Look at the other threads on this forum (try looking for DA-1 in the search bar). It is better to learn otherwise you will face the same challenges next year(s).

It is well known (at least in the canton of Zurich) that 0.3% of private assets can be deducted from income as costs, known as “costs for the management of securities held as private assets”.

I have read in this forum that these costs must then also be deducted from DA-1. I have not read in any instructions that this is correct. Can anyone confirm this?

Example invoice:

50’000 invested in VT. Dividend yield = 3% = 1500.

Of which 15% tax withheld = 225.

These 225.- can in principle be reclaimed with DA-1. However, if I now deduct 0.3% from my 50,000 assets as costs (= 150.- ), these can no longer be reclaimed with the DA-1. Accordingly 225 - 150 = 75.

Since the minimum amount is CHF 100, it would only be worth filling out a DA-1 form if I had assets of around 80,000 or more (and even then only marginally…).

It’s (proportionally) deducted from the gross dividend yield of your DA-1 securities to calculate your tax rate, not from the withholding tax amount. And this is done by the internal calculation of the tax authorities, you don’t have to deduct this yourself on the DA-1 form.

In your example you certainly won’t fall below the CHF 100 threshold because of that (assuming you don’t have an extremely low tax rate).

With a sufficiently high tax rate you get both, an income tax deduction amounting to 0.3% of your investments and a tax credit for the full 15% US WHT.

Side-note: VT dividend is around 2.1%, not 3%.

thank you! i didn’t check vt’s dividend yield, it was just an example ![]()

Moved from ZRH to BRN a few months ago, and wow, the DA-1 part in Taxme (the web-based tax filling system) seems really prehistoric. In Zurich everything was filled automatically, in Bern it seems everything has to be done manually, so for each ETF/US stock → entry under Stocks, + entry under DA-1. And they require all figures in CHF, while everything is in USD on the PDFs from Swissquote. Yay… Not sure yet how to do that correctly.

If there is any suggestion/recommandation from fellow berners, please let me know ![]() I just have a few positions (<10), but some with dividends 4x/year, so it still looks like a few hours with the spreadsheet + webpage.

I just have a few positions (<10), but some with dividends 4x/year, so it still looks like a few hours with the spreadsheet + webpage.

You can get numbers from ICTAX

https://www.ictax.admin.ch/extern/en.html#/search

Type your ISIN enter the dates when you bought or sold and you will get final numbers in CHF

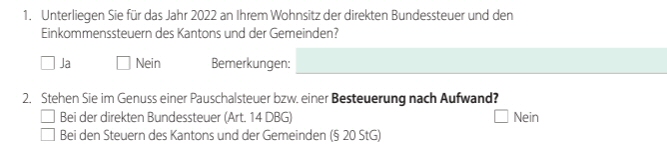

Did you figure out what this means? I also see it on my DA-1 form

The 2nd questions google translates to ‘‘Do you benefit from a flat-rate tax or a tax based on expenditure?’’ What does that even mean?

What have others ticked on these questions?

-

If you are Swiss resident, you are.

-

No

Thanks a lot for this link @Abs_max, it is exactly what I needed ! This should really be directly integrated to the TaxMe system…

Cool. In Zurich it is integrated. Hopefully soon it would be integrated in your canton too

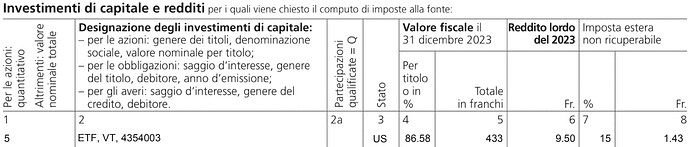

Can you explain to me how to fill the DA-1 for Ticino and what did you put in the Assets module ?

I don’t know which value I need to fill. If I need to use this

https://www.ictax.admin.ch/extern/it.html#/security/1780596/20231231

I have bought 42 VUG and 12 VT.

Thanks a lot !

This is how I filled it for one entry:

The information can be found on ictax and you can use a spreadsheet to do the simple calculations (moltiplication, % etc.)

Hi all,

I just reviewed my 2022 tax declaration which was finalised by my canton (Zug) and I noticed that I am not getting any WHT tax credit for my non-Swiss shares & ETFs. As reason, the tax officer wrote: “Formular DA-1: Zusätzlicher Steuerrückbehalt Fr. 0, die Titel werden nicht in der Schweiz verwahrt.” which seems to mean that, since these securities are held outside of CH, I am not entitled to a tax refund? These securities are held with DeGiro and IBKR and I cannot find anything online about that being ‘unacceptable’! Am I missing something?

Thanks!

The “Zusätzlicher Steuerrückbehalt” is not the same as the US withholding tax. It is an additional 15% that only Swiss brokers must take. So for Swiss brokers, 30% are taken, and you can get 15% back via DA-1 and the other 15% back via RUS (Zusätzlicher Steuerrückbehalt).

For foreign brokers there is no “Zusätzlicher Steuerrückbehalt”. Only the 15% US withholding tax is taken (if W8-BEN was signed) and this is credited via DA-1. It is logical that RUS is not reimbursed since it was also not subtracted by the broker.

So there is no significant disadvantage in holding US ETFs at a Swiss broker?

Correct, as long as the Swiss broker is an IRS Qualified Intermediary (only those brokers can reduce US WHT from 30% to 15% via W-8BEN).

The CHF 100 minimum only applies to the foreign withholding tax part. For R-US there is no minimum, you always get it back (and the refund also doesn’t depend on your tax rate).

The only disadvantage is that you have to wait a bit until you actually get the refund, and you don’t earn any interest on it.

Hi

I am finding this topic somewhat confusing.

I hold USA dividend paying stocks with SQ. I moved them from an overseas broker in the last month.

Some dividends have arrived in and SQ has deducted 2 * 15% = 30%. I queried this and they replied as follows.

'…For clients with tax domicile in Switzerland, two different tax deductions are made due to the double taxation agreement between Switzerland and the USA:

- 15% obligatory tax deduction - US portion (reclaim usually not possible)

- 15% additional tax deduction - Swiss share (reclaim possible)

*The reclaim of the additional tax deduction (Swiss share 15%) is made via the ordinary tax declaration with the competent tax authorities, similar to the withholding tax deductions for financial products with tax domicile Switzerland.’ [End Quote]

I had already supplied them with a completed W-8BEN form.

When these shares were held overseas, the Broker only deducted 15% [I had also a completed W-8Ben form.

I am wondering what SQ would have deducted if I had NOT sent them a W-8Ben form ?? Would it hav been 30% + 15% ?

Here is how it goes

Assuming investors filed in W8BEB timely

-

when US stocks are held at International brokerage firms like IBKR, 15% is deducted as WHT in US this can be claimed as refund via DA-1 . Conditions apply.

-

when US stocks are held at Swiss brokers like SQ, 15% is deducted in US and 15% additional is deducted in Switzerland. First part is claimed via DA-1 and second part is claimed via RUS form. In ZH tax return , all this happens in one form using online software. In German the two terms are called „ Beantragte ausl. Quellensteuer“ & „Ruckbehalt USA“ respectively.

I think then it would be 30% + 0% but then you would not be able to recover the full tax easily. Swiss tax treaty only supports refund of 15% held in US.