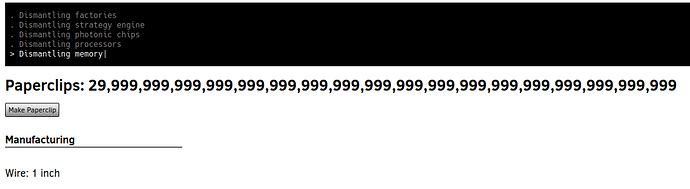

I restarted ![]()

The reason is that there were 3.5billins of drifters and jujst 20mil of my probes.

We will all have a common global experience. On some level, this might bring us all a bit more closer together. But only a small percentage of people are severely affected. I mean, if the quarantine ended now, and I saw it’s safe to travel, I would instantly book a flight to finally get some holidays. As soon as this is over, people will want to go back to their normal lives, if only they have money. Things have worked out before the pandemic, I don’t see why they wouldn’t after. There could be a liquidity problem, but we didn’t lose anything that couldn’t be quickly rebuilt.

Too late. I restarted. Now I’ll try to let it run as fast as possible while I work.

It doesn’t run while in the background.

wtf this can’t be real. Please tell me you cheated and didn’t really play that long.

BTW, for those of you still stuck in the game, I highly recommend cheating. I was stuck playing for way too long, I started cheating by changing the javascript, the game got really boring and I managed to break it’s hold on me just in time for dinner.

I’m jumping back and forth from having FOMO that I haven’t invested more on Monday to panicking that my portfolio will tank another -50% in Q2.

Me2! When I saw SP500 drop below 2200 I was thinking about going allin with the rest I have in cash, but was afraid that it will drop to 1000 or something lol. Now I’m praying that we see thsoe prices again.

I succumbed to FOMO yesterday and both some VWO, would have been better today but whatever. Today I am buying some US small cap, it was the next in line needed rebalancing. Next week more VIAC money will go into che Swiss market. In a couple of weeks I get a nice batch of RSUs vesting so I’ll have more ammo for the months to come (hopefully THAT stock won’t tank as much as everything else ![]() ).

).

Funny thing, the virus is confirmed being in Italy since at least beginning of January. (I actually suspect it was everywhere since November).

Why then was the world going on without problems? I am really still convinced this panic is overblown, and I am really annoyed of journalism (or I should say from the www, since there is a fight to get more clicks to get more money from advertising)

Consider also that today is Friday, and for the last 4 out of 5 weeks the markets couldn’t hold up over the weekend and started lower the following Monday… Plus there’s still a lot of uncertainty regarding the future and the wave of infections just arrived in the US this week…

But then, there is this article: https://www.ft.com/content/8f05b83c-7024-11ea-89df-41bea055720b

In case anybody needs motivation, I added to VGT, EWW, EWZ, ERUS and GREK today.

Funny thing: I was with my gf in Sardinia in October 2019 and she had a fever and a very bad dry cough. It only occurred to us today. I’m not suggesting anything, but if she got the same symptoms today, we would be panicking.

One time you should post your full portfolio with weights for each position. I mean, how many pos do you have? You added 5 new pos to you portfolio. And you still claim that the bulk of it is basically VT?

I never held VT, ever.

I descirbed my portfolio roughly in this forum post:

Core is VTI+VGT+VEA+VWO but I also have approx ~1% portfolio value in every EM country separately. Also separate tilts to EMU and APACexJapan to lower the relative weight of Japan and the UK in VEA. The whole idea of this portfolio was to gain outperformance by rebalancing which used to happen every couple of months. With the volatility we have now, it happens every second day.

Overall 25 positions plus some speculative single stocks, but I’m fighting with myself to abandon single stocks completely (still losing).

Hehe, this is the hardest… on what criteria do you pick those individual stocks?!

yeah which is VT, why do you have to be so exact?

And you still didn’t say how much %. It would be nice if you also told us the relative size of these exotic investments to your portfolio. If these under amounts under 10’000 CHF then I guess I can just ignore it ![]()

Because weighting is not the same.

Mostly high growth potential Chinese stocks. No criteria really. I sold most of it already and put in EMQQ

I said ~1% of portfolio value per EM country. Your criteria would imply 1M+ portfolio value. Make an educated guess ![]()

before you wrote it in a way that I could not understand if you mean in total or per country. Anyway, you still didn’t tell how much % in total for exotic investments.

In other news, did everyone get the memo that Boris Johnson and Britain’s minister of health got the covid-19?