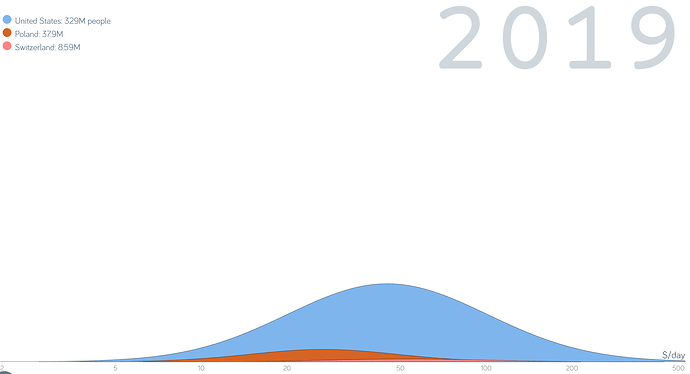

The gap between the poor and rich is gigantic in the US. They have so many problems that you could ask: is the US really a developed country?

It’s hard to give a definite answer to this question. If you look at the number of people for each income level, you will see that in Switzerland the range is $10 - $200, in Poland $5 - $100 and in USA it’s $5 - $500. It’s like a parallel society where the poor and rich live next to each other. This reminds me of my visit to Cape Town, where this division is very visible.

So, no reaction from global stock markets to the protests going on. I’ve read a lot recently about the stock markets seeming overpriced and rarely having been so divorced from the overall state of economies around the world. I have 3.5k sat in IB. invest now, or wait?

Normally I’d always say “invest now, because nobody knows what’s going to happen, and overall the tendency is always an upwards one” but… for the first time ever, I’m struggling with that.

It’s surprising. I’d expect (but am not betting) a strong upward move, with the anticipation of the Fed easing a bit more.

To put things in perspective:

How much are those 3.5k compared to your overall invested amount / net worth?

And how does it compare to your monthly savings?

It might be ir/relevant whatever you decide to do with it, so you might just go towards “time in the market” side, as it should win on average.

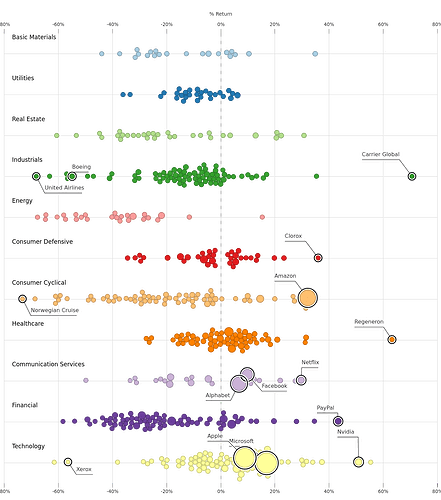

Indexing can make us loose view of the situation of individual companies. Courtesy of the bogleheads, I’ve stumbled upon this chart that shows it well : most of the economy is down but a few giants are carrying the index. I find the video in the link below particularly enlightening. Each dot represents a sp500 company, its size its marketcap and the colors sectors of the economy.

https://www.chartfleau.com/sp500/

Personnaly, I’m with Ray Dalio : we are at a social crossroads. Some countries have the means to mitigate the effects of the crisis (those with debt in their own money), some are way more bound by external rules. Some people are deeply affected, some are brushing it off. The image sent by the markets breeds this idea that rich investors are getting out unscathed while the common man is suffering.

This can go any number of ways, ranging from « nothing changes » to the fall of the dollar, including social unrest and new world orders.

Things may change in the market when people/companies will have to sell their stocks to get money. The governments and central banks are trying to sustain solvency and mainly succeeding for now but this may change as the crisis draws longer.

Nah, that won’t happen so quickly.

Not sure if this essay is publicly available, but here’s a good analysis on this: With Great Demographics Comes Great Power

No problem, I’ll make up another scenario for you:

U.S. presidential elections are to be held in 5 months time. Now imagine a hung vote with in one or more key states - similar to the 2000 elections and ensuing recount dispute for the Florida votes between Bush and Gore. Basically, assume the elections don’t yield a clear winner.

Only… this time Trump as the incumbent president is arguably a much, much more polarising figure than George W. Bush ever was. Add this year’s frustrations with Corona restrictions, high unemployment, poverty and racial tensions into the mix.

Given suitable election results and controversy, everything that we’ve seen lately may have been just a faint taste of the tensions, uncertainty and outright civil unrest that’s yet to come.

I agree with you. A crisis, yes. And it could last long. But that will not topple the current world order.

You’re right - it’s not a lot relative to net worth, and it’s about one month’s savings, though I’m expecting a fair few bills over the next month (taxes, Masters course fees) so maybe that’s why I’m hesitating. For once I’m going to follow instincts rather than principle, and wait a few days.

With my investments during the dip and extra revenue from salary my net worth is now back to what it was in January.

At this point I stopped buying. My allocation would indicate I should even sell some stocks… For now I am holding but if I would really follow my plan to the letter I should sell.

There’s one other bad scenario I became aware of today: A massive, rather soon, devaluation of the US Dollar. It’s a side remark in the Tagi interview with Albert Edwards, apparently quite a pessimist, but with some good arguments on his side (stock markets are high on central bank interventions, beware the hang-over).

I’m massively invested in USD assets (VT). The normal argument – to my knowledge – why this isn’t a problem is that currency movements usually are dwarfed by asset price movements, that in a globalised world in the end big companies’ earning are USD exposed anyway and that hedging is expensive.

But if a massive, US Dollar devaluation within the next 12-18 months is a realistic risk, shouldn’t I prefer currency-hedged assets? Like rebalancing from VT to the iShares MSCI World CHF Hedged UCITS ETF, for example (which I don’t much like, but it’s hard to find a CHF hedged world stock ETF).

And what makes you think that the CHF will not get devalued? Seriously, homegrown analysts who connected two dots and think they know something better than the market never cease to puzzle me

1 CHF was 0.17 USD, now it is >1 USD.

1 CHF was 80 old FF (=0.8 FF), now it is 0.92 EUR so it would be 6 FF.

But you are right, nobody knows what will happen in the next years.

Stock valuations take pretty good care of currency fluctuations. On devaluation net importers lose some, exporters win some. Stay diversified, don’t waste money on hedging and guessing where the currency goes.

It’s behind a pay/registration wall but I agree with you, any change we may see will be gradual.

It depends on how much faith you have on the long term value of the dollar but you can see it as you would a drop in price of VT itself: on the short term, your swiss franks would allow you to buy more of it, so this would be an opportunity. The closer to our investing horizon we get, the more it makes sense to me to invest in the currency we’ll spend.

I have a friend that was constantly telling me that the market will crash since summer 2019. I started investing and he was still sitting in cash. Eventually Corona happened and he started to invest slowly, down to around 2250. Markets started recovering and he already realized some gains by selling everything around 2600. Hoping that the market will decline again, but it never happened. On the way up he realized his mistake and started investing again, a big chunk on Tuesday this week (at 3080). Now 1/3 in cash and 2/3 in stocks, still deciding when to buy more.

He got it right with the crash, but it’s really true that you have to be right twice to market time sucessfully. There was literally no point in waiting for the crash, he could have lump sum invested everything last summer (at 2900-3000) and be in the same situation like today, probably even better because not holding dry powder anymore that he might invest even at higher prices.

You see, even if we both look stupid investing right before the crash. It was still the right choice. This philosophy (ignore news, lump sum instead of DCA, stay the course) will lead to better returns longterm.

This is how we should close this thread

(Stating the obvious, but)

You can only analyze those things in hindsight, otherwise there are just “what ifs” in the present.

I am sure there are hundreds of anecdotes - I can tell at least three close ones, with varying P&L results - and the “right one” can be picked only after.

I am content with what I did, but of course it could have been better - likewise it could have been worse.

One thing for sure, this situation taught me some stuff about myself. ![]()

Also, a good/best decision does not necessarily produce a good/best outcome.

Only with hopes there’s no double-dipping. ![]()

Depends on the asset class, hedged international bonds have a higher risk adjusted return than unhedged ones.

Hedging is also pretty cheap nowadays.(I’m talking about the real cost, expected future change in currency valuations are not hedging costs)