Stock valuations take pretty good care of currency fluctuations. On devaluation net importers lose some, exporters win some. Stay diversified, don’t waste money on hedging and guessing where the currency goes.

It’s behind a pay/registration wall but I agree with you, any change we may see will be gradual.

It depends on how much faith you have on the long term value of the dollar but you can see it as you would a drop in price of VT itself: on the short term, your swiss franks would allow you to buy more of it, so this would be an opportunity. The closer to our investing horizon we get, the more it makes sense to me to invest in the currency we’ll spend.

I have a friend that was constantly telling me that the market will crash since summer 2019. I started investing and he was still sitting in cash. Eventually Corona happened and he started to invest slowly, down to around 2250. Markets started recovering and he already realized some gains by selling everything around 2600. Hoping that the market will decline again, but it never happened. On the way up he realized his mistake and started investing again, a big chunk on Tuesday this week (at 3080). Now 1/3 in cash and 2/3 in stocks, still deciding when to buy more.

He got it right with the crash, but it’s really true that you have to be right twice to market time sucessfully. There was literally no point in waiting for the crash, he could have lump sum invested everything last summer (at 2900-3000) and be in the same situation like today, probably even better because not holding dry powder anymore that he might invest even at higher prices.

You see, even if we both look stupid investing right before the crash. It was still the right choice. This philosophy (ignore news, lump sum instead of DCA, stay the course) will lead to better returns longterm.

This is how we should close this thread ![]()

(Stating the obvious, but)

You can only analyze those things in hindsight, otherwise there are just “what ifs” in the present.

I am sure there are hundreds of anecdotes - I can tell at least three close ones, with varying P&L results - and the “right one” can be picked only after.

I am content with what I did, but of course it could have been better - likewise it could have been worse.

One thing for sure, this situation taught me some stuff about myself. ![]()

Also, a good/best decision does not necessarily produce a good/best outcome.

Only with hopes there’s no double-dipping. ![]()

Depends on the asset class, hedged international bonds have a higher risk adjusted return than unhedged ones.

Hedging is also pretty cheap nowadays.(I’m talking about the real cost, expected future change in currency valuations are not hedging costs)

Well it has already lost > 7% from the top against the EUR and similarly against CHF.

Well that shows how unaware I’ve been of currency movements ![]()

And thanks everyone for the answers. Nobody knows nothing and yet I still can be alarmed by opinions…

One of many threads on Bogleheads: https://www.bogleheads.org/forum/viewtopic.php?f=1&t=309076

Mon Mar 23, 2020 12:59 am

I’ve decided to sell 100% of my stocks in all investment accounts to preserve 2016 gains, and to prevent an irrecoverable loss in hard earned savings. This goes against all the rules I’ve learned about investing, but this time is very different so the rules go out the window. Stocks will keep crashing until this virus has peaked. I cannot wait until stocks are near zero.

Poke poke poke. I’m actually considering buying …

We had a lengthy discussion regarding Small-Cap Value and @Cortana’s reasoning was solid. Higher return for higher risk. This scenario played out academically. Outsized drop on elevated risk and now outsized gain od diminishing risk.

I know, the growth/value gap is big now…it looks really interesting! But I feel more comfortable just owning the haystack without any factors. SCV would be the only thing I would consider worth buying.

Why yes now and not a month or two ago?

To be fair, VTI (and Growth in fact, i.e. the big FAAAMN) recovered way faster/more than value in this “from trough” period. ![]()

I know I’m quoting myselft here, but the word epic doesn’t even qualify anymore for what is going on.

Today my FOMO is peaking, with some 50K of USD sitting on my IBKR account losing value to inflation…

Fair enough!

I was checking a couple days/weeks ago, therefore my lag and discrepancy with this viz. ![]() Thanks!

Thanks!

my portfolio (heavy in DM ex US and US value) which was mostly invested near the peak is already positive. I was expecting that to happen in ~18-24 months giving me time to nibble into at lower prices. I am a scientist and being unsure and feeling stupid most of the time is part of my daily existence, but market action over 3 months has been more humbling. i feel dumber than ever before. I am not sure I learnt anything in last 3 months.

@Cortana @1000000CHF are your boats above water or have become flying machines?

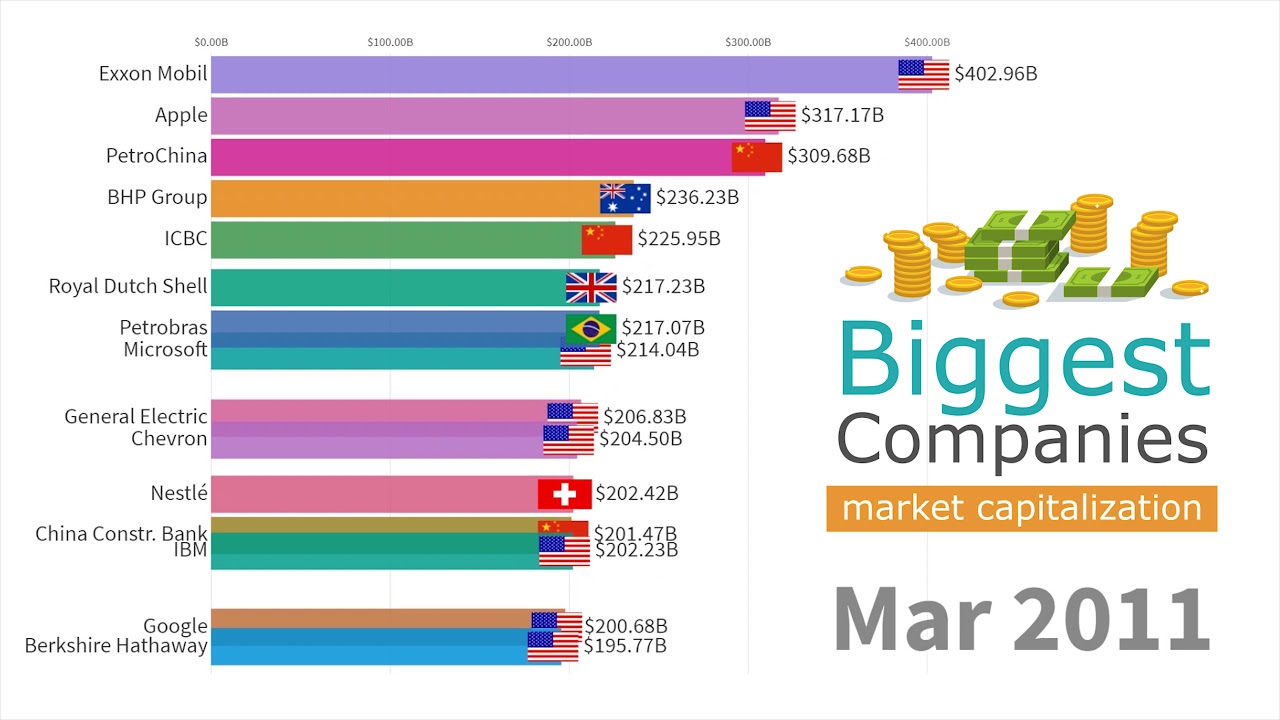

Good point. I just stumbled over this video yesterday. Pretty much what your charts say ![]() https://www.youtube.com/watch?v=LnnUK9W5cuI

https://www.youtube.com/watch?v=LnnUK9W5cuI

Also interesting video. Makes you realize that it’s close to impossible to tell who will be in the Top15 in future.

That video reminded me of this dude right here ![]()

And who pays 1.5% in ETF management fees?!? ![]()