Are you sure? It holds US-domiciled companies (60%).

OK, so for any non-US domiciled ETF (regardless of what it holds), there is no need for DA-1/R-US 164?

OK, thanks for this. So I will not fill out either ![]() I have some other small non-IE positions (DE & CA) but the dividend withholding tax won’t exceed the 100Fr minimum…

I have some other small non-IE positions (DE & CA) but the dividend withholding tax won’t exceed the 100Fr minimum…

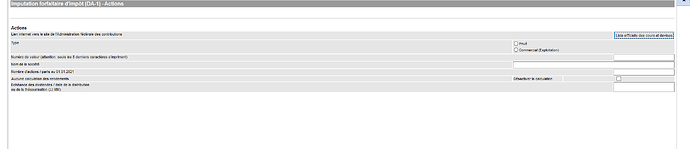

Fragen an die Besitzer von USA Wertschriften: Sind im Antrag US-Erträge enthalten, die in den USA den Einkommenssteuern unterliegen?

What are supposed to click here? Yes/No?

I did receives dividends from US listed ETFs and the broker did withhold some tax, should I select yes?

You should select “No” as long as you’re not subject to income taxes in the US. Only US citizens and probably other “US persons” need to select “Yes” here.

Despite reading a lot of posts on the forum and the blog, it remains unclear what the process is for the DA-1 with IB. Reading on the blog, it seems every dividend and buy/sell must be input manually in VaudTax. I called the tax department (Vaud) in order to have some answers. They told me it is better to upload directly a statement from the broker instead of filling everytjing manually (as I saw on the blog post), they even stated that it would be too time consumming. The guy told me this report exsit in IB as he saw many already, but couldn’t tell me the exact name.

In tax report I found :

-

The form 1042-S : You hav here the gross income + the tax rate + tax witheld

-

For the rest I found this post

This method seems great, didi it work ? I like that there is no securities listed and everything is grouped in one line. But what to do next ? Where/How do you input htis in Vaud Tax ?

Do you also put here only “Interactive Brokers US stock” ?

Thanks you.

If it can help you:

How did you fill out the DA-1 in Ticino? A separate form or from the program itself?

@wavemotion until last year (2020) I was downloading and filling a separate annex. This year (2021) I did notice that eTax includes the form (maybe it was already there previously, I don’t know) and did fill it within the software.

In any case I did print it and sign it separately so at the end it does not change that much, I guess.

Did anyone fill this out for Lucerne? I don’t see the DA-1 in there anywhere.

There are two questions under the section “Fragen zum Formular DA-1” though:

“Unterliegen Sie für das Jahr 2022 an Ihrem Wohnsitz der direkten Bundessteuer und den Einkommenssteuern des Kantons und der Gemeinden?”

and

“Stehen Sie im Genuss einer Pauschalsteuer bzw. einer Besteuerung nach Aufwand?”

If I work here and have a C-Permit (not taxed at source) I would think I’d have to anwser Yes to the first, and no to the second question, right?

But I don’t see the form anywhere. I did mail the tax office and will report back. I just thought someone might answer me before.

I had the same “issue” last year and also this year as I forgot about that in the mean time ![]() .

.

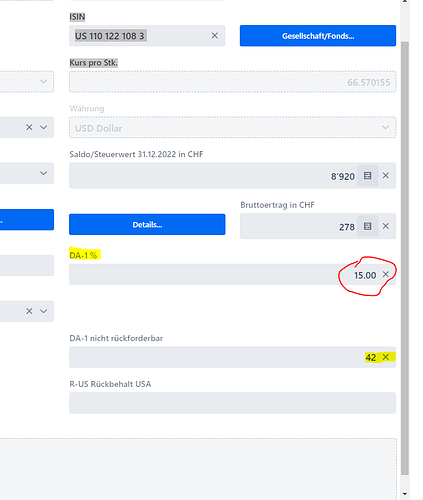

The solution is once you have the share entered to edit the fields:

Unfortunately, the ETF’s such as VT do not go directly in the right category and hence I needed to explain that in the comment section an got questions afterwards. But at the end it was all ok thanks to the tax report from IB.

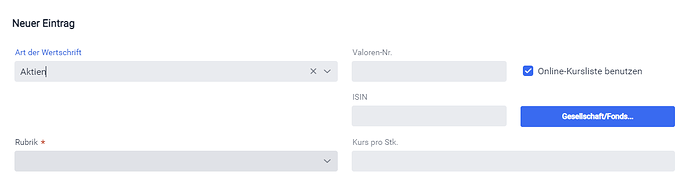

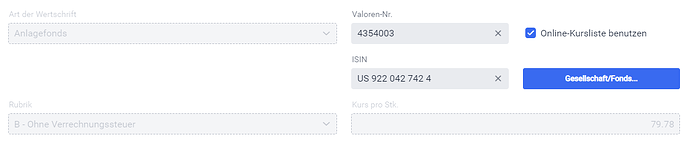

When I add the Valoren-Nr for VT it instantly selects the wrong “Rubrik”.

It selects B-Ohne Verrechnungssteuer instead of C-DA-1.

So you added a new position and then manually added all the info for VT when you selected C under Rubrik?

EDIT: I got an answer today. It’s indeed not possible. If you add VT to the software it automatically selects “Anlagefonds” as “Art der Wertschrift” and then does not let you select C under Rubrik. You need to manually set everything. Very annoying…

Ciao @weirded ,

Do you fill it with the total amount of the dividends or just the withholding Tax? in which section do you fill it up?

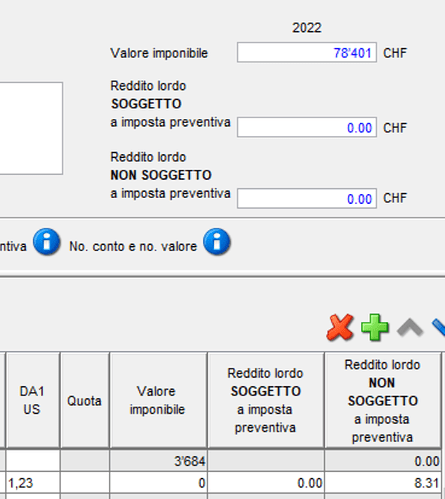

Do you also fill this section with all the Value of the assets and the Dividends?

Many thanks

@JdG I’ve just closed my declaration last weekend and already forgot about it ! ![]()

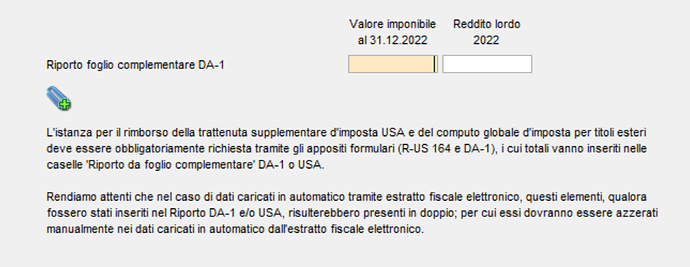

I’ve declared all the assets except those which I’ve listed in the DA-1 form under the main assets list (your first screenshot) and put the summaries from the DA-1 form in the specific section (your second screenshot).

I’ve done like that for the last 2-3 years without complaints from the tax office.

I suggest that you run the draft declaration and have a look at the totals in the securities section to be sure that everything adds up correctly (nothing missing and nothing counted twice)

@weirded thanks for the quick reply.

All clear, even more simple this way.

May I fill and enclosed also il foglio complementario DA-1, or the IB statements is enough?

If you want to claim back the withholding tax you have to fill the DA-1 as well

Grazie mille!!!

I also just completed the declaration in Ticino. As assets/dividends are in the DA-1, I haven’t declared any asset/dividend by security (just the total) and thus not even the transactions (buy/sell) in the standard form. Did you do the same?

Yes, I’m doing the same since few years, never had complaints so far

Hi everyone,

I already submitted my 2022 tax return without providing my stocks trades details,(only provided the dividend amounts and my portfolio at year end) nor any DA-1 form.

Last year I received some dividends from my US, Swiss and EU stocks

I really struggle for this procedure and don’t know anyone around me who is informed. Could anyone who has experience for this help me fill the form and submit it properly? I am open to pay a fee so please advise me how much you charge.

You can reply here or PM me.

Thanks