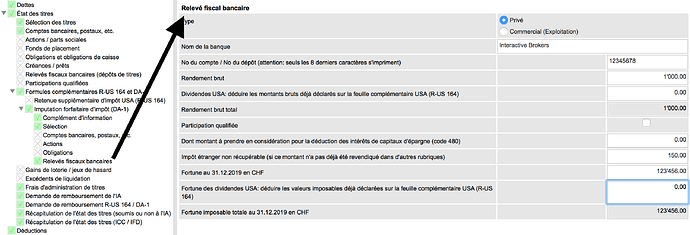

After a small simulation of a few VT positions the “lengthy” way and the easy, single entry way, the total amount of taxes did not change. This gave us some confidence that it is more or less ok to declare our stock positions under “releves fiscaux bancaires” under “imputatation forfataire d’impot (DA-1)”. Of course I have no idea if the tax authorities will accept this.

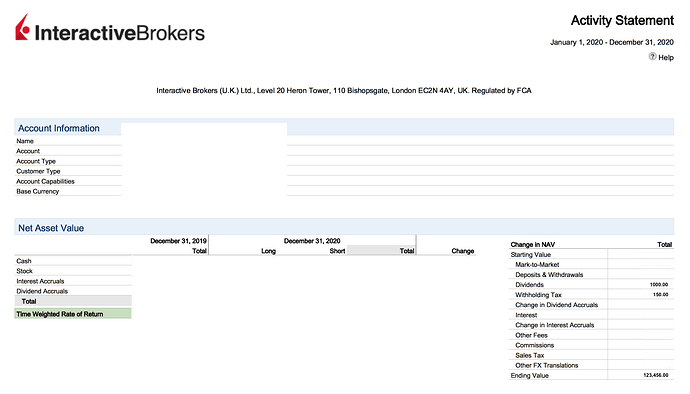

From the activity statement we take the dividends, withholding tax and ending value:

Then you add it here in VaudTax:

I hope the tax office will accept this.