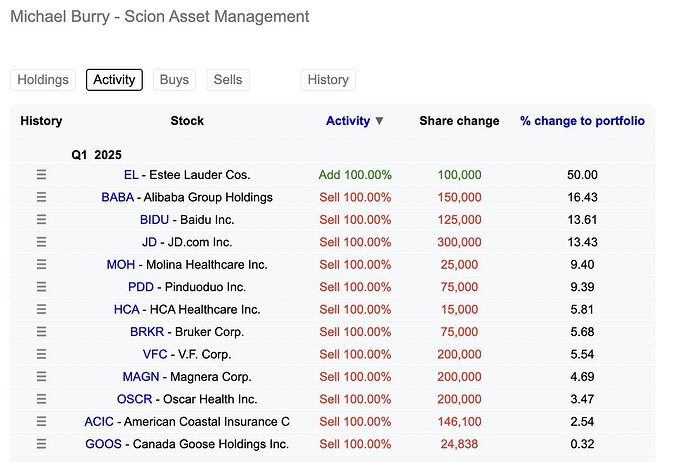

Anyone has a view on Estee Lauder (EL)? Looks like Michael Burry is bullish!

What a great service ![]() thanks a lot @Your_Full_Name for the quick response

thanks a lot @Your_Full_Name for the quick response

Cheers.

The FASTgraph above was just promotional material. completely for free! Upon reading the further analysis below a small fee will be charged automatically from the payment method(s) in your Mustachian account.

Couple of additional thoughts:

-

Analyst forecasts for earnings have been slightly shrinking …

… which might be a reason why price has followed down.

Price follows earnings, as they say.

-

Normal P/E multiple for the company over the past 5 years was about 39.1

If the company returned to that valuation you would be looking a price target of close to CHF 400 and a total annualized return over the next couple of years of 20-30%. -

Normal P/E multiple for the company over the past 20 years was about 24.2

If the company returned to that valuation you would be looking a price target of about CHF 250 and a total annualized return over the next couple of years of maybe 7%. -

The so-called “fair” multiple for the company given its growth is just 15.3

If the company went to a 15 multiple you would be looking at a price target of CHF 155 and a total annualized return over the next couple of years of minus 10%. -

The last time the compay was close to a 15 multiple was in early 2015, about 10 years ago.

Before you laugh, though, note that despite the earning growth rate of then 12% being higher than today (maybe 10% earnings growth looking back 5 years) and also take notice of the (then) normal multiple of just about 18.

Anyway …

Goofy-LLM ASLM✞: Still effing expensive!

[![]() ] Except for meme stocks and other vehicles of similar sort like PLTR or TSLA and some others.

] Except for meme stocks and other vehicles of similar sort like PLTR or TSLA and some others.

[1] “Normal” here = Average multiple over the past 5 years

[2] “Normal” here = Average multiple over the past 20 years

[3] The appropriate “fair” multiple is derived from the earnings growth of the company.

See this page for more details: Valuation Ratios | Fast Graphs Help Center

[✞] Artisan Small Language Model

Nobody invests in brick and mortar shops. I am said to be stupid. Sorry for that.

Per today my internal interest in the mechanical high risk strategy is XIRR (interner Zinsfuss) 26.84% since 2020. Hard, because in 2020 it lost money. And that was the first year and all passive index investors did make a lot of money.

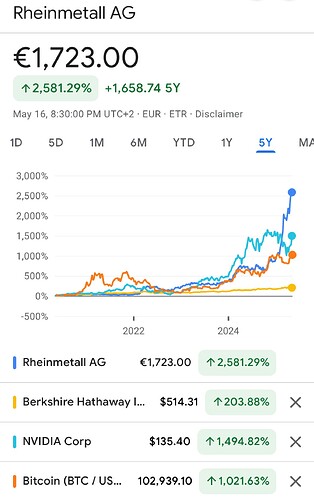

Bloody hell Rheinmetall, another freakin’ bleedin’ obvious one I slept on as usual…

Such a dumbass, I looked at it in Feb when it’d done +25% in a month, said “nah it’s run up”, then again in March, after another +30%, said “nah it’s run up”, then again in April, told myself “it’s all priced in” and it goes and does another +25%… What a dumbass chicken.

I would recommend you not to compare 5 year charts for Rheinmetall and NVDA or Bitcoin. Would be good for your mental health ![]()

I had nVidia, bought in Dec 2022 as another bleedin’ obvious. Sold at 2x, proceeded to do another 3x on top for a total of 6x. Don’t care about BTC but BTC and crypto in general is among my regrets, especially since my good friend who very sadly took his own life was bugging me for 6 months to go deep into crypto with him in 2019 and I didn’t ![]()

And we wonder why people don’t stop active investing ![]()

as long as such charts exist, active investing will continue.

Can’t find a witty and not whiny reply to this ![]()

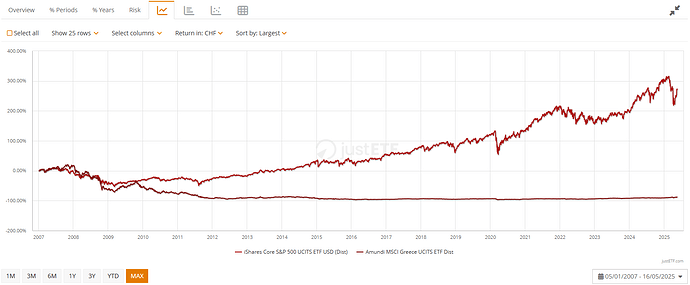

I would start with this

Oh wait - you don’t want to give a single Euro to greek companies even if they give back 2 more ![]()

Some people overestimate their own ability and then justify it with ‘I knew’, instead of acknowledging that it was luck.

There is no point plotting 100 years of history when @Mirager started investing 5 years ago.

Let’s be honest . Everyone who invests in anything needs some sort of luck

However it doesn’t matter to the person who became a millionaire that they were lucky , smart or talented. They became the millionaire and that’s what matters to them.

That’s why I was saying that active investing is always going to be around because of these asymmetrical gains. It doesn’t mean everyone experiences them

This would be more appropriate, just try to ignore the 2.5% TER ![]() anyway it’s off topic to stock picking.

anyway it’s off topic to stock picking.

Low-cost, diversified index funds probably don’t; they just require time (I know this is a stockpicking thread so I’m fine with whatever you answer).

You’re writing as if everyone is lucky enough to become a millionaire. You’re talking about a very unlikely scenario for the majority.

Only a very small group of people experience them. Nobody online is going to talk about how his active investing got him/her negative returns aka the confirmation bias.

123

You are right. But the discussion here is not about what an average individual should do. The discussion is about why active investing is interesting for many.

How I see it is following

- Passive investing is meant for capital growth but not life changing returns. Most value will be determined by duration and amount of contributions and not from the returns from investments.

- Active investing can deliver life changing returns or life changing loss.

I am passive.

I didn’t say that. In fact very few will. However this doesn’t stop people to try to be amongst that few.

Who are we talking about on daily basis in our life ?

Peter Lynch

Warren Buffet

Ackman

Charlie Munger

Ray Dalio

Early bitcoin investors

Active investors are inspired by the list above.

We are not talking about the average Joe who bought VOO. Of course average Joe is doing well too but that is not what inspires people.

In life there is always a difference between what’s possible & what’s probable. Possibilities drives individuals because otherwise we would have no innovation, no entrepreneurs, no risk taking and no returns for passive investors to benefit from ![]()