So, about time I made this post too.

I’m originally from Greece, biochemist by training, former academic, current consultant for 11 years and counting. Did my studies and failed academic “career” from 2000-2012 in the UK until my research fund dried out and long-term relationship ended, so without options or desire other than to return to Greece I returned, finished my mandatory military service and was planning to weigh up any opportunities. Luck had it that I found a wonderful UK-based healthcare consultancy which happened to have a Greek boss, and office there. Things were looking great, had found my partner, planning to marry, renovated our flat until disaster struck in Jan 2015 and the crazy left wing came to power. Luckily they didn’t have the guts to go really crazy, perhaps they knew they would be the first to be strung up and hanged if people’s lives were really disrupted. The issue is this broke any confidence I ever had in the country and made it a goal to look for a good opportunity to eff off and create a solid base which wouldn’t and couldn’t be shaken by politics.

I had an investing bug on and off for years, in the UK I’d made an ISA which had done really well but that money was used to renovate our flat in Athens. The real trigger was twofold, first a good friend of mine from the UK, let’s call him Bertrand, had some switch go off in his brain and he became obsessive with optimization and FIRE. He would go endlessly about how time is money, and money is freedom, points I agree on. What I didn’t like, and ended up badly, was that he systematically eliminated any and every cost from his life, down to taking the bus to go for a coffee. More importantly he eliminated any social interaction which wasn’t on the phone. “This is costing me time, it’s bleeding my time on earth away”, he used to say.

The second trigger, the main one, is that I ran the numbers on my Greek state pension and the private pension I’d put in place and figured out that the first was a Ponzi scheme, gift to current retirees, many of whom lived, worked and retired in a far easier time than me, and the second was a gift to the insurance company - essentially they promised to give my money back after many years. Really.

These thoughts coincided with my beloved UK going off and doing its Brexit thing. I was actually over there looking at flats to rent, keeping my job but taking it there, however had an obnoxious 20-something estate agent disrespecting my wife, who is ex-EU, and talking to her like she’s a destitute illegal migrant right in her face, with me there. Obviously resisted the urge to rearrange his facial geometry, but this was the trigger to say a big “eff off to y’all”. So I had to weigh up options again and Switzerland came up (I also seriously looked at Canada, Australia, Germany and the US too), ticking all the boxes, so we moved here 3 years ago.

Back to investments, by about 2019 my friend Bertrand had decided ETFs are way too slow for his liking, and was edging me to do crypto trading with him but I resisted. Then COVID came, we talked at length about it being an opportunity, and got our scientific minds together to look at which companies stood to create a vaccine for COVID, we made a shortlist but I chickened to put what little money I had left. Greece had changed government but what if the loony left came back? Having lived through capital controls, standing in the burning sun for 60 EUR/day for months I wasn’t about to lock money in, while still being in Greece. The kicker is that out of 10 companies in our shortlist, we’d captured 5 which DID make a COVID vaccine, and their stocks soared. I didn’t invest, my friend did.

At 2021, and this is the real turning point for my friend, he’d been pilling everything - including his father in law’s wedding gift of a Rolex watch - in crypto for a good 5 years, since the 2017 bull run and crash (“learn in your first bull run, retire in the second”, he used to say), he made millions, quit his highly successful and promising academic career (made full professor by 39) and fucked off to somewhere in the south of the UK by the sea, which he wouldn’t disclose in case people came to kidnap him or his wife for money. The guy’s sanity unraveled, became highly paranoid, erratic, obnoxious (“I go to the supermarket and see the cattle, the slaves, you’re a slave too, I am trying to free you but you won’t listen, they don’t know what I am, I look like a bum but have millions”). We kept very regular contact via emails (he didn’t have a phone because…reasons) until one time he went missing for a while around autumn 2023, this wasn’t uncommon, until his wife sent me a message that he’d killed himself. Tragic story. That’s why I am suspicious of FIRE and hyper-optimizers. FIRE intensified preexisting mental health issues, I understand that, I am not blaming FIRE, just can’t like it.

Back to investing, my parents are wonderful, highly educated people but awful at money management. My mother is pathologically averse to risk, my father is pathologically averse to saving (“I won’t make a rich corpse”, “burial shrouds have no pockets”, he’s said as long as I remember him!). He’s been great at making money, and even better at spending it. “Your father knows to enjoy better than anyone I’ve ever met”, my wife says. So I had sketchy examples, it’s fine, I’ll make sure my kids know!

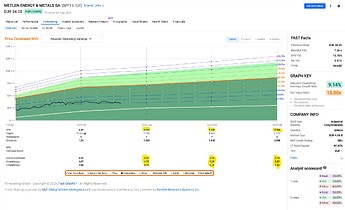

Coming to CH meant I could finally do some serious investing, pedal to the metal for 2 years saving 30-40% of my monthly salary (with 2 kids and wife who doesn’t work, yet), a big pile gathered, now I have consciously eased off the gas and feeling fine overall. I’m mostly here for the banter, though I do like this forum and people in it!

Edits:

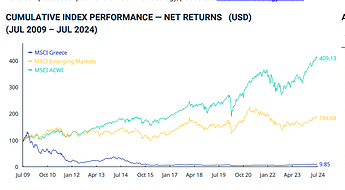

- Leaning towards receiving - but not chasing - dividends because I need the mental/emotional boost

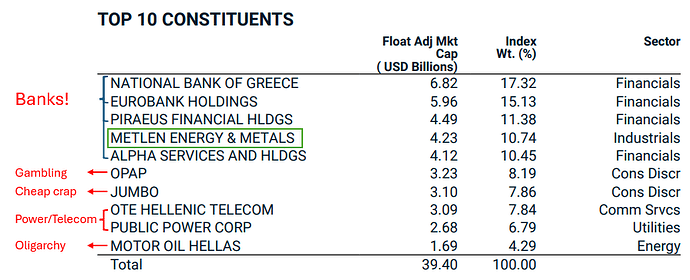

- People in Greece are rightly scared of the stockmarket, the Greek stockmarket had two spectacular bubbles in a row, some few made crazy money, many lost everything. What’s even worse is that at the time insider trading was essentially legal, there were zillions of “advisors” using high-pressure sales tactics similar to the Wolf of Wall Street, they made their cuts, people got shafted. Essentially anyone who put money in the Greek stockmarket from 1998 to about 2012 is unlikely to ever get their money back. It was the second bubble which really cleaned people up, including those poor suckers who tried to make up their losses, and those who let FOMO from missing the first bubble reel them in. Of course diversification, risk adjusted returns etc etc are concepts which stand the test of time, but this is the 90s, people had no easy access to information, and there were screens showing stock tickers in literally every coffee place in every last goat village of the country. That plus predatory salespeople. It was a slaughter of epic scale.

- Interestingly, thinking back I see that if I had the ears there have been people here and there who said words of wisdom, like my best friend’s father: “I went into the stockmarket when it was 100 points, don’t care if it went to 6000 and then down to 1000, because I went in at 100 points!” (Jack Bogle’s staying the course message, delivered by a guy who didn’t speak a foreign language and never travelled), I was too young and naive to understand at the time, but do understand now. Edit: I remember now, mid 90s when the stock mania was burning hot in Greece, I asked my dad about it, he said “there’s a saying in Wall Street that when the shoeshine boy gives stock recommendations it’s time to run, these here (the gents in his village’s square/coffee house/butcher/barbershop talking stocks 24/7) are the shoeshine boys of today”.

- I’m allergic to real estate