well, they also have around 2000 employees…so what about reducing their - considerably higher than other sectors’ employees with similar level of instruction - salaries of about 30000/2000 = 15 CHF/month?

BCV has around 30000 clients

Come on, let’s be real here with the numbers! ![]()

This discussion did cost us all more than CHF 24, I’m pretty sure of it lol.

Thank you for this sharing, although I don’t think that it will be useful for me and my girlfriend as we don’t spent a lot every month and it seems that you need to spend CHF 1’000.- to get 2 KeyClub points…

Maybe one day if I became rich

Hey guys, the discussion became a tad too flame-y  and OT, and I regret now that I’ve contributed to deviate it, so apologies to @MFV91.

and OT, and I regret now that I’ve contributed to deviate it, so apologies to @MFV91.

To amend, let me recap the various inputs relevant to the original post, in the hope that others find them useful:

- Neon or CSX

- Raiffeisen, free Maestro first year, limited on non-own ATMs, good benefits for museums, etc. - needs you to “become a shareholder” which may not be everyone’s cup of tea

- Ask your bank for retention policy, may get one more year for free

- SZKB free account and free Maestro >25k

- ZKB CHF 1.-/m

Also alternative ways of looking at it:

- Increase your CC with cashback use and use that to cover your banking fees

- within the same bank also, e.g. UBS Family CHF 15.-/m paid by using their CC cashback points

Lastly, compare features relevant for you between different banks / products:

e.g. I’m hardly going out at all, so I may not be a benchmark, but I find that within Switzerland I’m using almost no cash, thus ubiquitous ATMs for me are not really an important feature vs. for example a solid e-banking experience.

HTH

Perhaps an admin may want to move the more macroeconomics / philosophical discussion to continue in its own separate thread, where we can roast each other

https://www.bcv.ch/Private-Banking

It is taken from their website

Private Banking isn‘t Personal Banking.

(or if you do count it, it’s just a small share of it).

It is taken from their website

This is too: ![]()

Edit: Patron narrowly beat me to it.

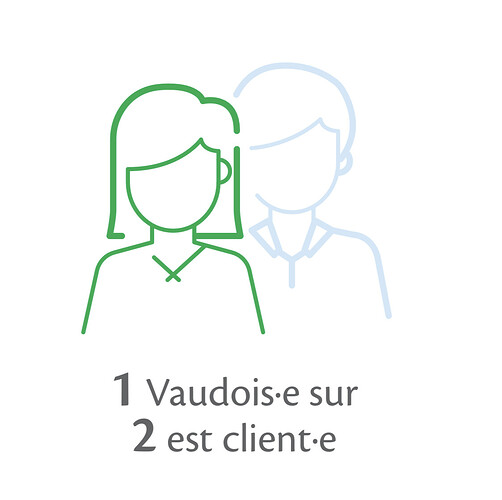

Assuming 50% of 400’000 customers have such an account and are going to pay 12 x 2 CHF more per year in fees, that’d be almost 5 million CHF. That’ll pay wages for a couple of employees.

Or the bonus of the CEO

No. From the 2020 annual report, page 185, total comp for the CEO is 2M including fixed salary, bonus, pension plan and all of the extras and about 11M for the whole executive board which is comprised of 8 members, so 1.28M each except for the CEO.

We are talking about BCV, not UBS, BlackRock etc.