I hear Tesla is a bargain right now, you are buying in hundreds of years of earnings in a second!

Looking at 1 year stock performance, I saw that PM has a crazy +80% performance! That must be one of the top performers in the S&P500 looking at the past 1 year performance. OK, maybe excluding ‘meme stocks’, like PLTR.

Guess How Much Time Many Investors Spend on Researching Stock Buys?

The median individual investor spends six minutes researching stocks before buying, a study finds.(Source)

This is chart for SSAC.SW

ishares MSCI ACWI ETF traded in CHF

There is still plenty of dip to buy in the world market. If you should is up to you

I’m not considering. I do what my mechanical strategies tell me. And that is at the moment just wait with an invested margin multiplier of 125% as of today. Very close to an all-time high by just doing nothing. That is why they call me the managing siesta director.

My bear market protocol is active until the SP500 is at 95% of its last high. At the moment it is at 92.14%. It will be activated again under 80%.

Life is easy if you stop worrying!

My mechanical strategy is DCA & relax. ![]()

Same same, plus some FASTgraphs magic fairy dust on top.

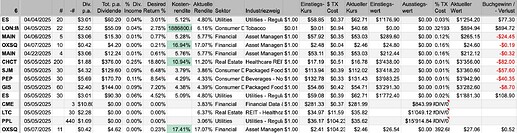

My trading since the start of April:

Imperial Brands, Main Street Capital and Oxford Square Capital are DRIP buys.

Eversource, Community Healthcare Trust, Smucker, Pepsi and General Mills are all undervalued and were financed with a couple of sells: got rid of PPL because they’re nicely overvalued with a dividend yield down to 3%, got rid of LTC Properties since they haven’t raised their dividend since I bought them (March 2020, no less!) and gave up a couple of shares of CME since they’re also quite overvalued.

Net effect is about $400 more dividends p.a. ($460 if I include the new dividends from DRIP).

I’ve been stockpicking for 2 years, with my entire portfolio. It’s underperformed most indicies but I hate the ETF / bit of everything approach. I focus on “deep value”, particularly in small / micro caps not represented in any major index. Worst performer to date is SMA Solar, down 70%. Best performer was Tower Semiconductor which doubled in price. About 6 weeks ago I went heavily into UK housebuilding due to:

- net annual immigration between 750k and 1 million

- increases value of land banks

- interest rates coming down

- a Labour government mortally afraid to engage with immigration. They’ll die on a hill fighting for housebuilding and planning reform because (compared with other topics) it’s politically non-contentious.

Have more than 20% gain on aggregate on these investments, think it can double.

Welcome to the forum!

I have enough of CH and US politics to filter out from this forum. Please keep UK political stuff out of here.

QCOM acquisition deadline extended:

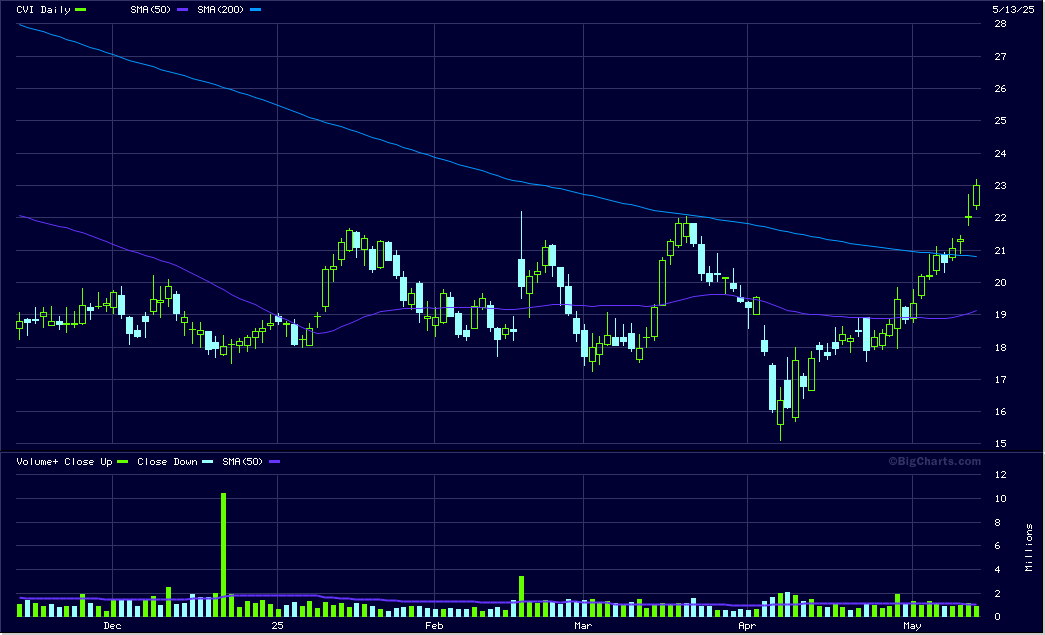

It almost hurt, but my robot (me) made me sell LC (never join a club that would even accept you) at a small gain of 22.19% after a year and ASTL at a loss of …ouch… 43.42%.

And all that just to buy a boring CVR Energy (CVI) …

UNH - overreact much? bought.

If the pharma cuts actually go into effect it would also be highly beneficial for them, no? Interesting that the rumors had 0 influence on their stock though.

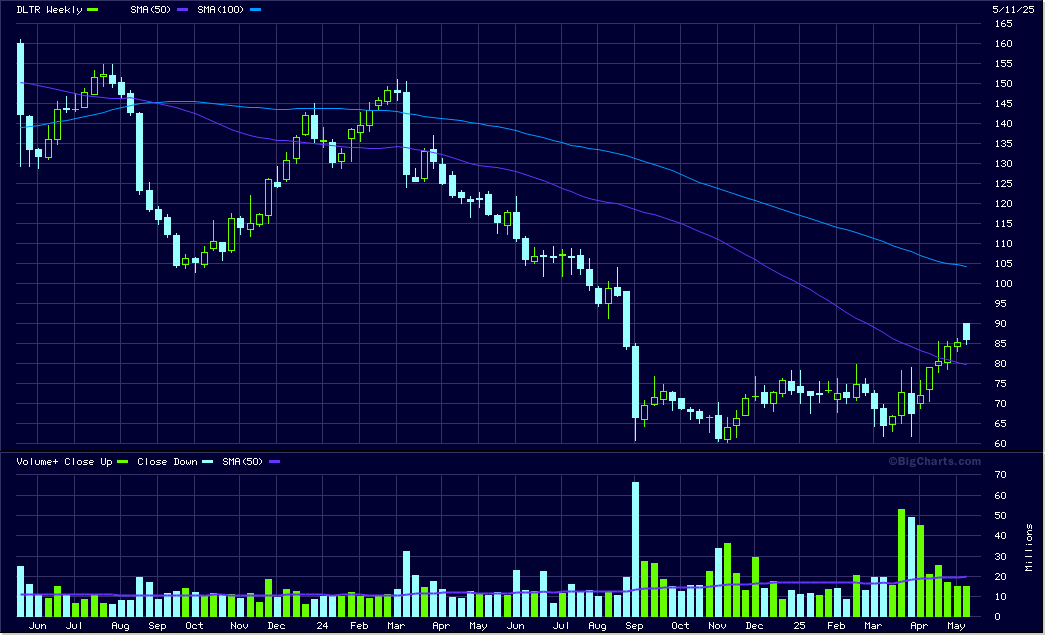

Now even cheaper today! ![]()

What happened to sell in May and go away? ![]()

Sounds like a falling…guillotine? It’s weird though, I was under the impression that it’s trading at 50% revenue which is crazy?

@Your_Full_Name May I please ask you for a Fastgraph analysis of Sika? Seemed very expensive for a long time but has lowered down and looks attractive to me now also with infrastructure programs globally.