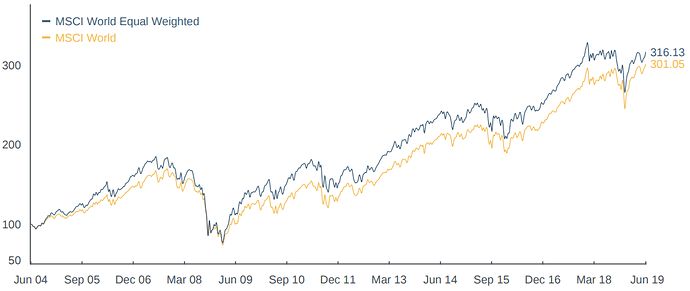

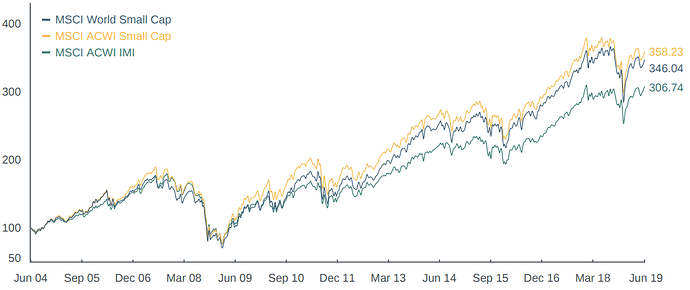

According to this research, an Equal Weight All Country portfolio generates superior long term returns to typical Market-Cap weighted portfolio:

A possible explanation to this outperformance lies in rebalancing of emerging market countries, which show more volatility and less correlation then developed countries, which is plausible.

I have found other online references to this notion, however authors usually came to the conclusion that costs associated of running such a portfolio are likely to eat up any gains, which is why it remains mostly academic.

What if we use a low cost broker, such as IB, and low cost ETFs to approach equal weights while keeping costs reasonable?

My start case is a portfolio based on:

- Vanguard Total US (VTI),

- Vanguard Developed Markets ex-US (VEA),

- Vanguard Emerging Markets (VWO)

in Market-Cap proportions of 55%+35%+10%.

Top three constituents of VEA (Japan, UK and Canada) amount to 45% of its total.

Top three constituents of VWO (China, Taiwan and India) amount to 60% of its total.

In other words, US + Japan + UK + Canada + China + Taiwan + India amount to 76% of All Country World Market cap weighted portfolio. Add 2 more countries by Market Cap and we are at 85+%.

I wont spend too much effort on Developed Markets ex-US, as they tend to be pretty slow moving and correlated. For Developed ex-US I now hold:

- VEA (TER 0.05%)

- CSEMU (Ishares MSCI Eurpoean Monetary Union, TER 0.12%)

- VDPX (Vanguard FTSE Pacific ex. Japan, TER 0.22%)

in 25:5:3 value proportions for a weighted average TER of 0.07%.

There are some underrepresented non-eurozone “victims” here, notably Switzerland (which I hold in excess through VIAC), Sweden, Denmark, Norway, Poland and Israel. I may add some of them with single country ETFs (EWD, EDEN, ENOR, EPOL, EIS) or MSCI Nordic ETF (XDN0) later on, but probably wont bother due to added cost, complexity and no signs of above average performance. My main objective was to reduce overall exposure to Japan and the UK, while preserving regional exposure and this is achieved.

Emerging Markets are where it gets more interesting and more difficult.

Here is a table with the current allocations of VWO and a corresponding ETF ticker for most liquid ETF with corresponding country exposure:

VWO 07.19 weighting ETF Ticker China 33.50% FXI Taiwan 13.70% EWT India 12.10% INDA Brazil 8.50% EWZ, IBZL South Africa 6.60% EZA Russia 4.20% ERUS, CSRU Thailand 3.90% THD Malaysia 3.00% EWM Mexico 3.00% EWW Indonesia 2.30% EIDO Philippines 1.50% EPHE Qatar 1.20% XGLF, QAT Chile 1.10% ECH Saudi Arabia 0.90% XGLF*,KSA UAE 0.90% XGLF*, UAE Kuwait 0.90% KUW8, DX2Z* Turkey 0.70% TUR, ITKY Greece 0.40% GREK Colombia 0.40% GXG Hungary 0.30% LEER* Peru 0.30% EPU Czech Rep. 0.20% LEER* Egypt 0.20% EGPT Pakistan 0.20% PAK

*XGLF = MSCI GCC

*LEER = MSCI Eastern Europe ex. Russia

*DX2Z = S&P Select Frontier 40

For my purposes, I defined a fixed unit of +5% overweight. For every 10000 USD in VWO, the unit would be then 500 USD. I found it is easiest to apply the same unit (or natural multiple) for every country I buy, therefore lifting the smallest ones most and making it easier to monitor and rebalance my portfolio.You can do as you see fit, the world is your oyster. This is not passive investing anymore.

Rebalancing this has to be hell, you say? Not necessarily. A simple Google Sheet constructed to show existing and desired allocations can facilitate this. Then again, my core portfolio is still the entirely passive VTI+VEA+VWO combination which keeps the overall cost low. All overweights are active plays although indexed to the passive core. My basic rule for rebalancing is to take profit at +20% of desired allocation, and buy at -10% below desired allocation, therefore minimizing the amount of transactions. Not that this is a problem with 0.30$/transaction at IB.

I would most certainly not recommend equally weighting the US and Pakistan, although something around 40%:30%:30% (US/Developed/EM) sounds pretty reasonable to me…

Other references:

Comparision/summary of Market-cap weighted, GDP-Weighted and Equal-weighted All Country allocation:

Vanguard on alternative indexing approaches:

Bogleheads Wiki on equal weighted indices:

https://www.bogleheads.org/wiki/Equal_weighted_indices

Master thesis on GDP-Weighted market allocation: