Strangely they already processed my tax declaration for 2020 but not the DA-1 form. My world is upside down.

Hey everyone,

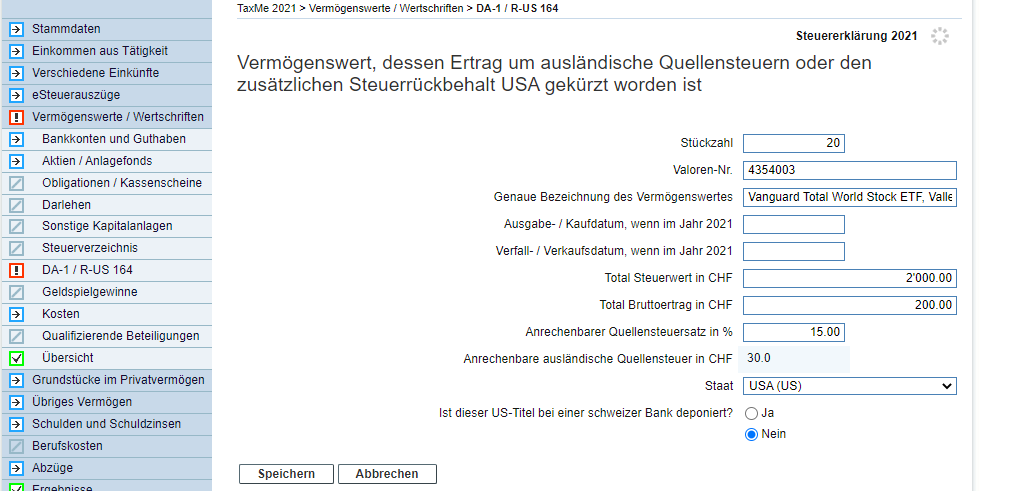

I am trying to figure out how to fill the DA-1 Form (with the Schaffhausen Tax Software).

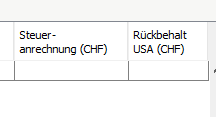

What do I need to fill under these two?

On the second one I imagine it’s the tax withholding, what about on the first one?

First time feeling the DA-1 so thank you for the help ![]()

No, the left one is for the 15% US WHT. The right one is for the additional 15% which are withheld by Swiss brokers on behalf of Swiss tax authorities (zusätzlicher Steuerrückbehalt USA). If you use IB or another foreign broker, only fill in the left one and leave the right one empty. For Swissquote and Yuh you most likely need to fill in both (no personal experience).

For brokers that aren’t qualified intermediaries and thus, deduct 30% US WHT, you can still only fill in 15% US WHT in the left one and have to leave the right one empty. The additional 15% are lost (unless you request a refund directly from US IRS).

Thank you for the help jay, that clears it!

Trying to fill out the tax declaration with only A2 German isn’t always the best idea ![]()

Hey Folks

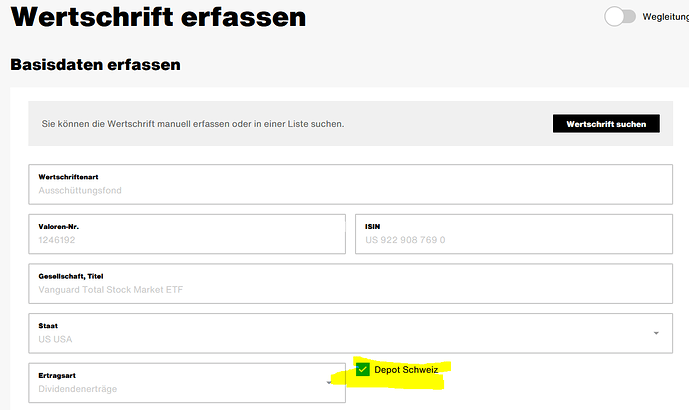

i try to make sense of this checkbox from ZH online Tax:

It translates into “Broker/Depot in Switzerland”. I believe i should uncheck it, since my broker is IB and well out of Switzerland.

To find out more, i checked it for one of my positions, and the only effect i see is the “Steuerrückbehalt USA” (US Witholding) popping up:

Does anyone know?

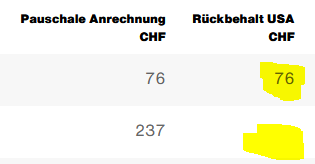

15% additional tax on US dividends withheld by swiss brokers. see jay response above

Not applicable in your case if you are at IB

Does anybody understand what to put in the last two headings?

“DA-1 nicht rückforderbar” is the amount withheld by the US on my dividends, right?

What about “R-US Rückbehalt USA”? If they deducted 15% from my dividends (VT held at IBKR), should 0 go there or the full amount that has been withheld from me?

See Guillaume_GVA‘s answer immediately above.

Does anyone know how is DA-1 filled in St. Gallen? I see nothing like this neither in the tax software, nor on their website.

Hi Cortana,

Can you tell if you had your DA-1 approved? I’m from Bern, but my friend is filling the tax return in BL and can’t have the ETFs in the DA-1 because they only appear as funds and then are classified as “B - Ohne VSt.”.

Thanks

Do you know how to do it in Bern? I‘m somewhat confused how it works.

When it comes to stocks and shares it‘s horrible to use. They don‘t even get it right with or without „Verrechnungssteuer“. At least they fixed it after appealing.

Had less than 100 CHF, so no DA-1 for 2021.

Do you need to fill any DA-1 form if the tax software (GeTax) calculate the amount correctly ?

I will assume it is part of the .tax file.

A good thing is that in Bern you can fill it from the web browser, so you can use google translator if needed.

Just with random values, but I think it’s easier than with other softwares I’ve seen. Isn’t it?

What I don‘t get is how you declare how many shares you had at the dividend dates and at years end. For me that‘s 5 different amount of shares. And they tell you not to add any additonal documents. I‘ll try it out and probably know next year if it gets approved straight away.

Yes, it’s like CHrad says. You don’t need to specify transactions in detail. You put the number of shares and the amount in CHF at the end of the year. And you also insert the total dividends you received. That’s it.

I think for the DA-1 you need to attach a statement. Otherwise Bern doesn’t ask for any document when you send the tax return. They’ll ask you later if they need.

I used an annual statement from my broker. Not the statements they have for tax purposes. Those are very detailed and complex.

I did my tax return last year (for 2020) and received the Quellensteuer from the dividends. In Bern it’s paid separately from other tax bills.

So I finally found how to do it in St. Gallen: the DA-1 is hidden in Wertschriften under Rubrik:

A: mit Verrechnungssteuer,

B - ohne Verrechnungssteuer,

C - DA1 / R-US.

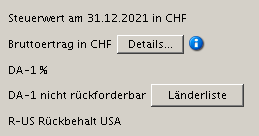

The question is what to do with the rest. Now there appear several new fields:

Staat: (I assume USA)

DA-1 % (what should I put in here?)

DA-1 nicht rückforderbar (Länderliste) (what should I put in here?).

Does anyone know how to fill these out? The IB activity statement only has a Withholding tax section, where the numbers don’t even add up to the total that’s written there. Thanks in advance for help.

| Staat | USA |

| DA-1 % | 15 |

| DA-1 nicht rückforderbar | The amount of US WHT in CHF, i.e. 15% of the gross dividend. Might be calculated automatically. |

| R-US | 0 |

I got my answer today by submitting my taxes in Geneva with GeTax software.

If you declare all your VT purchases and dividends, the DA-1 document is filled automatically and attach to your tax declaration.

I am doing my full Swiss tax return for the first time and am confused about the DA-1 and R-US 164. It is annoying that these are not filled automatically based on inputs to the État des titres annex (at least with my canton’s software)…

Do I need to fill in both of these forms?

For me, this mostly concerns one ETF (VWRL) held at Degiro (where I have submitted the W-8).

I thought that the W-8 prevented some of the anticipatory US taxes from being levied on dividends.