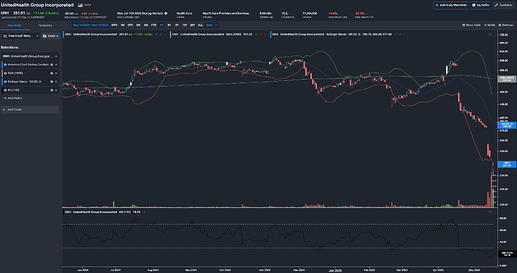

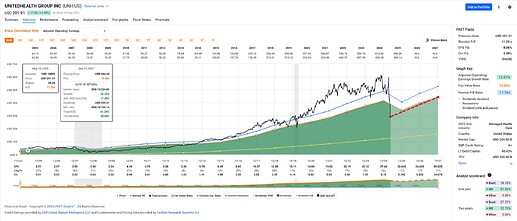

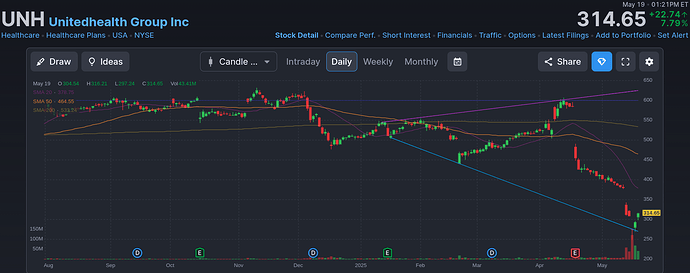

Anyone buy company shares (or sell options) on $UNH in the past week or so? It tanked nicely to about $290 after reaching a top of $620 last November.

Seems like a still fine company to me given their earnings growth (though of course them pulling their 2025 earnings guidance and the sudden departure of their CEO✟ might have put a dent in that trajectory).

Anyway, I sold a UNH Dec19’25 160 Put on Thursday for about $900. I’m fine owning them for $160 a share if I get assigned and with my option I’ll in the mean time generate a return – I like to look at it as the dividend yield if I actually owned the company at $160 (the cash at risk now) – of 9.4% annualized (with owning the shares outright at the close yesterday market price the dividend yield is 2.88%).

[✟] Not the CEO of UnitedHealthcare (a subsidiary of UnitedHealth) who was shot to death last December, but UnitedHealth’s CEO since 2021, now replaced by their chairmen stepping in.

2 Likes

I did. I’m surprised that I’m in the green on that since it tanked another 16% the day after I bought it.

and $900 of options? what’s that in real numbers a million dollars worth of shares at strike?

The $900 are for selling one option contract of a Dec19’25 160 Put which is a cool $16’000 if I get assigned. I could have bought it back on Friday already for about $500, but I intend to hold on to it for picking up some time decay once the fear ebbs further.

That’s a decent price! I should have done the same.

I wasn’t organised enough to sell the put, so may have missed the boat now:

Looks like it should recover back to 375 very quickly.

Well, I also missed out on buying the underlying at a subdued price, but then again I am really more interested in the cash flow (from selling the option, or future dividend payments) and the underlying itself was somewhat attractive, but not can’t-miss-this attractive.

$UNH up 7% today. The price of my option has probably halved.

Nice trade. Checked UNH cashflow statement and at that price it would even be accepted in my dividend strategy.

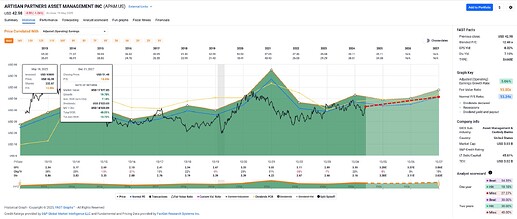

But I bought another very small company from the finance sector: Artisan Partnes Asset Management (APAM). High risk, high dividend.

I can do that now because up from this year I don’t live anymore off my dividend strategy; my momentum strategy that started as an experiment with some money I could lose has surpassed my dividend strategy in value. The performance difference is just too big, compounding in action.

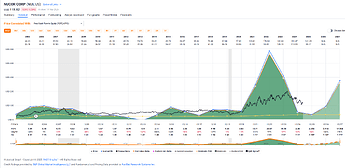

After over a decade my system made me sell Nucor. Had a very good run with it, many dividends and my concept of the market dividend worked nice there too. And at the end a capital gain for the rest of the position. It hurts a bit when you have to do something like that, but I follow my mechanics. Thank you Nucor for the nice time and goodbye. Cashflow was just not OK anymore and inventories rising. Could be a temporary situation, but better save than sorry.

I’m up 14%, which seemed so improbable I had to check my trades:

- 13 May - Bought 35 shares @ 317 so the first tranche recovered

- 15 May - Bought 40 shares @ 256 up 26% - where the money was made

I had a third buy order for 50 shares at $225, but this didn’t hit. I should have placed a put order instead.

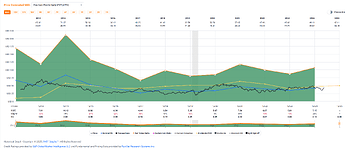

(Since you prefer FCF:

)

I see the high dividend – where do you see the high risk?

To my untrained eye they look more like a slightly unstable bond (with redemption “sometime in the future”) where interest rates fluctuate a little within a somewhat tight band, at least over the past decade …

Not for me (too low of a dividend, too cyclical, too “political”), but if I were to buy this company, we would be approaching a potential entry point in my book as analysts expect earnings to grow again – price would have to drop just a little more for me to have a margin of safety.

Anyway, that’s what makes a market!

I’m guessing you made an above 10% CAGR from entry to selling?

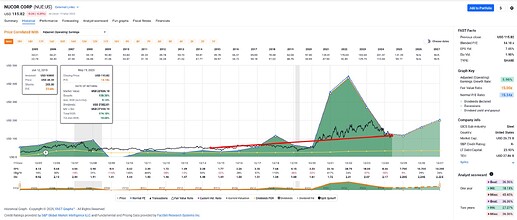

(For completeness their cashflow:

)

Well, you’re up more now …

Price is now 100% above my strike, I’ll let this baby run a little longer even though I have to admit I am tempted a little bit to just buy it back for a profit for $630 and be done with it instead of waiting another 214 days for the remaining $270 to materialize … My mental model is to sell when I make at least less than a dollar a day until expiry, so my sophisticated scientific option pricing approach – in finance/economic literature it’s called the Black-Goofy forumula – tells me to wait a little longer.

1 Like

Thanks.

Artisan is a small shop that does really good. But some bad decisions in the future can put them out of business very fast and there is no chance for them being saved. Actually they were too small to be even considered for my dividend strategy before when I used to live off that strategy. Not any longer.

When looking for a replacement for my Nucor sale I just used the U.S. Dividend 100 Index, sorted by dividend yield and then chose the first company that was from a sector I could still buy and that did fulfill all my requirements described in the mechanical investment thread. I hope I will be able to keep them as long as Nucor or even longer.

I described my cash flow requirements in the mechanical investment thread, Nucor did not comply for like 5 quarters so I have to say goodbye. But yes the remaining position was sold with quiet a nice gain. My “market dividend” method made me sell at the high a few times. Unfortunately I don’t have the complete records for single positions complete return, as dividends were a big part of those.

1 Like

BTW: if anybody is interested, here is a finviz of the U.S. Dividend 100 Index:

AFAIK there is only one ETF, the SCHD, that replicates that index. But as you know I’m not into ETF…

1 Like

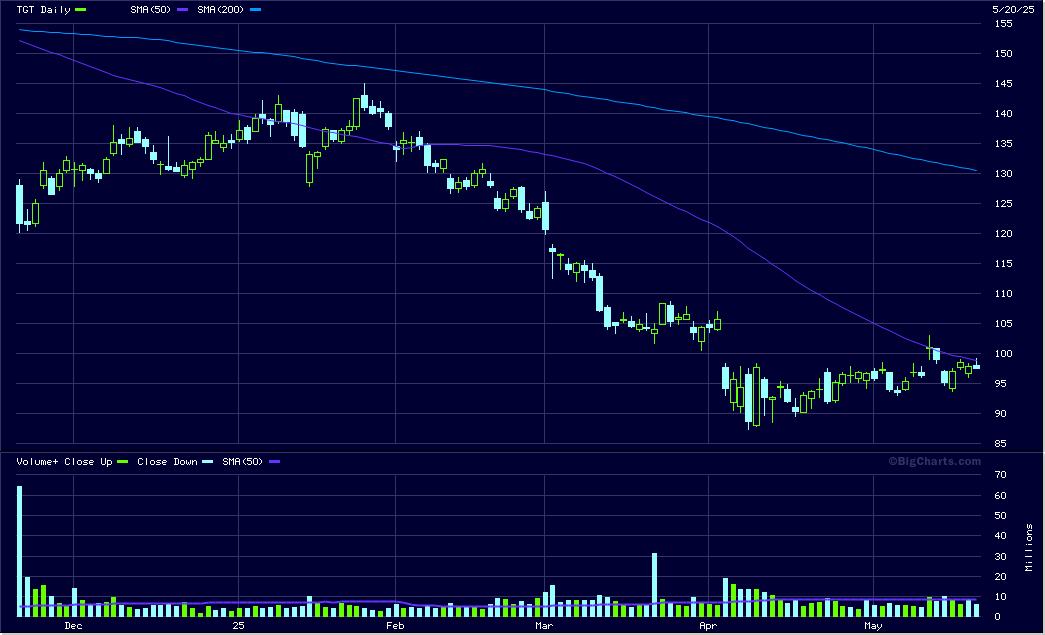

I also saw today that TGT had fallen to sub $90 in early April when I wasn’t paying attention to it.

Target looks OK, could have made it into my dividend portfolio. But I’m full at the moment. I even got some margin credit because of the Artisan buy. That way I can relax a little bit and don’t have to invest dividends every few days…I really don’t like cash lying around

Maybe there’ll be a better price to buy once tariffs start to hit.

As long as I don’t find a broker that lets me trade at the left side of the right end of the chart, I don’t care for past price. I don’t care for news, I may have an opinion but it will not influence any trade. If it is a good price and my mechanical strategy tells me to buy I buy, no matter what. If it tells me to sell I do that.

I am old, but I am still a fool and mechanical investment is the only thing that saves me from my stupidity. There are over 100 bias that affect our trading and I probably would fall for all of them and some more.

3 Likes

Thank you, was not aware of this site.

Beside SCHD, I‘m also in SCHY and CHDVD - maybe these ETF can also be used in that tool, I have to check that later.

As I said, I am not into ETF. There are a few million index, way more than single stocks and this is … sick. OK, I let them(whoever they are) have their money, but not mine, sorry.

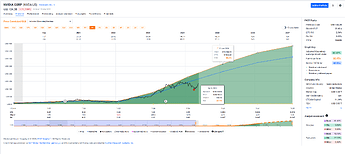

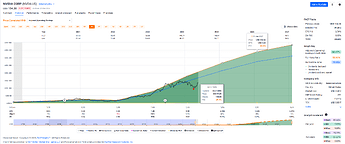

Wait, what? Back in April, you could have bought NVDA at a fwd PE of just 15?!

I think I’d better set up some automated alerts…

Yeah. If you really think that would be a good point to buy… define mechanical rules to do so.

Just don’t change the rules every time you see something that you should have done. I have probably ten thousands of things that appear to me that way in the last decades.

I think everybody can beat the “market”, because the market is defined as an index. The SP500 changed its rule twice and every time it was at the high of a bubble. Just by avoiding that you would have… OK, you cannot say beat the index, but just say you could have made a shitton of money.

NVDA was never my target (I hold SMCI) but if it ever will be and my mechanics say buy it…

I just buy it.

3 Likes

More like 21 x this (financial)† year’s earnings.

About 17 x for next (fianancial) year’s earnings.

And indeed about 15 x for (financial year) 2027.

But I see your point …

Narrator: "FOMO kicks in ..."

Maybe I’ll buy it for my son’s portfolio.

LLMs will stay around and NVDA will probably keep selling shovels for a while.‡

[†] NVDA’s financial year ends on Janary 31.

[‡] Even if so called “AI” is IMO still just a pipe dream.

1 Like