I begin to ask myself if what we see these last days is only some short term agitation or if it will be followed with a recession due to decreased productivity and globally end with a real bear market.

What is your strategy these days? Postpone any investment or invest as much as possible before it climbs again?

Any postponing of investment or shift in defined allocation is market timing. After reading a lot on the bogleheads forum recently, I have the impression that many people are closet market timers ![]()

Buy the dip ![]()

Chinese stocks took 1 week to bottom out and then rebound to reach new highs. Now EM are holding fine while developed markets fall.

I’m expecting similar things to happen now. Perhaps we will go down all the way to 200 MACD (as in every larger corrections since 2009), but this is it.

Invested my bonus on February 20th. Perfect timing lol.

Well, I’ve been holding off with investing for over a year now, the whole 2019 haven’t invested a penny, and it was a great year, my return on that year was 23%… So not a very smart move in retrospect.

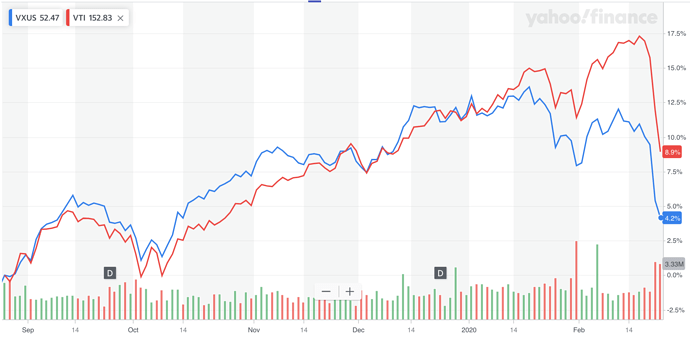

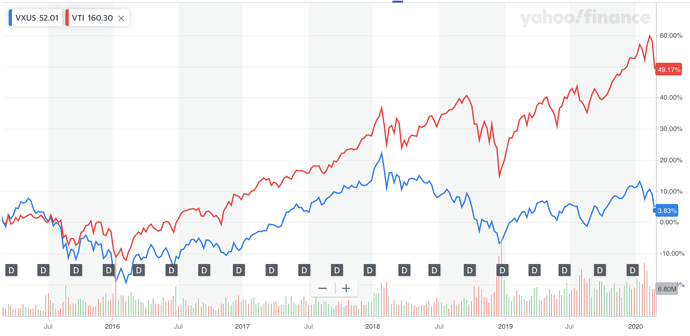

If you look at the recent 6 months, the recent drop seems really big:

But when you zoom out to 5 years, it’s doesn’t look that significant anymore:

I’m still on the fence with regards to investing more. Man, once you stop, it’s a trap, because you see it go up and up and you think “this has to be the peak of the bubble, I can’t buy now” ![]()

The title is catchy and suggests market timing, which nobody does here, right ? ![]()

Think positive, we are comfortably above previous tops…

The bottom shall be reached on 26th of March 2020, 17.54 CET, as arranged.

Cheers, Strabor

There will be an impact, but with some exceptions, most international companies are hiding information about the situation and the supply chain disruption. They hope things will restart within the first quarter and that they don’t need to report issues… I recommend this video for more details (in French). So basically you can wait for the first profit warnings for having a better idea of the impact.

What you say regarding holding information back is sensible because none of the companies wants to appear weak in front of their competition. At the same time it is stupid, if you look back in history - during WWI both powers held back information about the pandemic spanish flue because they did not want to show weakness. In the end spain was the first country to report it because they were not involved in the war and therefore we call it nowadays the spanish flue. And just so you know it, the spanish flue infected back then 27% of world population with an estimated death toll of 40 to 50 Millionen, maybe even up to 100 Million - It killed more people than WWI itself! I think companies would better give out information as fast as possible and be as transparent as possible as it is the only way to find solutions. And overall I think this is just nature. There are overpopulated places, old and weak people, so a virus can spread easily. This happened in the past, this happens all the time with animal populations and it will happen also in the future. We human just struggle with accepting death, even though it is probably the most normal thing in the world. And to respond to the actual topic: I am buying the dip, not all at once but every now and then some small portions.

Postponing investment.

The virus is a factor that was unforeseen and unaccounted for just 6 months ago. Yet stock markets are much higher than 6 months ago. In fact, S&P 500 has fallen to its mark approximately 3 months ago.

In my opinion this has the potential to take markets much lower.

I tend to think the effects are underrated so far.

S&P 500 is 50% higher than 4 years ago.

Why? Have profits grown so much?

In my opinion this has the potential to take markets much lower.

I agree with you but when do you know that the dip has reached the bottom? You should also consider that when markets turn, they will go up high and fast. Most likely you will hesitate to jump on the train and miss a big part of market recovery. Isn‘t it better to just continue investments as usual or maybe if you are with IB, buy more regular smaller portions and consider the higher fees as opportunity costs.

I tend to think the effects are underrated so far.

Do you mean the effect of the virus (spreading, death toll) or effect of the virus on markets? I think the effect of the virus are most likely underrated because it‘s hard to predict and authorities can only react. The markets are overreacting as always, I would not be surprised if it continues to go down because all the players start panicking, which might happen when they have to report numbers and profit warnings as mentioned by @Zerte2. Anyways don‘t listen to me I have no background in economics or finance ![]()

When do I know? In hindsight ![]()

Yes - but they’ve already gone up high and fast over the last three months (save for the last couple of days).

Primarily on the markets. I don‘t think we‘ve heard the bulk of the bad news yet. Maybe notably the one from Apple.

I’d describe my gut feeling like this: It seems to be a highly contagious virus, and governments’ measures taken against it are largely unprecedented. Therefore, it can erase more than just three months of gains from the markets.

Up until recently everyone was mostly traveling without concerns.

This has changed.

Most people are now concerned about traveling abroad.

Locking people up in boats and hotels doesn’t help to reduce this fear. Nobody wants to be locked in some random hotel for 3 weeks because some other person at the hotel tested positive.

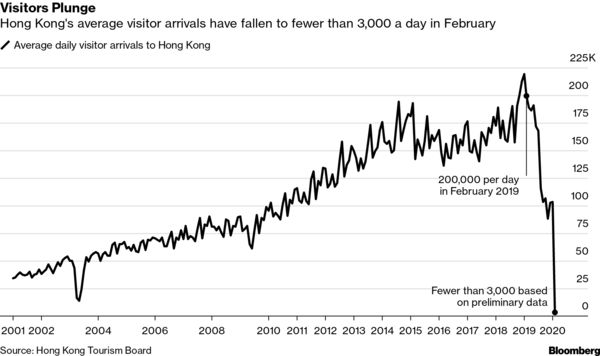

Look at the HK numbers (and yes, I know they had other problems before, still)

At this point cruise companies, airlines, hotels, and oil companies are not going to bounce back in a month IMO.

The other big problem (beside the obvious health problem) is disruption to supply chain…

BTW, I hope I’m wrong and it bounces right back like nothing happened and that whomever bought the dip this week becomes super happy with his/her gains.

recommended read: The Top is IN!!

https://forum.mrmoneymustache.com/investor-alley/top-is-in/

My 2 cents:

This panic is totally overblown.

I see two scenarios:

-

The virus disrupt the supply chain for some time, but then we manage to contain it and it will be forgotten in 6 months. Let’s take a pretty bad scenario where due to supply chain disruption all companies earnings were annihilated for Q1 2020, and let’s think from first principle.

- Question: What is the value of a business? Answer: the present value of his future cash flows.

- Question: Among the future cash flow, what is the weight of the coming quarter in the total value of the business? Answer: Not much, a DCF with pessimistic assumptions would not assign more than 1-2% to a single quarter

That means that even if no company was doing any profit this quarter, the market should not be down more than a few percents. But of course the street wants you to be panicked, so you transact and they can cash some fees.

I am buying the dip and not changing my course.

-

If the virus is not contained, becomes a massive pandemic and kills millions of people, knowing if i bought the dip or not will be the least of my concerns.

It is probably overblown. The supply chain, given enough time, will sort itself out if it has to. Still, until fear goes away I don’t see how tourism doesn’t suffer massively.

Looks like I forgot drinks…

A problem is that stocks are never rationally priced - they are mostly either too low or too high.

Take Amazon - a mature company. The P/E was close to a ridiculous 100 beginning of the month (it still at 85 !). Bezos wisely decided to cash out 4 billion $. At this price, buyers are basically giving him cash.

The concrete problem with very elevated prices is that you need lots of dip buyers just to sustain prices (in this case, 1 million small traders handing $2000 of their savings to just one guy). We saw the same with the crypto boom at the end of 2017, and certainly the same scheme happens in similar situations.

The virus is rather a trigger than anything else in that context (some mean people would say that it is a pin meeting a bubble ![]() ).

).

It just doesn’t make sense. The spanish flu wiped out millions and had literally no impact on stocks.

The world wasn’t interconnected like it is now. Tourism was not 3-15% of GDP (depends on the country). And there was no instagram of you stuck in a boat or an hotel with police outside.