I really love your post, and especially this last quote! I think everyone in this thread should print it out in size 72 bold to watch it every day!

It’s been interesting to see this thread evolve over the last three months.

Disclaimer: please don’t get offended by my personal summary

We’ve seen stockpicking+market timing at it’s finest (@glina), people going all-in (@bojack), others speculating about leveraged ETFs (@cortana), people making “bold” moves when others were fearful (@MrRIP) and various other things.

What we tend to forget: everyone has a different knowledge, different amounts to invest (people with 20k in their depot vs people with 500k+), different risk tolerance etc. Some of the advice in this thread has been really dangerous, especially for people who just started with investing.

My personal learning from this thread:

- Educate yourself first!

- Take everything you read on an, almost anonymous, forum with a grain of salt

- If something looks like a good idea, check if your starting points are the same

- Before following anyone’s advice, make sure you understand what your he/she is doing and why

- Almost everyone of us thinks he/she is smarter than the market and will outperform the rest

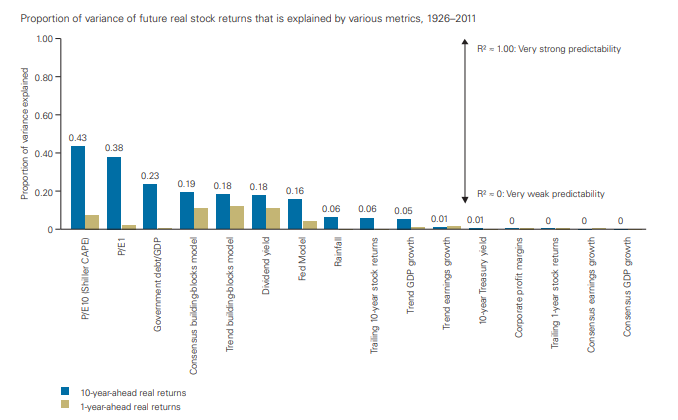

Nobody of us knows what the market will do in the next week, next year, next 10 or 30 years.

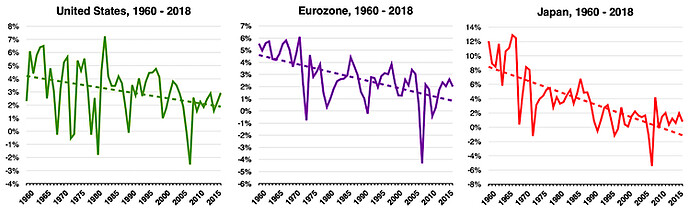

We all just hope that the stock market will continue to grow over time, and we don’t experience a Japanese scenario. I assume most of the people in here are younger than 50, and that almost none really invested before 2000. Another assumption is that most people only started investing after the financial crisis in 2007/09, where the market only knew one direction: UP. (me included)

I think the corona situation is an interesting experience for all of us. We’re able to learn about ourself (psychologically, risk tolerance, not taking other opinions of others as the truth), about others, about economy.

Personally, I’m curious to see how the next year is going to evolve. The macro economic figures are looking really bad: unemployment will rise, external projects will get cut, restaurants only being able to server max. 50% of capacity etc (talking mainly about Switzerland here, but I think it will be the same almost everywhere).

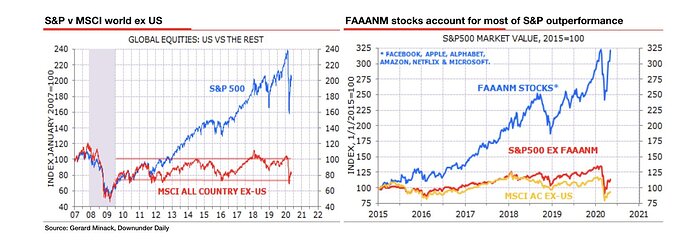

The worldwide stock markets are currently decoupled from the real world due to QE from the national banks. It will be interesting to see how long they will be able to sustain that fire, when real world economy definitely took a big hit and will not be able to recover so fast.

To end my post: I just know that I know nothing. And coming back to @Wolverines post: make sure you can reach your goals and live happily!